IRFC will hold a Board meeting on Tuesday, July 22, to consider and approve its unaudited financial results and other financial statements for the quarter ended June 30, 2025. The company informed the exchanges of the scheduled meeting through an official filing.

PNB Housing Finance Q1FY26 Highlights (Standalone, YoY)

Net profit increased by 23% YoY and declined by 3% QoQ to INR 534 crore.

Net Interest Income grew by 17% YoY and 4% QoQ to INR 760 crore.

Operating expenditure grew by 12% YoY and 2% QoQ to INR 216 crore.

GRM ex-shutdown and inventory losses would have been $8 per barrel

Inventory loss of $2 per barrel and $2 per barrel impact from shutdown

Current run rate of GRM is more than $8 per barrel

Targeting GRM of high single digit in Q2 (due to middle distillates) and lower freight cost

Source: Earnings Con Call

Sagar Cements Q1FY26 Highlights (Consolidated, YoY)

Net Profit at Rs 1.2 crore versus loss of Rs 28.3 crore.

Revenue up 19.6% at Rs 671 crore versus Rs 561 crore.

Ebitda at Rs 121 crore versus Rs 46.8 crore.

Margin at 18.1% versus 8.3%.

CIE Automotive Q1FY26 Highlights (Consolidated, YoY)

Net Profit down 6.1% at Rs 204 crore versus Rs 217 crore.

Revenue up 3.3% at Rs 2,369 crore versus Rs 2,293 crore.

Ebitda down 6.4% at Rs 337 crore versus Rs 360 crore.

Margin at 14.2% versus 15.7%.

In a stock exchange filing dated June 13, Infosys said that a meeting of its Board of Directors is scheduled on July 22 and July 23 to approve and take on record the audited consolidated and standalone financial results for Q1FY26.

In a separate stock exchange notification dated July 15, the company said that it will announce results for the first quarter on July 23 at 3:45 p.m.

Agi Greenpac Q1FY26 Highlights (Consolidated, QoQ)

Net Profit down 7.1% at Rs 88.9 crore versus Rs 95.6 crore.

Revenue down 2.4% at Rs 688 crore versus Rs 705 crore.

Ebitda down 7.9% at Rs 142 crore versus Rs 154 crore.

Margin at 20.7% versus 21.9%.

Oberoi Realty Q1FY26 Highlights (Consolidated, YoY)

Net Profit down 27.9% at Rs 421 crore versus Rs 585 crore.

Revenue down 29.7% at Rs 988 crore versus Rs 1,405 crore.

Ebitda down 36.2% at Rs 520 crore versus Rs 815 crore.

Margin at 52.7% versus 58%.

Inventory model plan to benefit margins by 1%.

Margin benefit to accrue as soon as the transition takes place.

Breakeven for quick commerce is not important for us.

Margin difference is not much between big and small cities.

Source: Eternal Con Call

DCM Shriram Q1FY26 Highlights (Consolidated, YoY)

Net Profit up 13% at Rs 113 crore versus Rs 100 crore.

Revenue up 13.4% at Rs 3,262 crore versus Rs 2,876 crore.

Ebitda up 22.9% at Rs 305 crore versus Rs 248 crore.

Margin at 9.3% versus 8.6%.

We will change our strategy if competition increases.

Will protect leadership market share at any case.

Monthly transacting users will continue to grow from here in food delivery.

