Digital payments platform PhonePe Pvt. on Monday launched a feature to pay income tax through its app.

The company said the feature allows taxpayers, both individuals and businesses to pay self-assessment and advance tax directly from within the PhonePe app.

PhonePe has partnered with PayMate, a leading digital B2B payments and service provider to enable this feature.

Users can choose to pay their taxes using their credit card or UPI.

"With credit card payments, users also get a 45-day interest-free period and earn reward points on their tax payments, depending on their bank," the company said in a statement.

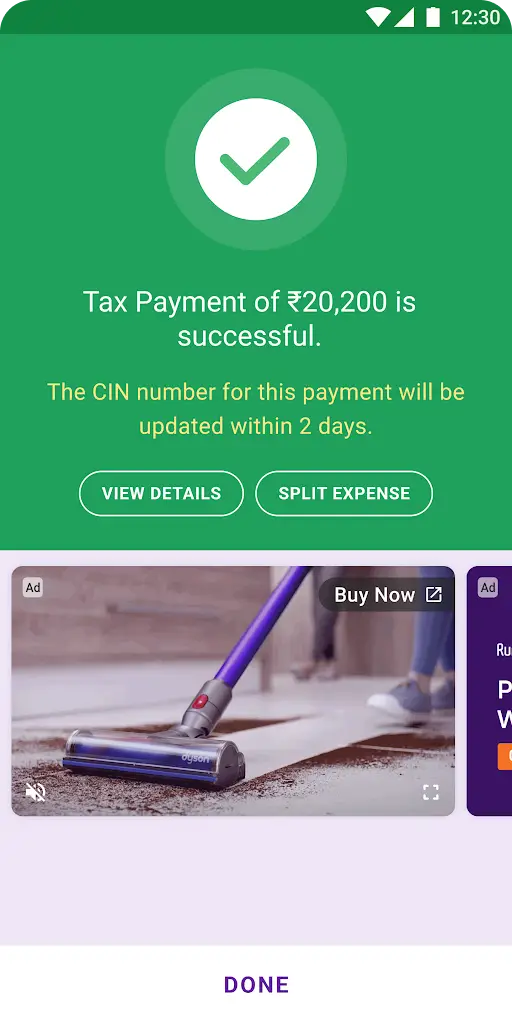

Once the payment has been made, taxpayers will receive a Unique Transaction Reference (UTR) number as an acknowledgement within one working day.

The challan for the tax payment will be available within two working days, PhonePe said.

How To Pay Income Tax From PhonePe?

