Public discourse on the political economy in India is marked by a peculiar trait. The ‘who' overtakes and overwhelms the need for answers to ‘what' and ‘why' as also ‘how'. If ‘who' is acceptable then ‘what' is also acceptable and if ‘who' is not acceptable ‘what' is rejected regardless of merit.

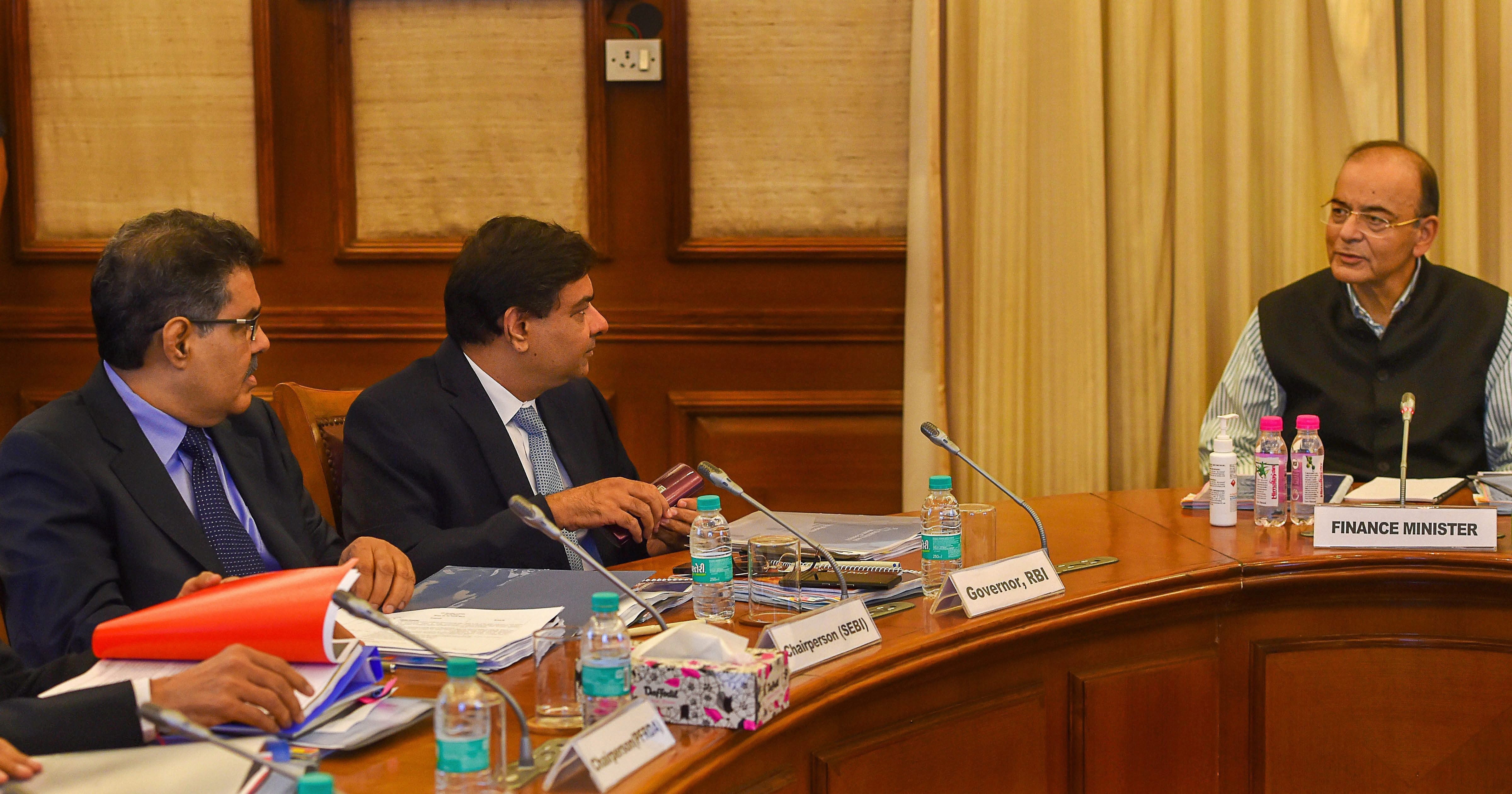

The face-off between the Government of India and the Reserve Bank of India vividly represents this phenomenon. A difference of opinion between the banking regulator and the government deserves reasoned attention and appreciation. The government and the RBI appear to have adopted the principle of ‘my way or the highway'. The occasion for statesmanship has been reduced to a supercilious squabble of the finger-wagging kind often seen on TRP-chasing soaps.

