Thank you for following NDTV Profit's live coverage on fourth quarter earnings. Do follow the blog tomorrow, do not miss the action as big names like IRCTC, Birlasoft, Cummins India along with others are set to post their quarterly earnings.

Good night!

Dynamatic Technologies Q4 Highlights (Consolidated, YoY)

Revenue up 2.8% to Rs 381 crore versus Rs 370 crore.

Ebitda down 11.5% to Rs 38 crore versus Rs 42.9 crore.

Margin at 10% versus 11.6%.

Net Profit down 71.8% to Rs 16.1 crore versus Rs 57.1 crore.

V2 Retail Q4 Highlights (Consolidated, YoY)

Revenue up 68.4% to Rs 498.5 crore versus Rs 296 crore.

Ebitda up 84% to Rs 57.8 crore versus Rs 31.4 crore.

Margin at 11.6% versus 10.6%.

Net Profit up 79% to Rs 6.4 crore versus Rs 3.6 crore.

After posting fourth quarter results, the board of the company is also set to pay a dividend of Rs 3.25.

Source: Exchange filing

Sansera Engineering Q4 Highlights (Consolidated, YoY)

Revenue up 4.8% to Rs 782 crore versus Rs 746 crore.

Ebitda flat at Rs 127 crore.

Margin at 16.3% versus 17%.

Net Profit up 28.7% to Rs 59 crore versus Rs 46 crore.

DCX Systems Q4 Highlights (Consolidated, YoY)

Revenue down 26.3% to Rs 550 crore versus Rs 746 crore.

Ebitda down 73% to Rs 10.2 crore versus Rs 37.9 crore.

Margin at 1.9% versus 5.1%.

Net Profit down 37.2% to Rs 20.7 crore versus Rs 33 crore.

ITI Q4 Highlights (Consolidated, YoY)

Revenue up 73.9% to Rs 1,046 crore versus Rs 601 crore.

Ebitda Loss at Rs 28.2 crore versus Ebitda Loss of Rs 174 crore.

Net Loss at Rs 4.4 crore versus Loss of Rs 239 crore.

Time Technoplast Q4 Highlights (Consolidated, YoY)

Revenue up 5.3% to Rs 1,469 crore versus Rs 1,394 crore.

Ebitda up 14.8% to Rs 214 crore versus Rs 186 crore.

Margin at 14.5% versus 13.3%.

Net Profit up 18.6% to Rs 109.5 crore versus Rs 92.4 crore.

Triveni Engineering Q4 Results (Consolidated, YoY)

Net Profit: Up 13.6% at Rs 183 crore versus Rs 161 Crore

Revenue: Up 24.4% at Rs 1,629 crore versus Rs 1,302 Crore

Ebitda: Up 25.5% atRs 308 crore versus Rs 246 Crore

Margin: At 19% Versus 18.8%

NMDC Steel Q4 Results (QoQ)

Revenue: Up 34% At Rs 2,838 crore versus Rs 2,120 crore

Ebitda Loss: At Rs 291 crore versus Loss Of Rs 656 crore

Net Loss: At Rs 473 crore versus Loss Of Rs 758 crore

Entero Heathcare Solutions Q4 Results (Consolidated, YoY)

Revenue: Up 29.5% at Rs 1,339 crore versus Rs 1,034 crore

Ebitda: Up 69.3% at Rs 49 crore versus Rs 29 crore

Margin: At 3.6% versus 2.8%

Net Profit: Up 22.5% at Rs 26 crore versus Rs 21 crore

The Board of Directors recommended the payment of Final Dividend of Rs 1 per share for the financial year 2024-25, subject to approval of the shareholders in the ensuing Annual General Meeting.

NMDC Q4 Result Highlights (Consolidated, YoY)

Revenue: Up 7.9% to Rs 7,004.59 crore versus Rs 6,489.31 crore

Net Profit: Up 4.8% to Rs 1,483.18 crore versus Rs 1,415.62 crore

Ebitda: Down -2.4% to Rs 2,051.11 crore versus Rs 2,101.71 crore

Margin: At 29.3% versus 32.4%

NMDC Q4 Result Highlights (Consolidated, QoQ)

Revenue: Up 6.6% to Rs 7,004.59 crore versus Rs 6,567.83 crore

Net Profit: Down 21.8% to Rs 1,483.18 crore versus Rs 1,896.66 crore

Ebitda: Down 13.5% to Rs 2,051.11 crore versus Rs 2,372.01 crore

Margin: At 29.3% versus 36.1%

Medplus Health Q4FY25 Results Highlights (Consolidated, YoY)

Revenue up 1.3% at Rs 1,510 crore versus Rs 1,490 crore

Ebitda up 29% at ₹136 crore versus Rs 106 crore

Margin at 9% versus 7.1%

Net Profit up 53.7% at Rs 51.3 crore versus Rs 33.4 crore

After posting fourth quarter results, the board of the company is also set to pay a final dividend of Rs 512.

