Ugro Capital Q4FY25 Highlights (YoY)

Net profit up 24% at Rs 41 crore versus Rs 33 crore.

Revenue up 25% at Rs 412 crore versus Rs 330 crore.

GNPA at 2.3%

NNPA at 1.6%

Assets under management of Rs 12,003 crore, up 33% YoY and 8% QoQ.

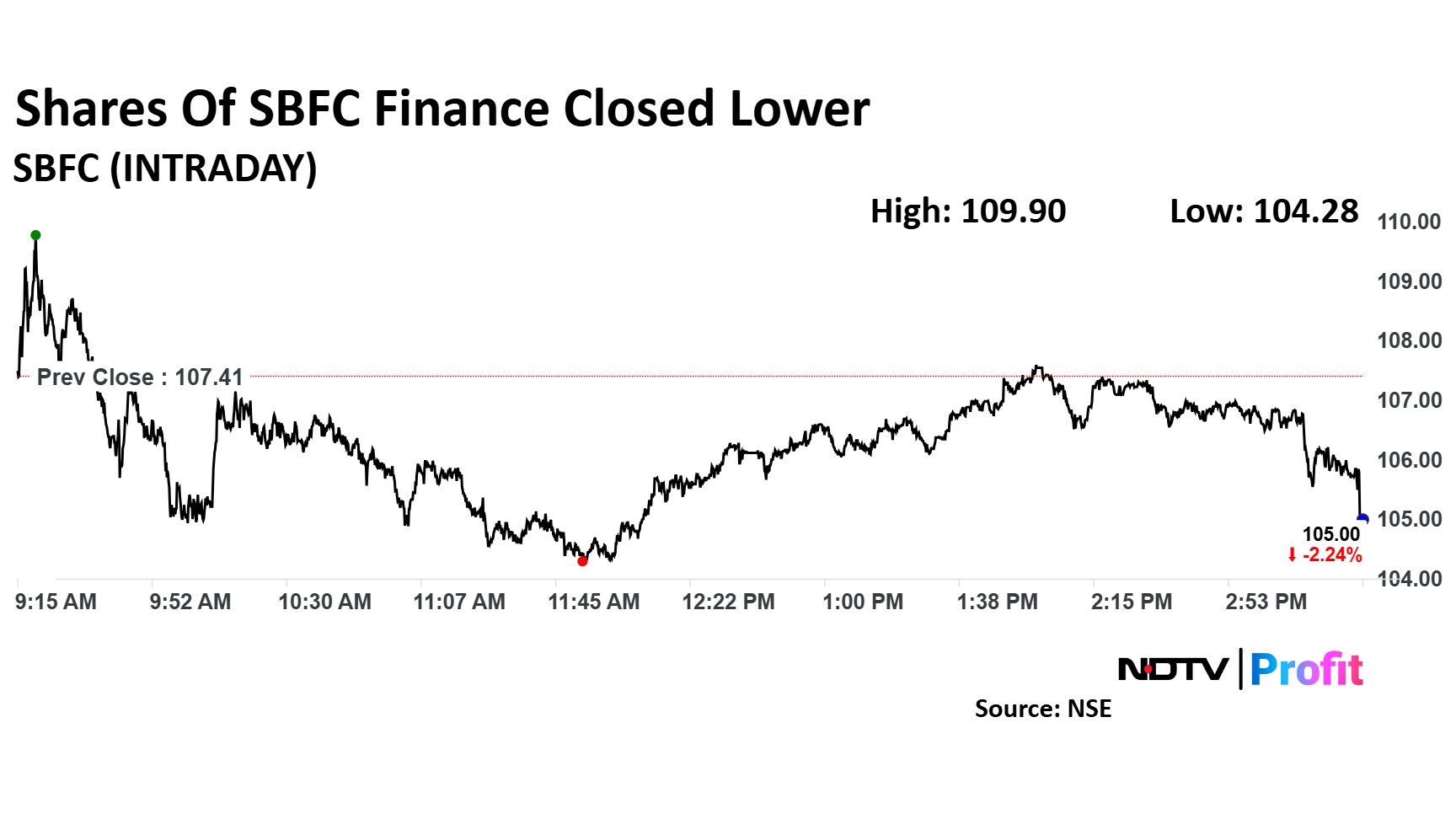

SBFC Finance Q4 Growth (YoY)

Provisions up 53% at Rs 21 crore versus Rs 14 crore.