Source: Eternal Con Call

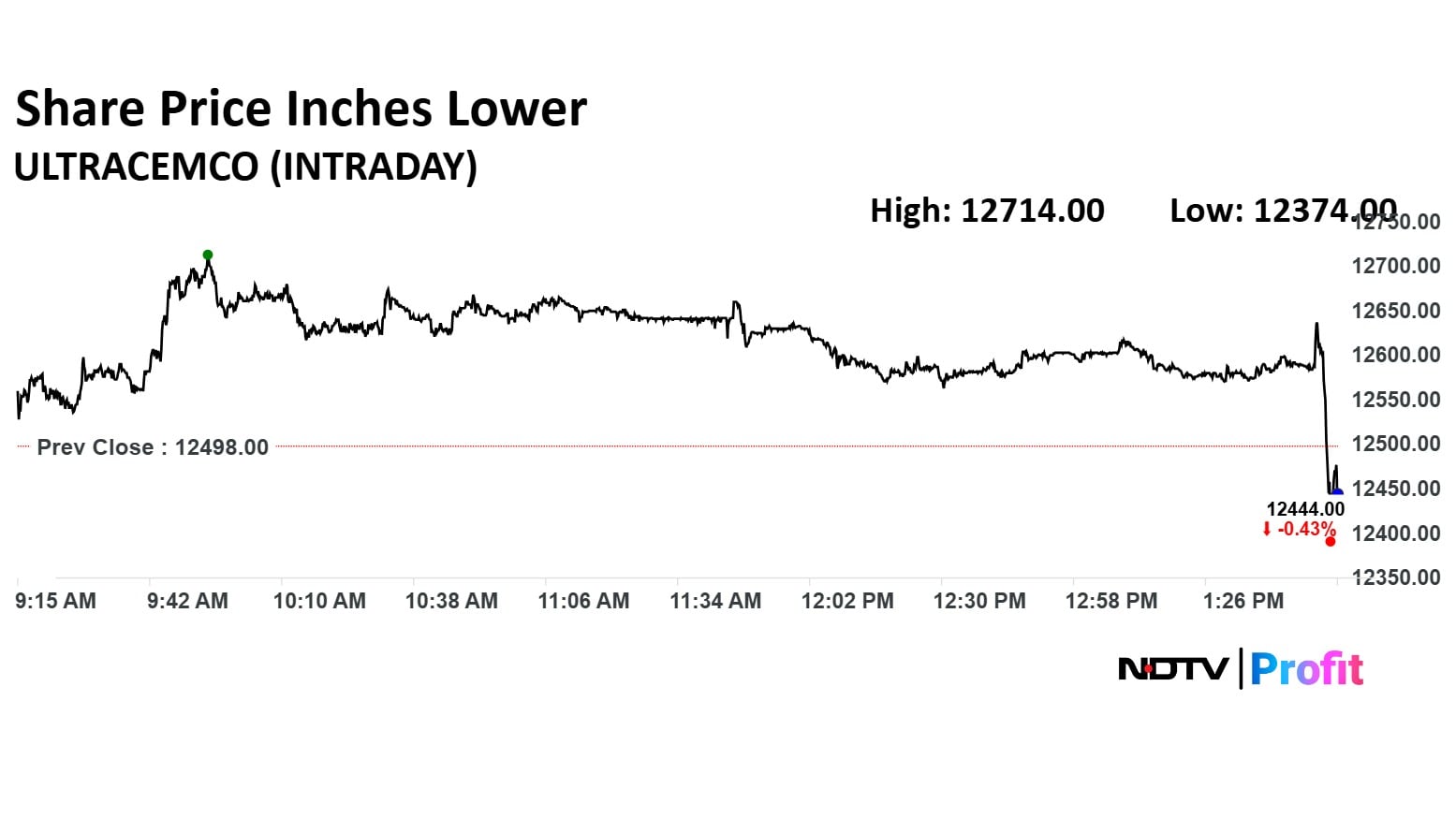

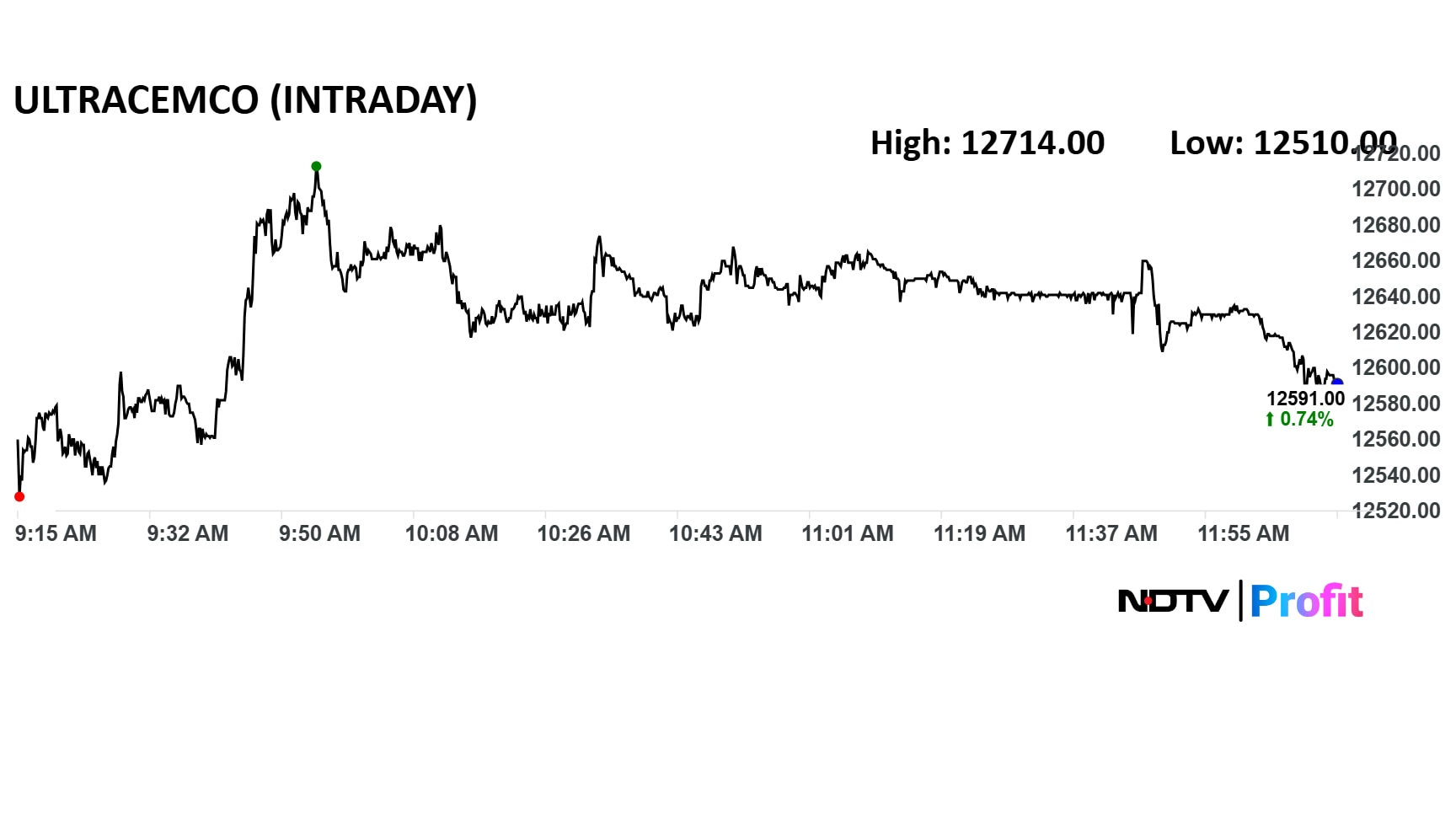

Atul Daga, CFO, said:

Believe markets have been steady with government capex program

Government capex has improved in the first two months of this year

Volume growth of 9.7% YoY

Kesoram business got included with Ultratech since March 1, 2025

Urban housing has been slow in last six months

Source: Earnings Con Call

Havells India Q1FY26 Highlights (Standalone, YoY)

Revenue down 6% at Rs 5,437.81 crore versus Rs 5,798.11 crore (Bloomberg estimate: Rs 6,049 crore)

Ebitda down 9.9% at Rs 519.91 crore versus Rs 576.20 crore (Bloomberg estimate: Rs 547 crore)

Margin at 9.6% versus 9.9% (Bloomberg estimate: 9.4%)

Net Profit down 14% at Rs 352.34 crore versus Rs 411.18 crore (Bloomberg estimate: Rs 381 crore)

Will be transitioning q-comm business from marketplace model to inventory ownership over next 2-3 quarters

Expect to start working with brands directly without any disruption to the business

Control on inventory gives more leverage on margins in the business plus allows us to push harder and faster on assortment expansion

Expect to see about 1 percentage point margin expansion over time as a result of this transition

As an outcome of this transition, we will also see shrinkage in Hyperpure’s non-restaurant business as most of the B2B buyers in that business were sellers on our quick commerce platform