Source: Exchange filing

Bosch Q4 Highlights (Consolidated, YoY)

Revenue up 16% to Rs 4,911 crore versus Rs 4,233 crore.

Ebitda up 16% to Rs 647 crore versus Rs 557 crore.

Margin flat at 13.2%.

Net Profit down 1.9% to Rs 554 crore versus Rs 564 crore.

After posting fourth quarter results, the board of the company is also set to pay a final dividend of Rs 65.

Source: Exchange filing

P&G Hygiene Q4 Highlights (YoY)

Revenue down 1% to Rs 992 crore versus Rs 1,002 crore.

Ebitda down 18.5% to Rs 210 crore versus Rs 257 crore.

Margin at 21.1% versus 25.7%.

Net Profit up 1% to Rs 156 crore versus Rs 154 crore.

Sun Flag Q4 Highlights (Consolidated, QoQ)

Revenue down 1% to Rs 883 crore versus Rs 892 crore.

Ebitda down 9.3% to Rs 100 crore versus Rs 111 crore.

Margin at 11.4% versus 12.4%.

Net Profit down 13.7% to Rs 43.3 crore versus Rs 50.1 crore.

LIC Q4 Additional Highlights (Consolidated, YoY)

Annual Premium Equivalent at Rs 18,853 crore versus Rs 21,180 crore, down 10.99%.

Value of New Business at Rs 3,534 crore versus Rs 3,650 crore, down 3.18%.

VNB Margin down 610 bps at 18.75% versus 19.36% (QoQ).

Supriya Lifescience Q4 Highlights (YoY)

Revenue up 16.4% to Rs 184 crore versus Rs 158 crore.

Ebitda up 21.7% to Rs 67.6 crore versus Rs 55.5 crore.

Margin at 36.7% versus 35%.

Net Profit up 36.4% to Rs 50.4 crore versus Rs 37 crore.

After posting fourth quarter results, the board of the company is also set to pay a final dividend of Rs 12.

Source: Exchange filing

LIC Q4 Highlights (Consolidated, YoY)

Net Premium Income down 3.2% to Rs 1,47,917 crore versus Rs 1,52,767 crore.

Solvency Ratio at 2.11% versus 1.98%.

Persistency Ratio for 13th Month at 68.62% versus 68.61% (Consolidated, QoQ).

Persistency Ratio for 61st Month at 58.54% versus 59.69% (Consolidated, QoQ).

Net Profit up 38% to Rs 19,039 crore versus Rs 13,782 crore.

Hindustan Copper Q4 Highlights (Consolidated, YoY)

Revenue up 29.4% to Rs 731 crore versus Rs 565 crore.

Ebitda up 18% to Rs 267 crore versus Rs 226 crore.

Margin at 36.5% versus 40%.

Net Profit up 50.6% to Rs 187 crore versus Rs 124 crore.

Hindustan Copper Q4 Highlights (Consolidated, QoQ)

Revenue up 123.1% to Rs 731.40 crore versus Rs 327.77 crore.

Ebitda up 148% to Rs 266.70 crore versus Rs 107.57 crore.

Margin at 36.5% versus 32.8%.

Net Profit up 198% to Rs 187.18 crore versus Rs 62.87 crore.

JK Lakshmi Cement Q4 Highlights (Consolidated, YoY)

Revenue up 6.6% to Rs 1,897.62 crore versus Rs 1,780.85 crore.

Ebitda up 4% to Rs 351.20 crore versus Rs 336.52 crore.

Margin at 18.5% versus 18.9%.

Net Profit up 17% to Rs 183.54 crore versus Rs 157.01 crore.

Precision Camshafts Q4 Highlights (Consolidated, YoY)

Revenue down 25.7% to Rs 190 crore versus Rs 256 crore.

Ebitda up 18.3% to Rs 25.6 crore versus Rs 21.7 crore.

Margin at 13.5% versus 8.5%.

Net Profit to Rs 40.44 crore versus Rs 3.34 crore.

Goodyear India Ltd Q4 Highlights (YoY)

Revenue up 9.5% to Rs 602.70 crore versus Rs 550.53 crore.

Ebitda up at Rs 17.34 crore versus Rs 5.38 crore.

Margin at 2.9% versus 1.0%.

Net Profit of Rs 4.87 crore versus loss of Rs 4.21 crore.

Bharat Dynamics Q4 Highlights (YoY)

Revenue up 112.2% to Rs 1,800.54 crore versus Rs 848.56 crore.

Ebitda up 4% to Rs 322.53 crore versus Rs 310.84 crore.

Margin at 17.9% versus 36.6%.

Net Profit down 6% to Rs 272.77 crore versus Rs 288.77 crore.