What are the issues in the arena of ricocheting rhetoric? The Government of India wants the RBI to ease the stringent conditions imposed on banks careening with losses and bad loans. It also wants RBI to consider diluting the norms for capital adequacy. And most contentiously, the government has questioned the need for the RBI to maintain high reserves suggesting that excess reserves could be deposited with the government.

The Reserve Bank of India sees this as an encroachment of its domain and infringement of its independence. In a series of clarion calls, Deputy Governor Viral Acharya first read the riot act by stating that “governments that do not respect the independence of central banks sooner or later incur the wrath of markets”. This was followed by a detailing of the objections by Deputy Governor NS Viswanathan.

The RBI has cried out that government advice is tantamount to an attack on its autonomy. Faced with resistance, the government sought consultation under Section 7 (1) of the RBI Act which explicitly states the “Government may from time to time give such directions to the Bank as it may, after consultation with the Governor of the Bank, consider necessary in the public interest.” This is followed by Clause 2 which says, subject to any such directions, “the affairs and business of the Bank shall be entrusted to a Central Board of Directors which may exercise all powers”.

What is striking is that in the war of words and the fury of the faithful, the crux is enveloped in the haze of pollution in Mumbai and Delhi.

The unstated questions: Why is the RBI resisting and what does the government want this money for?

Anatomy Of Autonomy

Autonomy by definition is an abstract idea. Is the RBI independent? The Reserve Bank of India is listed in Schedule 7 under the Union List and the government‘s powers are explicitly articulated in Section 7 in the RBI Act.

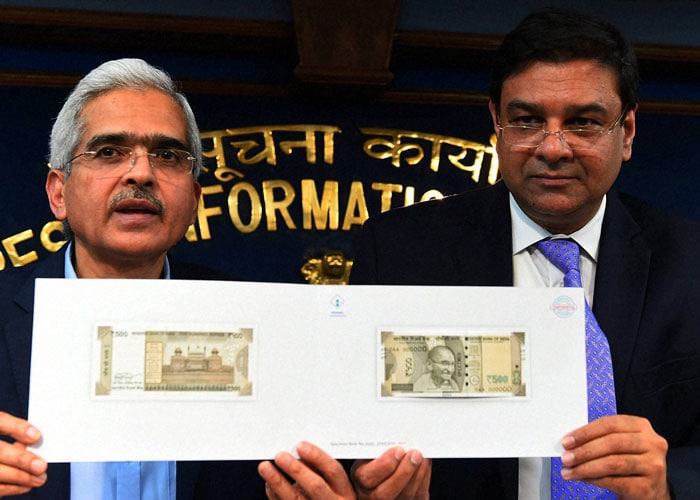

Facts are brutal, but it must be asked: was the RBI autonomous or independent in its action on Nov. 8, 2016?

The theory that the past can be avenged or redeemed in the present or in the future is only validated in the tomes of evangelists.

The issue of autonomy has been settled more than once. As early as in 1968, Morarji Desai as deputy prime minister had advised then RBI Governor LK Jha that the RBI must be “a truly independent body”. Jha articulated his view to IG Patel—who was later RBI Governor in 1980s—in a letter on Nov. 6, 1968. He said: “The independence of the Reserve Bank, as indeed of the Central Bank of any country, can never mean that it would follow a policy contrary to that of the Government.” It must “inevitably accept and implement the policies and adopt the objectives which the Government”. “Its independence is mainly operational within the field of responsibility” and “subject to Government's overriding powers to give directives.”

It is not just the Reserve Bank which has faced this issue. In the run-up to the 1972 election Richard Nixon eased out Fed Chairman William McChesney Martin and appointed his pick Arthur Burns. Nixon pressured Burns to keep Fed rates low with the infamous ‘we can take inflation not unemployment' thesis. It proved to be a disaster and brought into currency the term “stagflation” and a period of high inflation and unemployment and low growth. It took a Paul Volcker and the Volcker Shock to put the economy back on rails.

Bill Clinton, George Bush, and Donald Trump have all railed against the policies of U.S. Federal Reserve – under Alan Greenspan, Ben Bernanke, and Janet Yellen.