Assets under management up 28.22% at Rs 8,747 crore versus Rs 6,822 crore.

(QoQ)

Return on Assets at 4.53% versus 4.54%

Gross NPA ratio at 2.74% versus 2.7%

Net NPA ratio at 1.51% versus 1.63%

IDFC First Bank plans to cut deposit rates significantly soon. For FY26, the bank aims to grow its loan book by 20% and deposits by 22-23%. The profit decline in FY25 is not seen as a trend.

The bank expects a 10 basis point decline in Net Interest Margin from Q4 levels in FY26. It may not renew high-cost fixed deposits at current rates if customers opt for lower rates.

The bank holds adequate provisions on its microfinance book and aims to maintain a Liquidity Coverage Ratio (LCR) of around 115% after the new RBI norms.

(Source: Informist/ Earnings concall)

IDFC First Bank aims to achieve a return on equity (ROE) of 15-16% and is focused on generating returns on capital.

The bank's Q4 profit declined due to normalized credit costs, largely impacted by its microfinance book, which saw gross slippages of Rs 572 crore. However, the credit card business reached breakeven within four years.

The bank has paid off Rs 7,000 crore in legacy loans in FY25 and plans to pay off an additional Rs 4,500 crore in FY26. The incremental credit-deposit ratio stood at 76.1% in FY25.

(Source: Informist/ Earnings concall)

SBFC Finance board approved raising up to Rs 3,000 crore via non-convertible debentures.

IDFC First Bank Business For FY25 (YoY)

Loans and Advances up 20.4% at Rs 2.42 lakh crore.

Retail, Rural and MSME book up 18.6% at Rs 1.97 lakh crore.

Microfinance portfolio reduced by 28.3% and its proportion to overall loan book reduced from 6.6% in FY24 to 4.0% in FY25.

(Source: Press release)

IDFC First Bank Business For FY25 (YoY)

Customer deposits up 25.2% at Rs 2.42 lakh crore.

Retail deposits up 26.4% at Rs 1.91 lakh crore.

CASA deposits up 24.8% at Rs 1.18 lakh crore.

CASA ratio stood at 46.9% versus 47.2%.

Retail deposits constitute 79% of total customer deposits as of March 31, 2025.

(Source: Press release)

The gross slippage was Rs 2,175 crore in Q4 as compared to Rs 2,192 crore in Q3.

Provisions for FY25 stood at Rs 5,515 crore (2.46% of the loan book), driven by the higher slippages in the micro-finance book.

Excluding microfinance and one toll account, credit cost for the overall loan book was 1.76% in FY25. Sequentially, it has improved by 9 bps from 1.82% in Q3 to 1.73% in Q4.

(Source: Press release)

The Board recommended a dividend of Rs 0.25 per equity share for the financial year 2024-25, subject to approval of shareholders at the ensuing Annual General Meeting.

IDFC First Bank Q4FY25 Highlights (Standalone, YoY)

Net Profit down 58% at Rs 304 crore versus Rs 724 crore (Bloomberg estimate: Rs 421.5 crore)

Net interest income up 10% at Rs 4,907 crore versus Rs 4,469 crore. (Bloomberg estimate: Rs 5,073.5 crore)

Net Interest Margin at 5.95%. (Bloomberg estimate: 6.14%)

Core Operating income up 8.7% at Rs 6,609 crore versus Rs 6,079 crore.