After posting fourth quarter results, the board of the company is also set to pay a final dividend of Rs 1.32.

Source: Exchange filing

RCF Q4 Highlights (Consolidated, YoY)

Revenue down 4% to Rs 3,730 crore versus Rs 3,880 crore.

Ebitda down 8.7% to Rs 178 crore versus Rs 195 crore.

Margin at 4.9% versus 5%.

Net Profit down 24% to Rs 72.5 crore versus Rs 95.2 crore.

Gateway Distriparks Q4 Highlights (Consolidated, YoY)

Revenue up 42.7% to Rs 535 crore versus Rs 375 crore.

Ebitda up 29.4% to Rs 108 crore versus Rs 83.2 crore.

Margin at 20.1% versus 22.2%.

Net Loss at Rs 193 crore versus Profit of Rs 55 crore.

Exceptional Loss of Rs 259 crore in Q4.

EID Parry Q4 Highlights (Consolidated, YoY)

Revenue up 22.6% to Rs 6,811 crore versus Rs 5,557 crore.

Ebitda up 13% to Rs 530 crore versus Rs 469 crore.

Margin at 7.8% versus 8.4%.

Net Profit up 30.4% to Rs 287 crore versus Rs 220 crore.

SP Apparels Q4 Highlights (Consolidated, YoY)

Revenue up 35.3% to Rs 399 crore versus Rs 295 crore.

Ebitda up 33% to Rs 54 crore versus Rs 40.6 crore.

Margin at 13.5% versus 13.8%.

Net Profit up 6.7% to Rs 30.4 crore versus Rs 28.5 crore.

Minda Corp Q4 Highlights (Consolidated, YoY)

Revenue up 8.7% to Rs 1,321 crore versus Rs 1,215 crore.

Ebitda up 10.3% to Rs 152.9 crore versus Rs 138.6 crore.

Margin at 11.6% versus 11.4%.

Net Profit down 26.5% to Rs 52 crore versus Rs 70.8 crore.

Sky Gold & Diamonds Q4 Highlights (Consolidated, YoY)

Revenue up 106.1% to Rs 1,058.17 crore versus Rs 513.37 crore.

Ebitda up 149% to Rs 63.02 crore versus Rs 25.31 crore.

Margin at 6.0% versus 4.9%.

Net Profit up 180% to Rs 38.17 crore versus Rs 13.61 crore.

Bharat Sanchar Nigam FY25 Highlights (Consolidated, YoY)

Revenue up 7.8% to Rs 20,841 crore versus Rs 19,330 crore.

Ebitda at Rs 5,396 crore versus Rs 2,164 crore.

Margins at 23.01% versus 10.15%.

Net loss down 58% to Rs 2,247 crore versus Rs 5,370 crore.

Net profit for Q4 at Rs 280 crore versus loss of Rs 849 crore in Q4FY24.

Gujarat Fluorochemicals Q4 Highlights (Consolidated, YoY)

Revenue up 8% to Rs 1,225 crore versus Rs 1,133 crore.

Ebitda up 25% to Rs 286 crore versus Rs 229 crore.

Margins at 23.3% versus 20.2%.

Net profit up 89% to Rs 191 crore versus Rs 101 crore.

To pay dividend of Rs 3 per share.

TTK Prestige Q4 Highlights (Consolidated, YoY)

Revenue up 4.3% to Rs 650 crore versus Rs 623 crore.

Ebitda down 33.5% to Rs 51.3 crore versus Rs 77.2 crore.

Margins at 7.9% versus 12.4%.

Net loss of Rs 40.6 crore versus profit of Rs 58.7 crore.

Company saw exceptional loss of Rs 71.42 crore in the quarter under review.

To pay dividend of Rs 6 per share.

The Naukri-parent announced a dividend of Rs 3.60 per share, with the record date fixed as July 25.

Shriram Properties Q4 Highlights (Consolidated, YoY)

Revenue up 34.9% to Rs 407.73 crore versus Rs 302.24 crore.

Ebitda at Rs 48.81 crore versus Rs 9.58 crore.

Margins at 12% versus 3.2%.

Net profit at Rs 47.78 crore versus Rs 20.22 crore.

Info Edge Q4 Highlights (Consolidated, YoY)

Revenue up 14% to Rs 749.60 crore versus Rs 657.40 crore.

Ebitda up 13% to Rs 247.90 crore versus Rs 219.30 crore.

Margins at 33.1% versus 33.4%.

Net profit at Rs 463.30 crore versus Rs 60.30 crore.

In a stock exchange filing on May 8, Bajaj Auto said that a meeting of its Board of Directors has been scheduled on May 29 to consider the audited financial results for the financial year ending March 31, 2025.

The Board will also consider the recommendation of a dividend on equity shares, if any, for FY25.