The hallowed U.S. Federal Reserve, like other central banks, is an independent government agency but also one that is ultimately accountable to the public and the Congress. The U.S. Fed is frequently described as “independent within the government not of the government.” And the U.S. Fed Chief can be removed “for cause” by the President.

As Jha told Patel, “The relationship between the Bank and the Government has, therefore, to strike a delicate balance.” There is no way out either. At Jackson Hole, in August 2016, Nobel Laureate Prof Christopher Sims eloquently underlined that the independence of central banks is dependent on government because monetary policy needs a corresponding response in fiscal policy by the government. He said “interest rate policy, tax policy, and expenditure policy, both now and as they are expected to evolve in the future” jointly determine outcomes.

Archaeological Arguments

The government is as responsible for the spectacle as the Reserve Bank of India. Uncannily, there is this addiction to organise an archaeological excavation of past policy decisions. The archaeological artefacts of decisions during the Congress regime have been presented as certificates – ranging from what Jawaharlal Nehru wrote, to what Manmohan Singh said, about RBI's autonomy.

Why must a government with a handsome majority depend on past precedents to justify current action?

Since the eruption of the face-off, different government officials have articulated a confusing babel of binary propositions. On Nov. 6, 2018, headlines across English and language newspapers screamed that the government wants Rs 3.6 lakh crore from the Reserve Bank reserves. There was no denial till three days later Economic Affairs Secretary Subhash Garg, tweeted to declare:

Lot of misinformed speculation is going around in media. Government's fiscal math is completely on track. There is no proposal to ask RBI to transfer 3.6 or 1 lakh crore, as speculated. (continued...).

The discourse is potholed with unanswered questions.

- Did the government ask the Reserve Bank of India for a portion of its reserves? A mere denial does not suffice, as the exact amount and the logic is hard to make up.

- If the government did want money or concessions or forbearance, why not state it upfront?

- What is the amount that was sought?

- Does this mean there is a mismatch of expenditure and budgeted revenues?

- Is there, to paraphrase Harry Belafonte, a hole in the fiscal bucket?

- If not, was the money intended for a new raft of electoral sops?

Abdication Of Obligations

It is not enough for the RBI to protest or rebel. It must explain—to the government and the public at large—what is at stake. For the sake of its own credibility, the regulator must make public the contentious issues.

Instead of deploying ivory tower intellectualism, the RBI should make the facts public.What is the nature and quantum of reserves? What kind of concessions/dilutions have been sought in capital adequacy, which are the sectors that the government is seeking relief for?

If the Governor and his team have conscientious objections these must be put in public domain. The government has expressed a desire to trim down the reserves. Is the buffer robust enough to deal with challenges posed to the rupee by oil roil and Trump Tariffs? Nineteen of the banks are in losses and 11 of them that are under corrective action have recorded over Rs 65,000 crore in losses since September 2017. The call for a relaxation of norms for banks under PCA—even as recapitalisation is stalled between intent and execution—could be catastrophic. Does the RBI need less or more of contingency reserves?

It is true that populism is essentially nationalising of costs for political dividends. The RBI, which has in the past advised against sops—for instance farm loan waivers—may have reasons for its resistance. It must analyse and elucidate the risks it foresees. What is the final analysis and conclusion of the central bank?

Opacity only aggravates suspicions.The asymmetry of information has consequences in business and the business of politics.

Not A Private Affair

It has been over six weeks since the outing of the war. Yet, it is unclear what exactly the government seeks and what the RBI is resisting. The government could have built public opinion, consensus and a case on what it wants and why. Similarly, the RBI could have laid out a four-by-four chart on the implications of what can be done what simply must not be done.

At the end of the day, the elected government will have the last word. If it ignores sage advice, it will face the electoral music.This weekend the pulse-discovery market in the national capital is divided between a possible compromise and a flare out at the Monday board meeting. There is speculation that the government wants the RBI to be steered by the board. There is also a buzz about seniors working for a truce and reconciliation. Regardless of the outcome it is critical to record and reiterate that these are public monies and the risks are bound to visit taxpayers, savers, and the economy at large.

The government and the RBI owe the public an explanation. This is not a private battle.

Shankkar Aiyar is the author of ‘Aadhaar: A Biometric History of India's 12-Digit Revolution'; and ‘Accidental India'. He is a political-economy analyst and Visiting Fellow at IDFC Institute.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.