What investor conferences allow you to do, is meet corporates and investors as a bunch in one day. That this happens in an off-the-record environment allows them to speak their mind a lot more freely, and we get to gauge what's next on the investing horizon. The Emkay Conference allowed me to speak to a lot of large fund managers, and a few mid-sized corporates.

Not even one of the five companies that I met was supremely confident that earnings would recover in a big way in the second half of 2017-18. Yes, earnings growth will return, but that it will necessarily revive in Q3 or Q4 of FY18 is not a certainty. This was the clear signal that I got from all the companies that I spoke to. Interesting then, that the street is still very very hopeful that H2FY18 will see a hockey-stick recovery in earnings growth.

Krishna Kumar Karwa of Emkay made a fairly interesting observation. He said that the market is building up such hopes of an earnings revival that if it doesn't happen by Q3FY18 – which would have the benefit of a low base due to the demonetisation impact in Q3FY17 – the markets could well be extremely disappointed.

Fund managers are a different breed because they are more adept at finding winners even if the markets aren't doing well and thus are not secularly bearish unless the scenario is really bad. Is it really bad? No. Far from it. But most were still skeptical about putting big money to work. I didn't talk to foreign institutional investors, who have already been on a selling spree. As you read this, FIIs have probably added to the Rs 11,000 crore that they have already sold in August.

Sure, there are always stories that people can bet on, even in a weak market scenario, but putting big money to work does not seem to be the favoured play currently.

The fund managers find uncertainties on the horizon, including what the U.S. Federal Reserve will do, whether earnings growth starts shaping up or not, and the fact that valuations are not cheap. But others at the Emkay Conference still saw India as among the best large growth markets in the world, where the macros are stable. Ratna Sahay of the International Monetary Fund told BloombergQuint that India was best placed to shelter external shocks if it came to that.

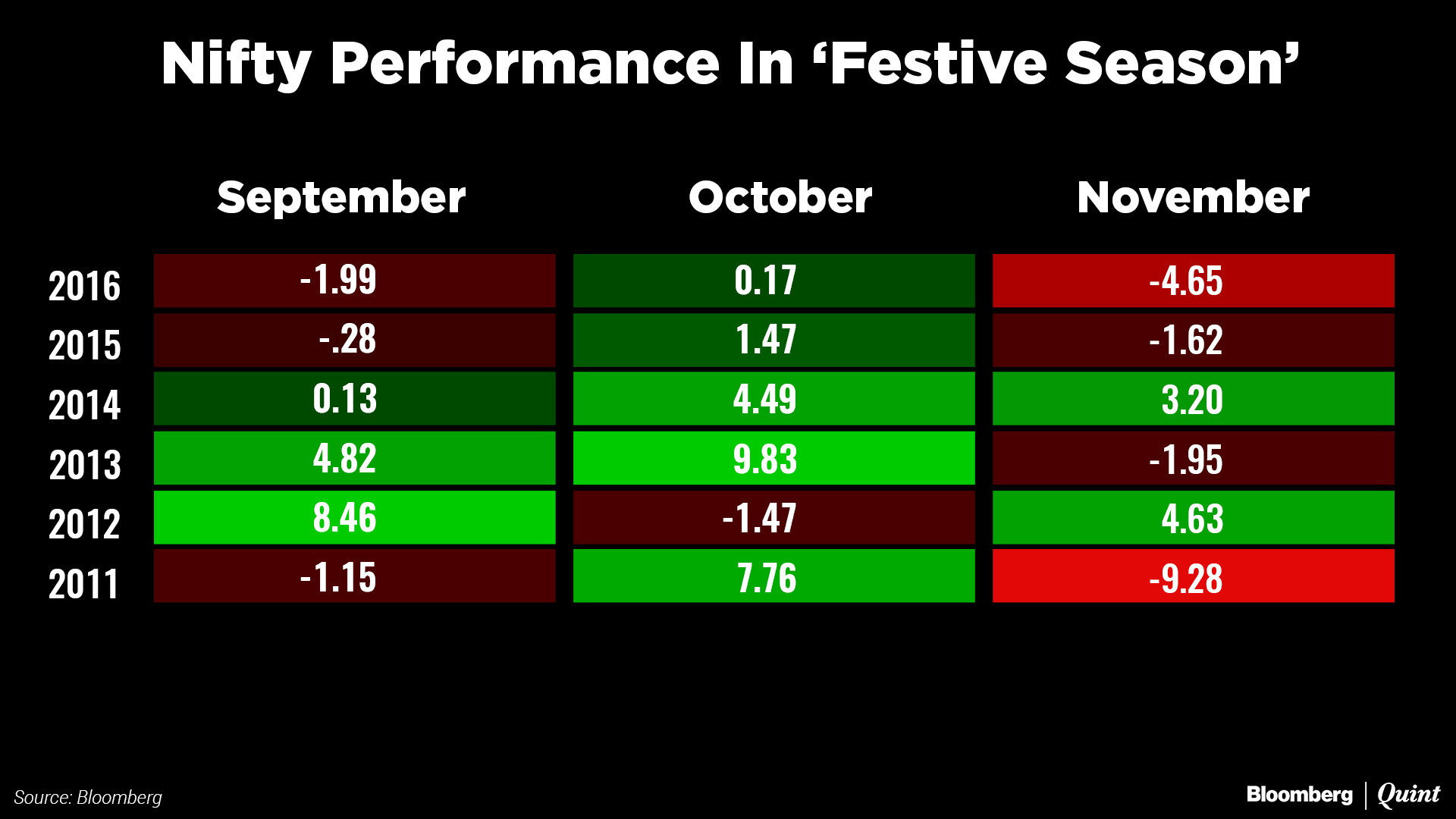

Call it the Hand of the Gods – since the festive season arrives in September and lasts till November – or mere coincidence, but this is hard data.

There have been only two instances this decade, one in November 2016 and the other in November 2011, when the markets corrected over 4 percent. One only hopes that global and local factors don't conspire to spoil the mood when the festivities come around.

Niraj Shah is Markets Editor at BloombergQuint.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.