Indoco Remedies Ltd. posted a loss of Rs 26.4 crore in the quarter ended Dec. 31, 2024, in comparison to a profit of Rs 16.3 crore reported in the corresponding quarter last year.

The pharmaceutical company's revenue declined 10.6% year-on-year for the three months ended December, reaching Rs 411 crore, as against Rs 459 crore reported in the year ago period.

Operating income, or earnings before interest, taxes, depreciation, and amortisation, fell 80.9% year-on-year to Rs 12 crore. The Ebitda margin contracted to 2.9% from 13.7% in the same period the previous year.

The fall in revenue can be impacted due to decline in exports amid low supply due to planned shutdowns. “Domestic formulation business continued to contribute to revenue growth, while the export formulation business has been impacted by supply constraints from our sites that underwent planned shutdowns for enhancement of capacities and productivity,” said Aditi Panandikar, managing director of Indoco Remedies.

Indoco Remedies Shares Fall Over 4%

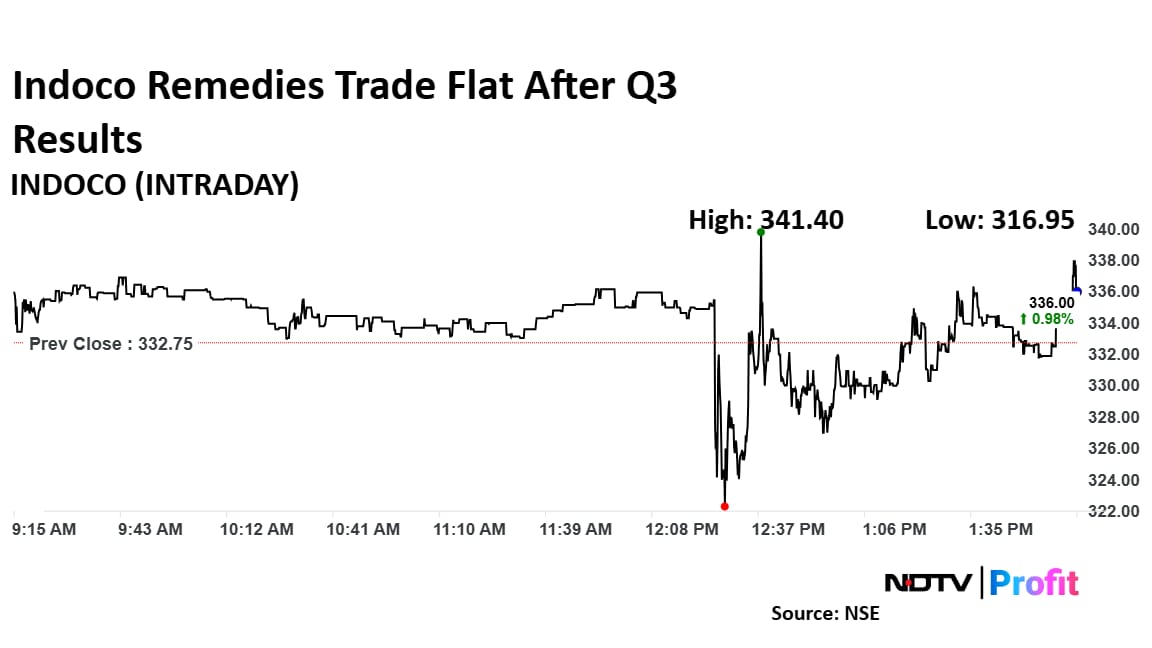

Shares of Indoco Remedies fell as much as 4.75% to Rs 316.95 apiece on the NSE, the lowest level since Dec. 17. However, it pared losses to trade 0.06% lower at Rs 332.55 apiece, as of 1:55 p.m. This compares to a 0.55% decline in the NSE Nifty 50 Index.

The company's stock has fallen 9.82% in the last 12 months. The total traded volume so far in the day stood at 7 times its 30-day average, whereas the relative strength index was at 53.

Out of seven analysts tracking the company, two maintain a 'buy' rating, two recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 6.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.