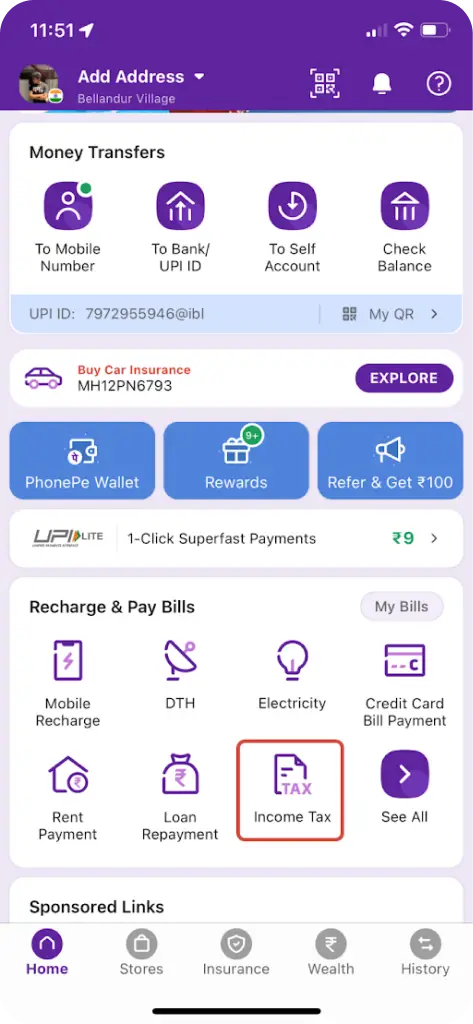

Step 1: Select the ‘Income Tax' icon on the homepage of PhonePe app

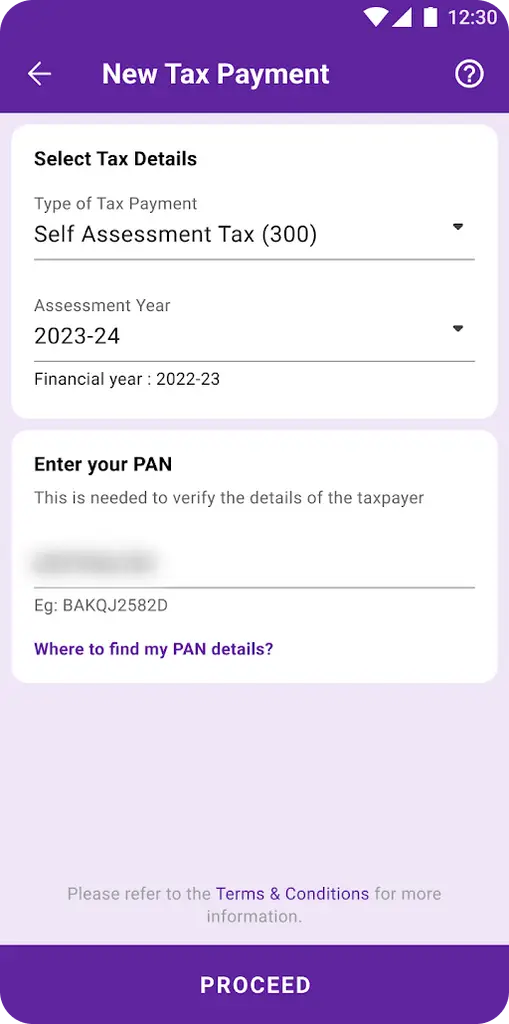

Step 2: Select the type of Tax, assessment year, and enter PAN card details.

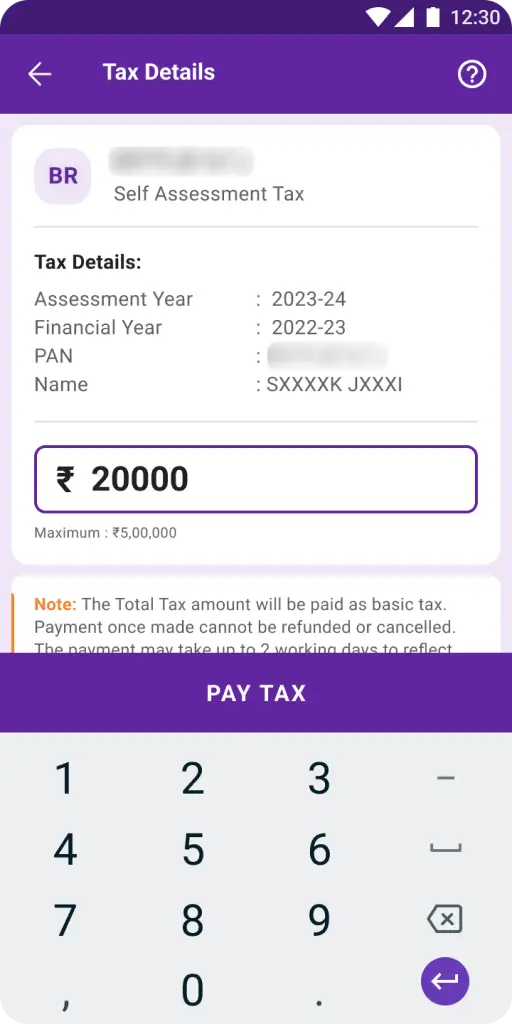

Step 3: Enter the total tax amount and pay using the preferred mode of payment

Once the payment is completed, it will be credited to the income tax portal within 2 business days.

Niharika Saigal, Head of Bill Payments and Recharge Business at PhonePe said, “Paying taxes can often be a complex and time-consuming task, and PhonePe is now offering its users a hassle-free and secure way to fulfil their tax obligations...this will transform the way our users pay taxes as we have now made the process both simple and easy.”

Started in 2015, the Walmart subsidiary was recently separated from its e-commerce sibling Flipkart. PhonePe has about 50 crore registered users and processes 45% of transactions on Bharat Bill Pay System (BBPS).

The company became a fintech in 2017 and launched mutual funds and insurance products.

3 Crore Income Tax Returns (ITRs) Filed

Over 3 crore ITRs for AY 2023-24 have already been filed till July 18 this year as compared to 3 crore ITRs filed till July 25 last year, the Income Tax Department said on July 19.

"Grateful to our taxpayers & tax professionals for having helped us reach the milestone of 3 crore Income Tax Returns (ITRs), 7 days early this year, compared to the preceding year!" the department said in a tweet.

Grateful to our taxpayers & tax professionals for having helped us reach the milestone of 3 crore Income Tax Returns (ITRs), 7 days early this year, compared to the preceding year!

July 19, 2023

Over 3 crore ITRs for AY 2023-24 have already been filed till 18th of July this year as compared… pic.twitter.com/jcGyirW2waEssential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.