Source: Letter To Shareholders

First quarter where Q-comm NOV exceeded food delivery NOV for the full quarter

Going forward, Eternal to only disclose NOV (which is GOV minus the discounts)

At this point, don't see any innovation in the space which puts business under any obvious threat

In near terms, percentage margins have bottomed out

Should see margins improve as a large number of stores mature

Absolute losses should come down from hereon

Source: Letter To Shareholders

Eternal Q1 Segment Wise Profitable

Food delivery profit up 45 % to Rs 465 crore YoY, up 6 % QoQ

Quick commerce loss at Rs 42 crore versus Rs 43 crore profit YoY, at Rs 82 crore loss QoQ

Hyperpure loss at Rs 5 crore versus Rs 14 crore loss YoY, Rs 8 crore loss QoQ

Eternal Q1FY26 Highlights (Consolidated, QoQ)

Revenue up 22.9% at Rs 7,167 crore versus Rs 5,833 crore (Bloomberg estimate: Rs 6,624.2 crore)

Ebitda up 59.7% at Rs 115 crore versus Rs 72 crore (Bloomberg estimate: Rs 178.4 crore)

Margin at 1.6% versus 1.2% (Bloomberg estimate: 2.6%)

Net Profit down 35.9% at Rs 25 crore versus Rs 39 crore (Bloomberg estimate: Rs 105 crore)

Latent View Analytics Q1FY26 Highlights (Consolidated, QoQ)

Revenue up 1.6% at Rs 236 crore versus Rs 232 crore

Ebit down 11% at Rs 40.8 crore versus Rs 45.9 crore

Margin at 17.3% versus 19.8%.