Net NPA at 0.53% versus 0.52% (QoQ)

Gross NPA at 1.87% versus 1.94% (QoQ)

SBFC Finance Q4FY25 Highlights (Standalone, YoY)

Total income up 29.2% to Rs 361.1 crore versus Rs 279.4 crore

Net profit up 29% to Rs 94.4 crore versus Rs 73.4 crore

Net interest income up 25% at Rs 211 crore versus Rs 169 crore

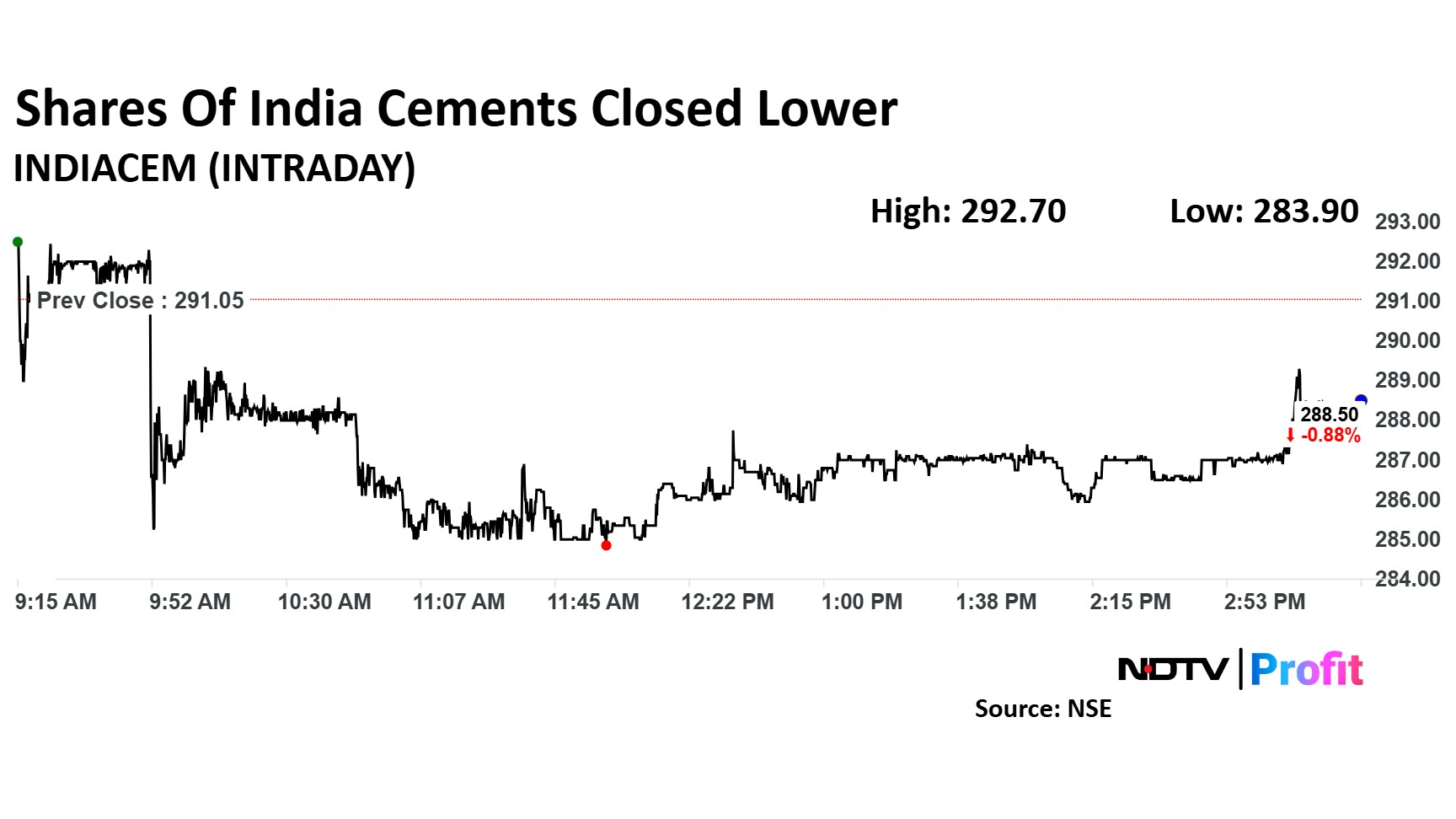

The India Cements board approved the draft merger scheme of units ICL Financial, ICL Securities, ICL International and India Cements Infra with itself.

(Source: Exchange filing)

India Cements Q4 Highlights (Consolidated, YoY)

Revenue down 3.1% to Rs 1,197 crore versus Rs 1,236 crore.

Ebitda loss to Rs 3 crore versus profit of Rs 37 crore.

Net Profit of Rs 19.14 crore versus loss of Rs 50.06 crore.

Exceptional Items during the quarter include: Profit on sale of investment in subsidiaries, Coromandel Electric and Coromandel Travels, amounting to Rs 92.81 crore, including reversal of provision for diminution in value of investment and provision for diminution in value of vessel held for sale and others of Rs 2.68 crore.

Avantel Q4 Highlights (Consolidated, YoY)

Revenue up 17.95% to Rs 49.26 crore versus Rs 41.76 crore.

Ebitda down 36.14% to Rs 11.59 crore versus Rs 18.15 crore.

Margin down 19.93% to 23.52% versus 43.46%.

Net profit down 49.95% to Rs 6.08 crore versus Rs 12.15 crore.

MRPL Q4 Highlights (Standalone, QoQ)

Revenue up 7.8% to Rs 24,596 crore versus Rs 21,871 crore.

