Bajaj Finance Ltd.'s profit for the quarter ended March surpassed estimates, while its asset quality remained stable.

Net profit rose 57 percent year-on-year to Rs 1,176 crore, according to the non-banking lender's exchange filing. That's higher than the Rs 1,092 crore estimated by analysts tracked by Bloomberg.

Net interest income, or core income, rose 50 percent to Rs 3,395 crore—higher than the Rs 3,263-crore estimate. That was primarily led by a 53 percent rise in new loans booked, according to a statement accompanying the filing.

Its asset quality remained stable with gross non-performing assets ratio contracting to 1.54 percent from 1.55 percent in the previous quarter. Net NPA ratio fell to 0.63 percent sequentially from 0.62 percent.

Speaking about capital adequacy and the need to borrow, Rajeev Jain, managing director of the company said “the overall capital adequacy remains fairly strong”.

“In general we have raised funds in the past eight to nine years when the ratio has been closer to 14 percent. Our business also has a sense of seasonality where the first and third quarter and stronger and the second and fourth quarter are relatively weaker. My sense is that we may borrow capital in the second half, close to the fourth quarter,” he told BloombergQuint.

Other Highlights:

- Capital adequacy ratio (including Tier-11 capital) as of March 31, 2019 stood at 20.66 percent.

- Total operating expenses to net interest income for the quarter was at 34.58 percent against 39.47 percent in the corresponding quarter last year.

- Assets under management as of March 31, 2019 grew by 41 percent to Rs 1,15,888 crore from Rs 82,422 crore as of March 31, 2018.

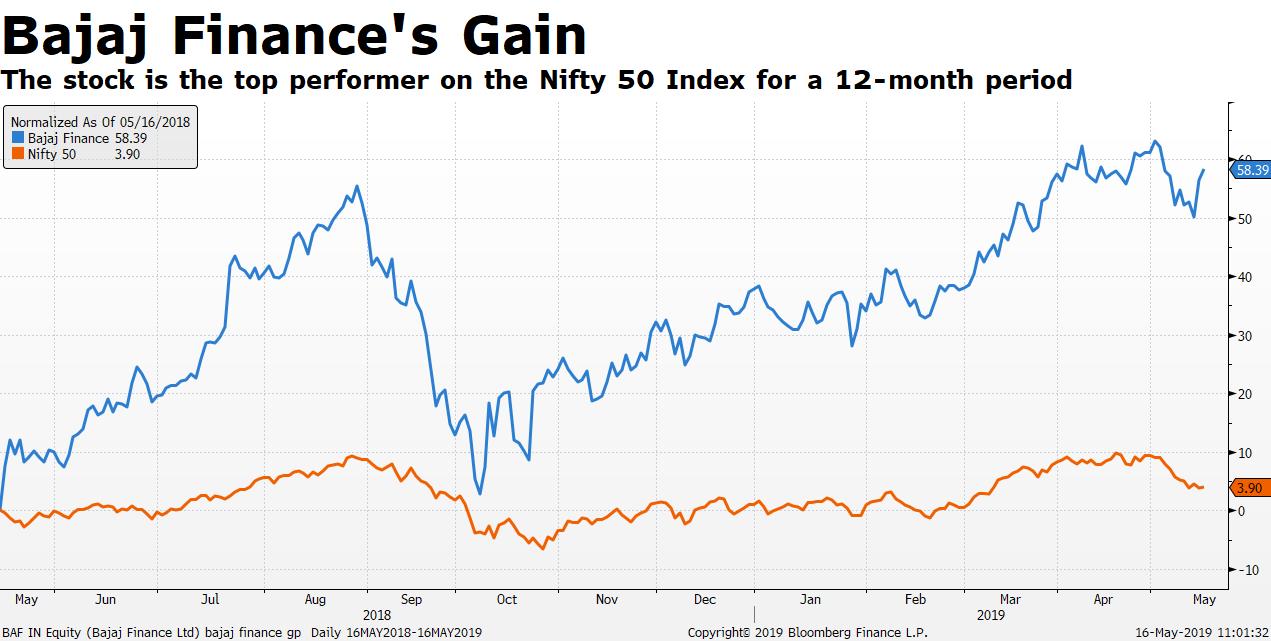

Bajaj Finance's shares rose as much as 3.6 percent to Rs 3,110.65 apiece after the earnings announcement compared to a 0.9 percent advance in the Nifty. The stock was trading close to 2 percent higher than its opening price, this morning.

The stock has risen 58.37 percent over the last 12 months. compared to a 3.95 percent rise in the NSE Nifty 50, making it the top performer on the index.

Watch the full interaction here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.