Net Profit down 5% at Rs 50.8 crore versus Rs 53.5 crore

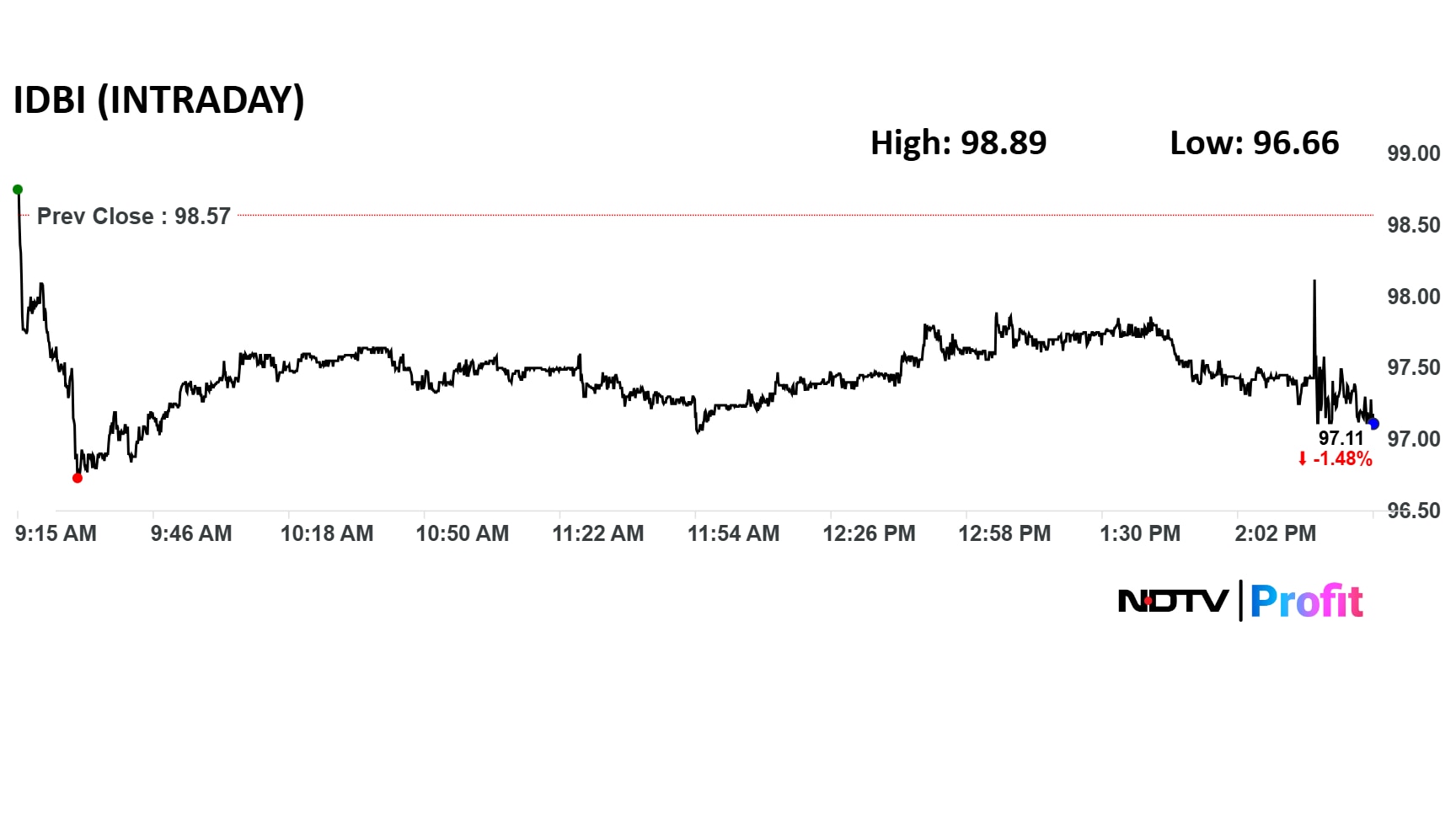

IDBI Bank Q1 Business Performance

Total Deposits increased to Rs 2,96,868 crore as on June 30, 2025, compared to Rs 2,77,548 crore as on June 30, 2024, registering a growth of 7% year-on-year.

CASA (Current Account Savings Account) stood at Rs 1,32,553 crore and the CASA ratio was 44.65% as on June 30, 2025. As on June 30, 2024, total CASA and CASA ratio were Rs 1,34,810 crore and 48.57% respectively.

Net advances stood at Rs 2,11,907 crore as on June 30, 2025, compared to Rs 1,94,026 crore as on June 30, 2024, registering a growth of 9% YoY.

Shares of IDBI Bank were trading lower. The Q1 results showed a dip in earnings. The government is pursuing disinvestment plan for IDBI Bank.

Shares of IDBI Bank were trading lower. The Q1 results showed a dip in earnings. The government is pursuing disinvestment plan for IDBI Bank.

IDBI Bank Q1 FY26 Highlights (Standalone, YoY)

Profit up 17% to Rs 2,007 crore versus Rs 1,719 crore.

Write back of Rs 179.46 crore versus Rs 443.46 crore.

NII down 2% to Rs 3165.77 crore versus Rs 3232.82 crore.

Net Interest Margin at 3.68% versus 4.18%.

Gross NPAs at 2.93% versus 2.98% (QoQ).

Net NPAs at 0.21% versus 0.15% (QoQ).