Ebitda up 9.6% to Rs 1,130 crore versus Rs 1,031 crore.

Margin to 4.6% versus 4.7%.

Net profit up 19.4% to Rs 363 crore versus Rs 304 crore.

After posting the fourth quarter results, the board recommended a final dividend of Rs 1 per share.

Source: Exchange filing

Bhansali Engineering Q4 Highlights (Consolidated, YoY)

Revenue up 7.4% to Rs 345 crore versus Rs 321 crore.

Ebitda down 5.7% to Rs 48 crore versus Rs 51 crore.

Ebitda margin to 13.96% versus 15.89%.

Net profit down 2.3% to Rs 39 crore versus Rs 40 crore.

The shares of Ugro Capital closed 4.54% lower at Rs 185.26 on Friday ahead of posting results. The decline compares to a 0.86% decline in the benchmark index Nifty 50.

The shares of Ugro Capital closed 4.54% lower at Rs 185.26 on Friday ahead of posting results. The decline compares to a 0.86% decline in the benchmark index Nifty 50.

On Friday, post market hours, Zensar Technologies also posted its fourth quarter results.

Zensar Tech Q4 Highlights (Consolidated, QoQ)

Revenue up 2.5% to Rs 1,359 crore versus Rs 1,326 crore.

EBIT up 2.9% to Rs 189 crore versus Rs 183 crore.

Margin to 13.9% versus 13.8%.

Net profit up 10% to Rs 176 crore versus Rs 160 crore.

Friday post market hours, Tata Technologies posted its fourth quarter results. The service segment revenue was at Rs 1,024 crore versus Rs 1,012 crore in the previous quarter. The technology solutions segment revenue was at Rs 261 crore while the LTM attrition came in at 13.2% for this quarter.

