Kotak Mahindra Bank Ltd.'s second-quarter profit met estimates on the back of healthy loan growth.

Net profit rose 14.8 percent year-on-year to Rs 1,141.6 crore in the July-September quarter, the country's second-largest lender by market capitalisation said in a release today. That's in line with the Rs 1,173 crore consensus estimate of analysts tracked by Bloomberg.

Net interest income, or core income of the lender, rose 16.3 percent to Rs 2,689 crore. That compares with Rs 2,716 crore estimated.

The bank's net interest margin stood at 4.2 percent during the quarter.

“Kotak Mahindra's earnings growth is likely to be driven by robust lending and non-interest income growth, especially as margin pressure looms from rising funding costs,” Bloomberg Intelligence had said in a report.

It, however, said, “Keeping low-cost deposit growth at a comparable pace to its strong loan growth could be a challenge, which may blur the net interest margin outlook.”

Asset Quality Improves

The Uday Kotak-led bank's asset quality improved during the period. Gross non performing assets ratio fell to 2.15 percent from 2.17 percent in the preceding quarter. Net bad loans ratio, too, narrowed to 0.81 percent from 0.86 percent. Provisions declined to Rs 354 crore from Rs 469.6 crore in the previous quarter.

Other Highlights:

- Capital-adequacy ratio stood at 18 percent.

- Advances were up 21 percent year-on-year to Rs 1,84,940 crore.

- Exposure to NBFCs at 5.2 percent of total outstanding loans.

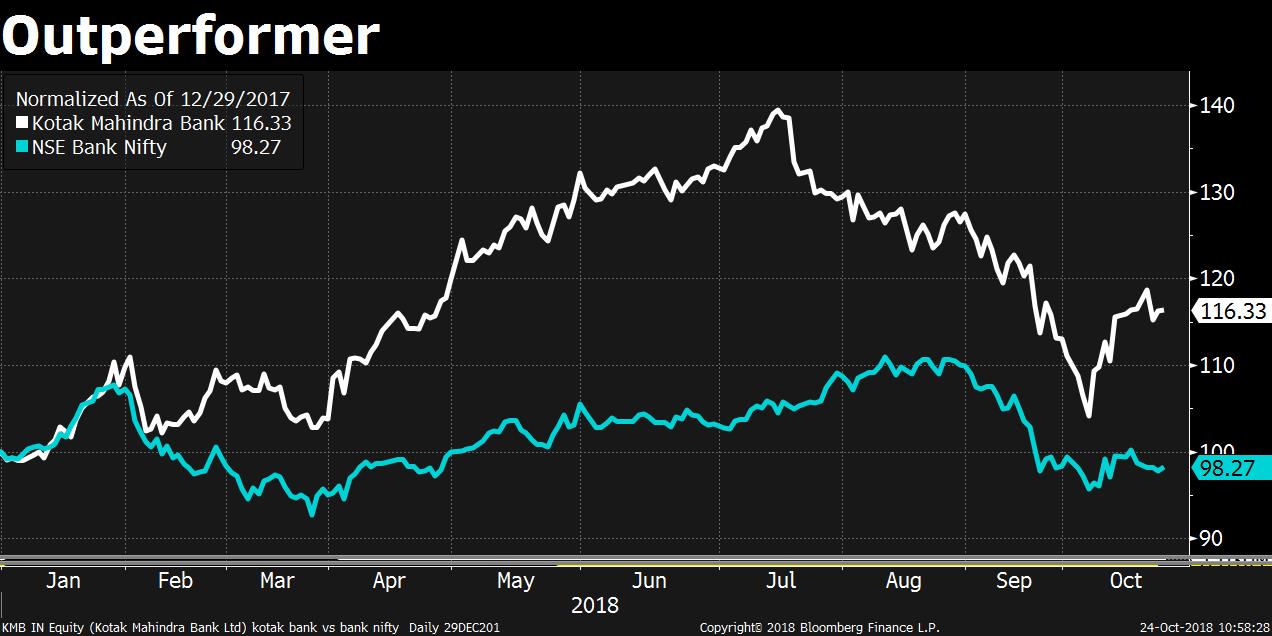

The stock was down 0.9 percent to Rs 1,164 apiece as of 1:40 p.m. It has risen nearly 16 percent so far this year compared to a 1.6 percent decline in the NSE Nifty Bank Index.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.