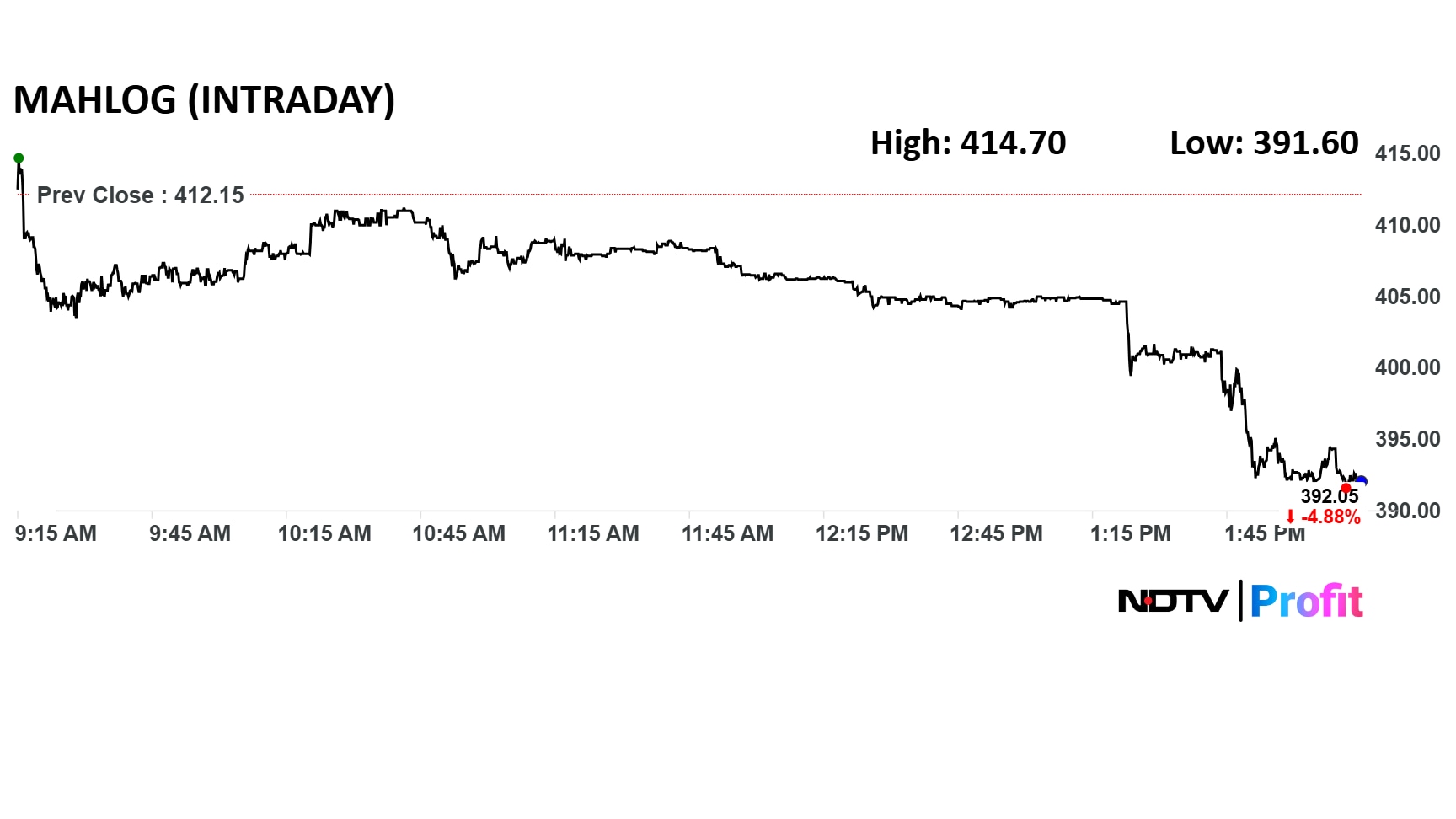

Shares of Mahindra Logistics fell 5% after poor Q1 results.

Shares of Mahindra Logistics fell 5% after poor Q1 results.

Mahindra Logistics Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 14.4% at Rs 1,625 crore versus Rs 1,420 crore.

Ebitda up 15.1% at Rs 76.3 crore versus Rs 66.3 crore.

Margin remained flat at 4.7%.

Net loss of Rs 10.8 crore versus a loss of Rs 9.3 crore.

UltraTech Cement Business Highlights (YoY)

Consolidated volume growth of 9.7% year-on-year (including India Cements).

Operating Ebitda per metric tonne of Rs 1,248, higher by Rs 337 metric tonne.

Clinker conversion improved to 1.49 versus 1.44.

Grey cement realisation improved by 2.2% sequentially.

UltraTech Cement Q1FY26 (Consolidated, YoY)

Revenue up 13.1% to Rs 21,275.45 crore versus Rs 18,818.56 crore (Bloomberg estimate: Rs 21,506 crore)

Net profit up 48.9% to Rs 2,225.9 crore versus Rs 1,494.82 crore (Estimate: Rs 2,251 crore)

Ebitda up 46.2% to Rs 4,410.34 crore versus Rs 3,017.1 crore (Estimate: Rs 4,408.6 crore)

Ebitda margin at 20.7% versus 16% (Estimate: 20.08%)