Tata Technologies Q4FY25 (Consolidated, QoQ)

Revenue down 2.4% to Rs 1,285.65 crore versus Rs 1,317.38 crore (Bloomberg estimate: Rs 1,331.7 crore)

Net Profit up 12% to Rs 188.87 crore versus Rs 168.64 crore (Bloomberg estimate: Rs 177.75 crore)

Ebit down 1% to Rs 202.26 crore versus Rs 203.58 crore (Bloomberg estimate: Rs 251.45 crore)

Margin at 15.7% versus 15.5% (Bloomberg estimate: 18.7%)

Friday post market hours, RBL Bank posted its fourth quarter results. A rise in provisions and slight fall in net interest income weighed on RBL Bank's net profit for the quarter ended March.

RBL Bank: Q4FY25 (Standalone, YoY)

Net Profit down 80.5% to Rs 68.7 crore versus Rs 352 crore (Bloomberg estimate: Rs 47.5 crore)

Net interest income down 2% at Rs 1,563 crore versus Rs 1,600 crore.

NIM at 4.89%, down 1 bps (QoQ).

Gross NPA at 2.6% versus 2.92% (QoQ)

Net NPA at 0.29% versus 0.53% (QoQ)

India Cements had reported a consolidated net profit of Rs 116.52 crore in the third quarter ended on December 31, 2024. The profit was boosted by the sale of investments.

While the consolidated revenue from operations stood at Rs 940.81 crore in the third quarter as compared to Rs 1,113.06 crore in the year-ago period.

The private-sector lender reported a significant 53% decline in its profit year-on-year (YoY), posting a net profit of Rs 716 crore. The drop in profit was attributed to a substantial increase in provisions, particularly for its microfinance institutions segment.

While the bank’s net profit fell sharply on a YoY basis, it showed an improvement of 69% sequentially, reflecting a better performance compared to the previous quarter. However, the higher provisioning for stressed loans in the MFI segment weighed heavily on the bank's financial results.

The shares of SBFC Finance closed 1.26% lower at Rs 106.15 on Friday ahead of posting results. The decline compares to a 0.86% decline in the benchmark index Nifty 50.

The shares of SBFC Finance closed 1.26% lower at Rs 106.15 on Friday ahead of posting results. The decline compares to a 0.86% decline in the benchmark index Nifty 50.

The shares of India Cement closed 1.12% lower at Rs 287.8 on Friday ahead of posting results. The decline compares to a 0.86% decline in the benchmark index Nifty 50.

The shares of India Cement closed 1.12% lower at Rs 287.8 on Friday ahead of posting results. The decline compares to a 0.86% decline in the benchmark index Nifty 50.

The shares of IDFC First Bank closed 2.32% lower at Rs 66.08 on Friday ahead of posting results. The decline compares to a 0.86% decline in the benchmark index Nifty 50.

The shares of IDFC First Bank closed 2.32% lower at Rs 66.08 on Friday ahead of posting results. The decline compares to a 0.86% decline in the benchmark index Nifty 50.

Zooming out, here is a quick glance at all the estimates that the companies are expected to post today.

The estimates for the fourth quarter results are as per the consensus estimates of analysts tracked by Bloomberg.

Other companies, including Avantel Ltd., Bhansali Engineering Polymers Ltd. and Mangalore Refinery and Petrochemicals Ltd., are also set to release their fourth-quarter results today.

SBFC Finance Ltd. is set to announce its fourth quarter results today.

The company is expected to post a revenue worth Rs 239.7 crore. Ugro Capital Ltd. is likely to report a profit of Rs 45.1 crore with a revenue of Rs 630.8 crore.

India Cements is set to announce its fourth quarter results today. The company is expected to report a revenue of Rs 22,967.4 crore with a net profit of Rs 2,538.4 crore.

Analysts also estimate the Ebitda of the firm to stand at Rs 4,615.9 crore along with an Ebitda margin of 20.1%.

IDFC First Bank is set to announce its fourth quarter results today. The bank is set to clock a a profit of Rs 421.5 crore, along with a revenue of Rs 6,978 crore for the quarter ended March.

These estimates are as per the consensus estimates of analysts tracked by Bloomberg.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.