Ambuja Cement's net profit surged by 157.4% year-on-year, reaching Rs 2,115 crore, compared to Rs 824.25 crore in the same quarter last year. The revenue for the quarter rose by 4.5%, reaching Rs 8,415 crore, compared to Rs 8,052 crore in the previous year, indicating steady top-line growth.

While the company posted strong net profit figures, its earnings before interest, taxes, depreciation, and amortisation witnessed a decline of 51.8% to Rs 799 crore, compared to Rs 1,656 crore in Q3 of FY24. Company's Ebitda margin was down at 9.5%, compared to 20.6% in the same quarter of the previous year.

The company's revenue included government grant and other income.

The cement and building materials company is part of the diversified Adani Portfolio.

“We are pleased to report a quarter of sustainable performance, aligned with our growth plan. With focus on innovation, digitisation, customer satisfaction, and ESG, our vision drives our expansion into new geographies," said Ajay Kapur, whole time director and chief executive officer of Ambuja Cement.

Higher volume along with improved operational parameters resulted in growth in all business parameters, the company said in its press release.

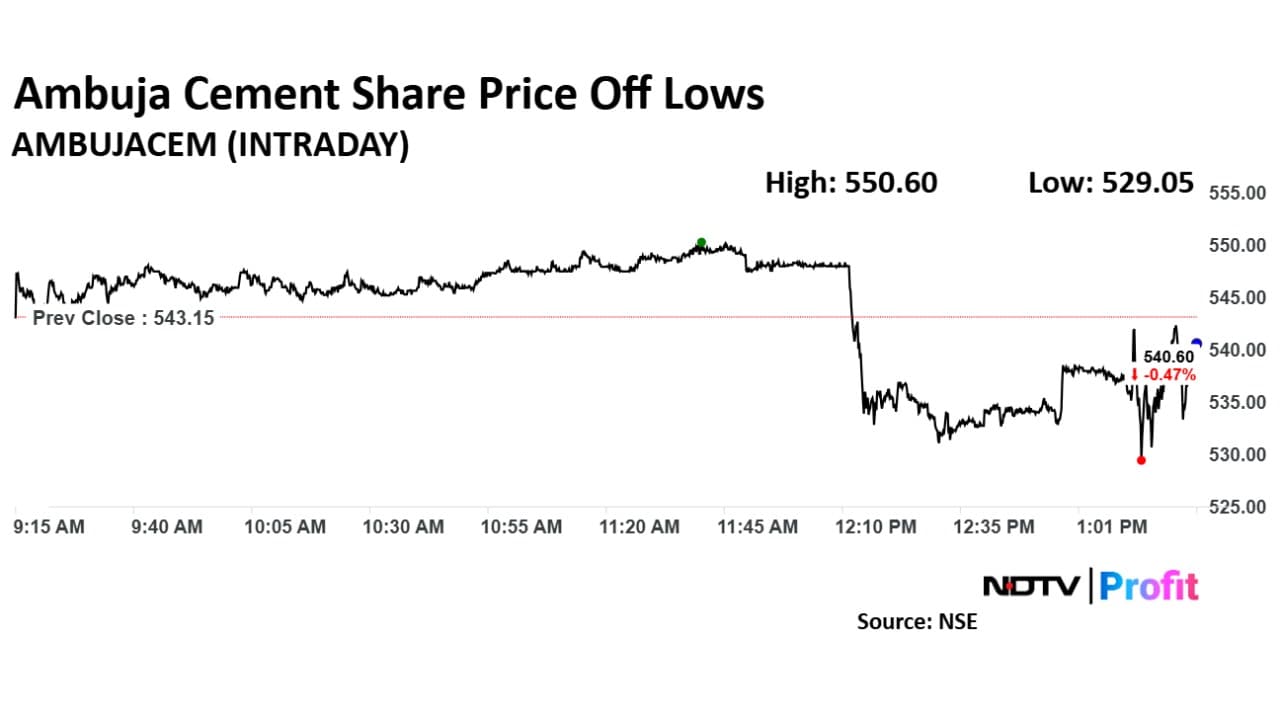

Ambuja Cement Share Price

Share price of Ambuja Cement fell as much as 2.60% to Rs 529.05 apiece. It pared losses to trade 1.26% higher at Rs 536.30 apiece, as of 01:25 p.m. This compares to a 0.86% advance in the NSE Nifty 50.

The stock has fallen 6.58% in the last 12 months. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 50.

Out of 42 analysts tracking the company, 28 maintain a 'buy' rating, nine recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 21.3%.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.