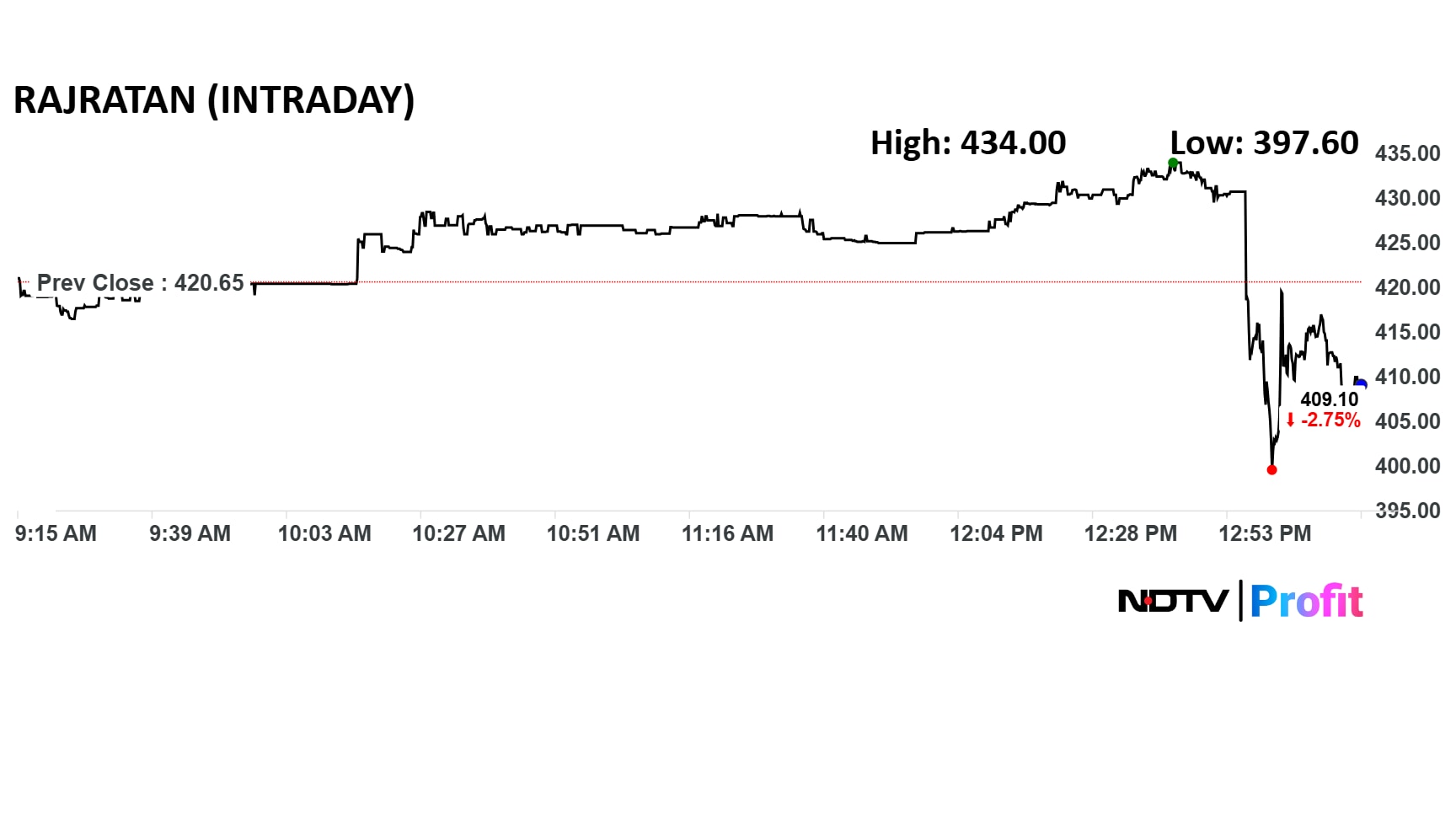

Shares of Rajratan Global Wire fell 5.5% after Q1 profit dip.

Shares of Rajratan Global Wire fell 5.5% after Q1 profit dip.

Rajratan Global Wire Q1FY26 Highlights (Consolidated, YoY)

Revenue up 12% at Rs 247 crore versus Rs 220 crore

Ebitda up 4.7% at Rs 30.9 crore versus Rs 29.5 crore

Margin at 12.5% versus 13.4%.

