I'm Starting With The Man

In The Mirror

I'm Asking Him To Change

His Ways

And No Message Could Have

Been Any Clearer

If You Wanna Make The World

A Better Place

Michael Jackson, January 1988

48 hours. Two interesting transactions. Verizon buys Yahoo. Flipkart's Myntra buys Jabong.

Both were widely speculated about but the details are still veryinteresting. As my multiple screens and feeds buzzed with details and commentaries onthe transactions, my mind went back to the strains of the enduring ‘Man in theMirror' song by Michael Jackson. Different times. Different contexts. Yet, thesame enduring message.

The two transactions hold up a mirror to the venture ecosystem andchallenge some closely held beliefs. Investors like us, and entrepreneurs, need to face reality and in some cases, changeour ways. I have heard from many of the Unicorn/'almost Unicorn' founders and their ever optimisticinvestors the familiar chant - “Kuch to ho hi jayega, so many millions havegone into the company.”

Translated it reads - we are too big to fail. The twotransactions are a painful reminder that it doesn't work like that. No one istoo big to fail!

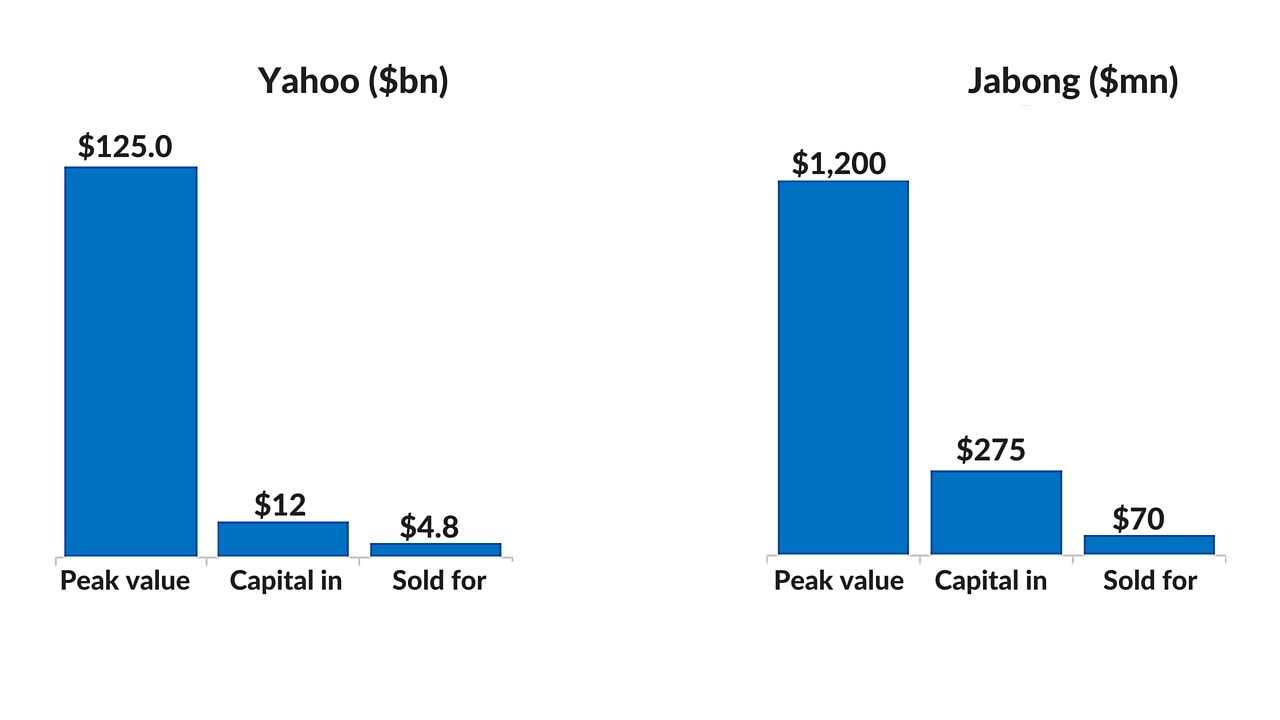

Leading with Yahoo, the company was theinternet for the first generation of people who went online. The home pageis still the most visited single page (excluding google.com) on the entireworld wide web with 43 million visitors a day. The $4.83 billion price tag is a far cry from Yahoo's peak market capitalizationof approximately $125 billion and from the $20 billion that Microsoft was willing to pay in November2008. The company has invested $11-12 billion* in the core business includingacquisitions. This represents a return of about 40 cents to the dollar! For all thenaysayers, Yahoo Japan shows what could have been possible. In a market that is athird of the U.S. market, the Japanese company is a market leader and has amarket capitalization of $ 26 billion.

Jabong is a similarly cautionary tale. The company got off to a superquick start helmed by young, aggressive founders and backed by Rocket Internet. Jabong reportedly refused an acquisition offer from Amazon of $700-800 million and at its peak was valued at $1.2 billion. Over $275 million* wasinvested in the business, which eventually sold for $70 million, returning about25 cents to the dollar. The $70 million actually represents a good outcome as till just a few months back, the company could notbe sold for even half that amount. Timing is everything. Flipkart acquiredMyntra, at that time a smaller business than Jabong is today, for $300 millionin 2014, albeit with a stock component.

The Yahoo experience also teaches another important lesson to investors and entrepreneurs. Onlya few, key decisions matter – you can make a lot of mistakes! Despite all thehand wringing and what could have been, two decisions saved the company. First,the decision to partner with Softbank and create Yahoo Japan in 1996 andsecond, the decision to invest $1 billion in Alibaba in 2005. Both must have beendifficult decisions, especially the latter, but they ended up paying offspectacularly. Apart from these, Yahoo made a lot of poor acquisitions that only enriched the sellers. It is also interesting to note that both the deals originated from Jerry Yang's connect with Softbank and Alibaba. Notchone up for the founders in the founders versus professionals debate!

Schadenfreude anyone? The point of writing this is not to indulge ingood old fashioned bashing of what has already happened. But to point out thatthe world is a crazy place where valuations can swing dramatically and capitalinvested is no guide to eventual returns. There is no law that protects capitalinvestments, however large they maybe. Things that work in one context don'talways work forever. The only constant is business performance and cash flowthat allows businesses to survive. Valuations will go up and they will go downbut if you are around then you can take advantage of the cycle. As the oldadage goes, to finish first, you have to first finish…

The man in themirror is saying that founders, startups and investors should celebratebusiness successes rather than funding rounds!

(Sarbvir Singh is an experienced venture capital investor in India and was thefounding Managing Director of Capital18. The portfolio of companies that he has worked withinclude BookMyShow, Yatra and Webchutney among others.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.