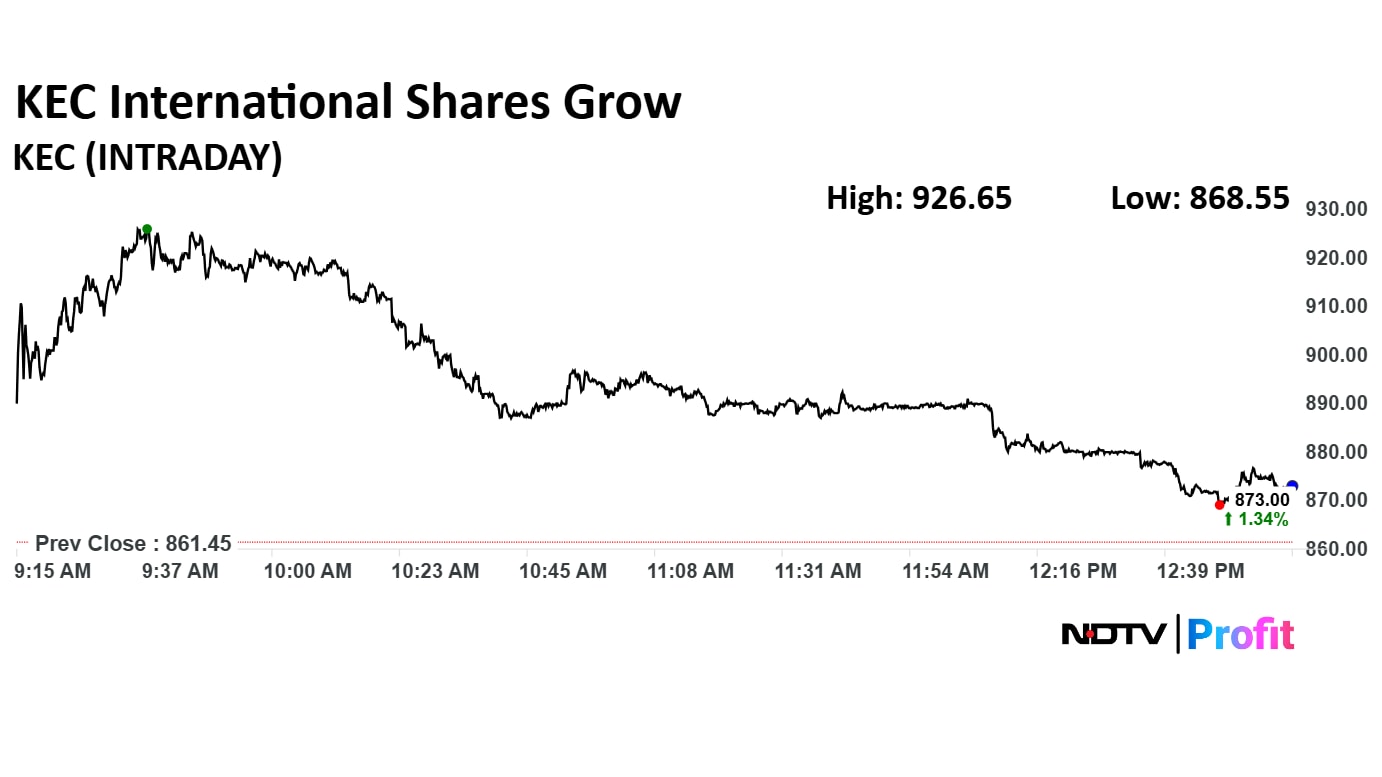

Share price of KEC International Ltd. rose as much as 7.57% through the day to Rs 926.65 apiece, after the company's Q4 profit grew 76.8% to Rs 268.2 crore from Rs 151.7 crore.

The company also reported a consolidated revenue increase of 11.5% year-on-year, reaching Rs 6,872 crore compared to Rs 6,165 crore.

Share price of KEC International Ltd. rose as much as 7.57% through the day to Rs 926.65 apiece, after the company's Q4 profit grew 76.8% to Rs 268.2 crore from Rs 151.7 crore.

The company also reported a consolidated revenue increase of 11.5% year-on-year, reaching Rs 6,872 crore compared to Rs 6,165 crore.

Citi expects LIC's value of new business to go down 11% in the quarter ended March. LIC remains the only insurer whose VNB is predicted to slip, as per Citi's report.

Share price of iron and steel majors NDMC Ltd. and NMDC Steel Ltd. fell as much as 1.56% and 1.67% through the day, ahead of their expected financial results.

Hello, and welcome to NDTV Profit's live coverage of Q4 earnings.

As many as 300 companies are set to declare their financial performance for the quarter ended March, with names like Life Insurance Corp. of India, NMDC Ltd., and Bharat Dynamics Ltd. leading the pack.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.