Net Profit down 11.2% at Rs 13.5 crore versus Rs 15.2 crore

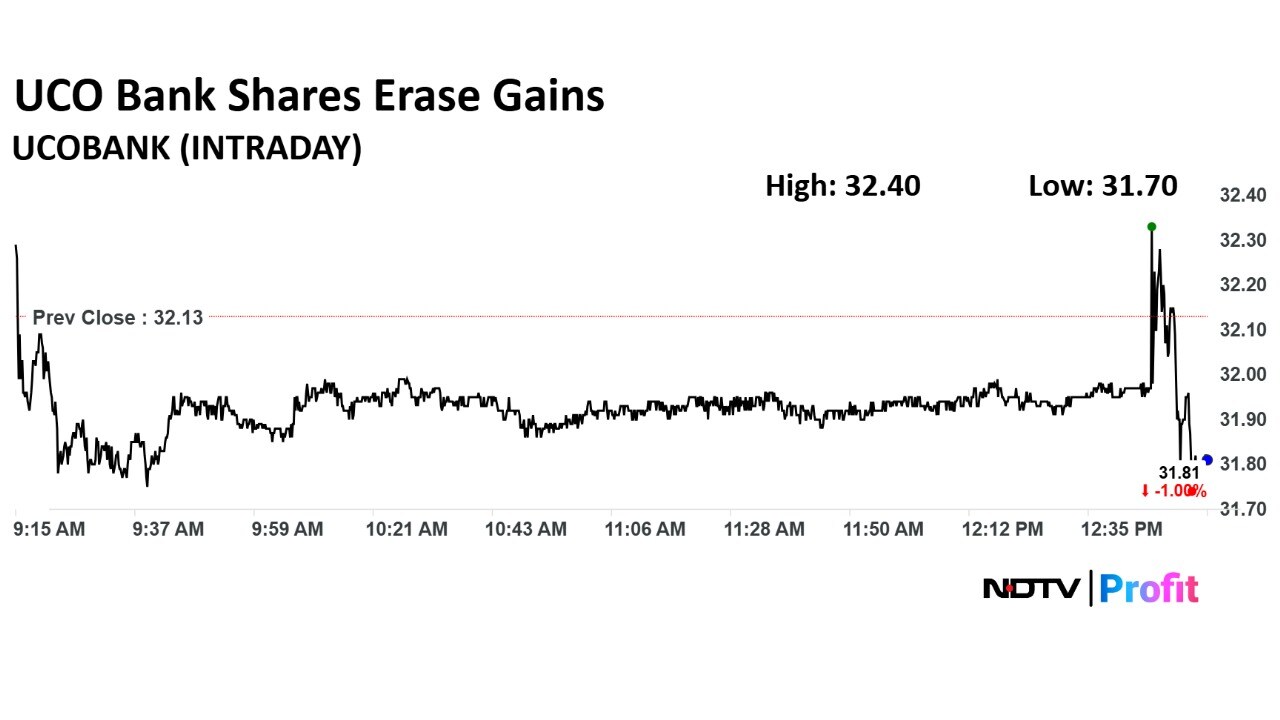

UCO Bank shares fluctuated on Monday after the Q1 results. While it initially jumped 0.8% after the results, the stock dropped 1% within minutes.

UCO Bank shares fluctuated on Monday after the Q1 results. While it initially jumped 0.8% after the results, the stock dropped 1% within minutes.

UCO Bank Q1FY26 (Standalone, YoY)

Net profit up 10% at Rs 607.4 crore versus Rs 55 crore

Net interest income up 7% at Rs 2,403 crore versus Rs 2,254 crore

Gross NPA at 2.63% versus 2.69% (QoQ)

Net NPA at 0.45% versus 0.5% (QoQ)

Operating profit up 18.2% at Rs 1,562 crore versus Rs 1,321 crore

Provisions down 7% at Rs 616 crore versus Rs 663 crore (QoQ)

Provisions up 34.3% at Rs 616 crore versus Rs 459 crore

Paisalo Digital Q1 FY26 Highlights (Consolidated, YoY)

Total Income up 17.2% at Rs 219 crore versus Rs 187 crore.

Net Profit up 13.7% at Rs 47.2 crore versus Rs 41.5 crore

Shares of Zomato, now rebranded as Eternal Ltd., traded 1.26% higher on Monday morning, ahead of the company’s first-quarter earnings announcement for FY26.

Market analysts remain optimistic about Zomato’s performance, with brokerages such as Goldman Sachs and HDFC Securities maintaining a bullish stance. Their confidence stems from Zomato’s continued product innovation and expansion into newer verticals like Bistro, which are seen as key growth drivers. The company’s food delivery business and quick commerce arm, Blinkit, are both expected to contribute significantly to revenue this quarter.

UltraTech Cement Ltd. is set to announce its financial results for the first quarter of the financial year ending March 2026 on Monday, and it has gained the confidence of a number of analysts.

Revenue is seen rising 19% to Rs 21,506 crore year-on-year, as per Bloomberg projection.

Read UltraTech Cement Q1 Preview here.

UltraTech Cement share price rose 1.73% to a record high of Rs 12,714 apiece ahead of Q1 results. The share price was trading 0.8% higher at Rs 12,596 apiece as of 12:10 p.m. as compared to 0.3% advance in the NSE Nifty 50 index.

UltraTech Cement share price rose 1.73% to a record high of Rs 12,714 apiece ahead of Q1 results. The share price was trading 0.8% higher at Rs 12,596 apiece as of 12:10 p.m. as compared to 0.3% advance in the NSE Nifty 50 index.

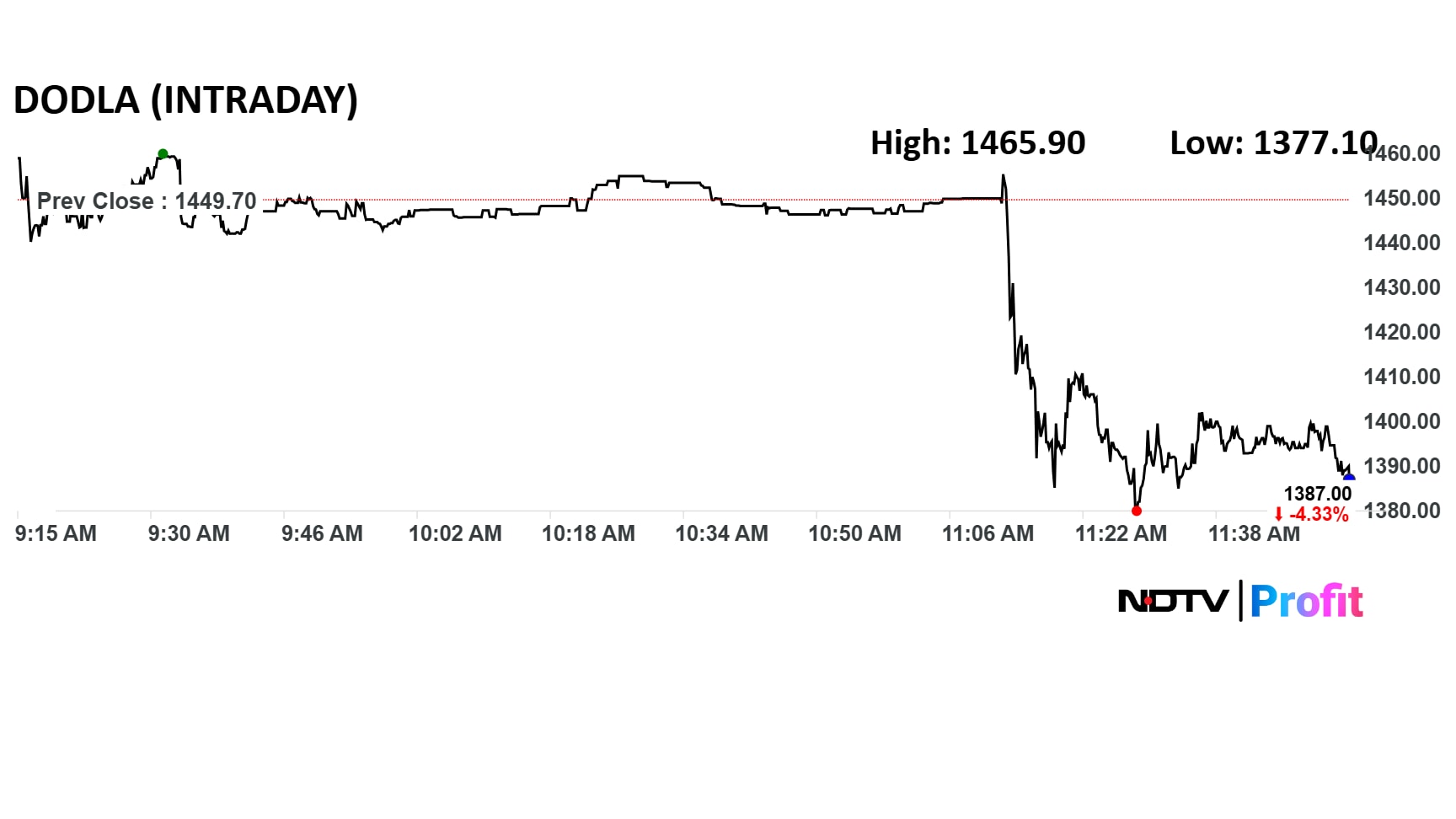

Dodla Dairy shares fell significantly after the Q1 numbers showed a decline in net profit. The scrip fell 5% intraday.

Dodla Dairy shares fell significantly after the Q1 numbers showed a decline in net profit. The scrip fell 5% intraday.

Dodla Dairy Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 10.5% at Rs 1,007 crore versus Rs 912 crore.

Ebitda down 21.5% at Rs 82.5 crore versus Rs 105 crore.

Margin at 8.2% versus 11.5%.

Net Profit down 3.2% at Rs 62.9 crore versus Rs 65 crore.

At least 46 companies are set to announce their financial results for the quarter ended June 2025 on July 21. Prominent names include Aditya Birla Group-backed UltraTech Cement, online food delivery platform Zomato’s parent Eternal and PNB Housing Finance, among others.

Andhra Cements Ltd., Bansal Wire Industries Ltd., Choice International Ltd., CIE Automotive India Ltd., Control Print Ltd., Crisil Ltd., DCM Shriram Ltd., Dhanlaxmi Bank Ltd., Eternal Ltd., Havells India Ltd., IDBI Bank Ltd., Latent View Analytics Ltd., Lynx Machinery & Commercials Ltd., Netripples Software Ltd., Oberoi Realty Ltd., Parag Milk Foods Ltd., PNB Housing Finance Ltd., Purple Finance Ltd., Shradha AI Technologies Ltd., S & T Corporation Ltd., UCO Bank., UltraTech Cement Ltd., Wendt (India) Ltd. and SV Trading & Agencies Ltd.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.