Inflows into equity mutual funds snapped a four-month rising streak even as the benchmark indices reported their best September in six years after India cut corporate tax rates.

Net inflow into equity and equity-linked savings schemes fell 28 percent over the previous month to Rs 6,609 crore in September, according to data released by the Association of Mutual Funds in India.

“Investors used the spike in stock prices after the corporate tax cut to book profits through redemptions,” said Sunil Subramaniam, managing director and chief executive officer at Sundaram Asset Management Company Ltd.

Contribution through systematic investment plans remained steady in September.

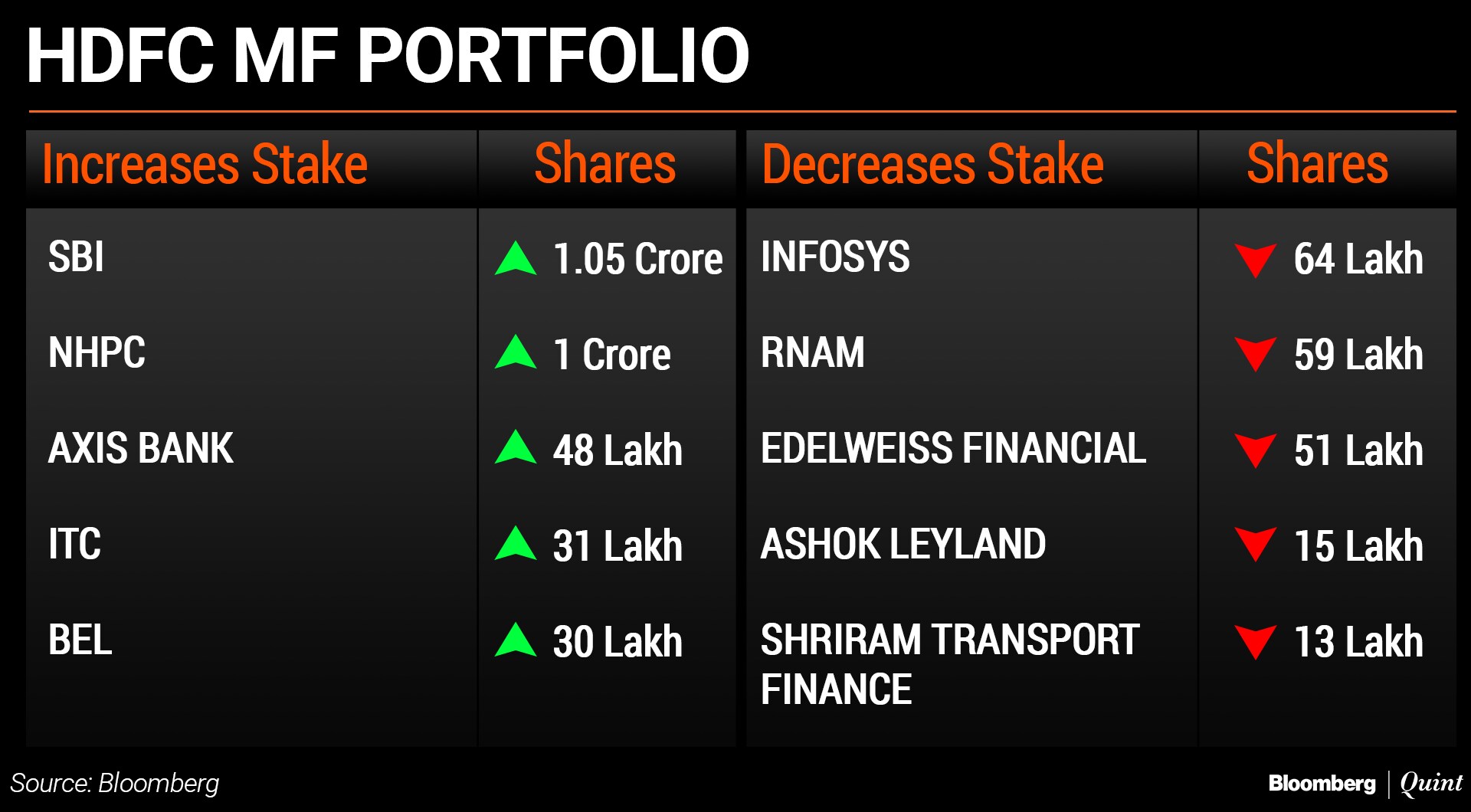

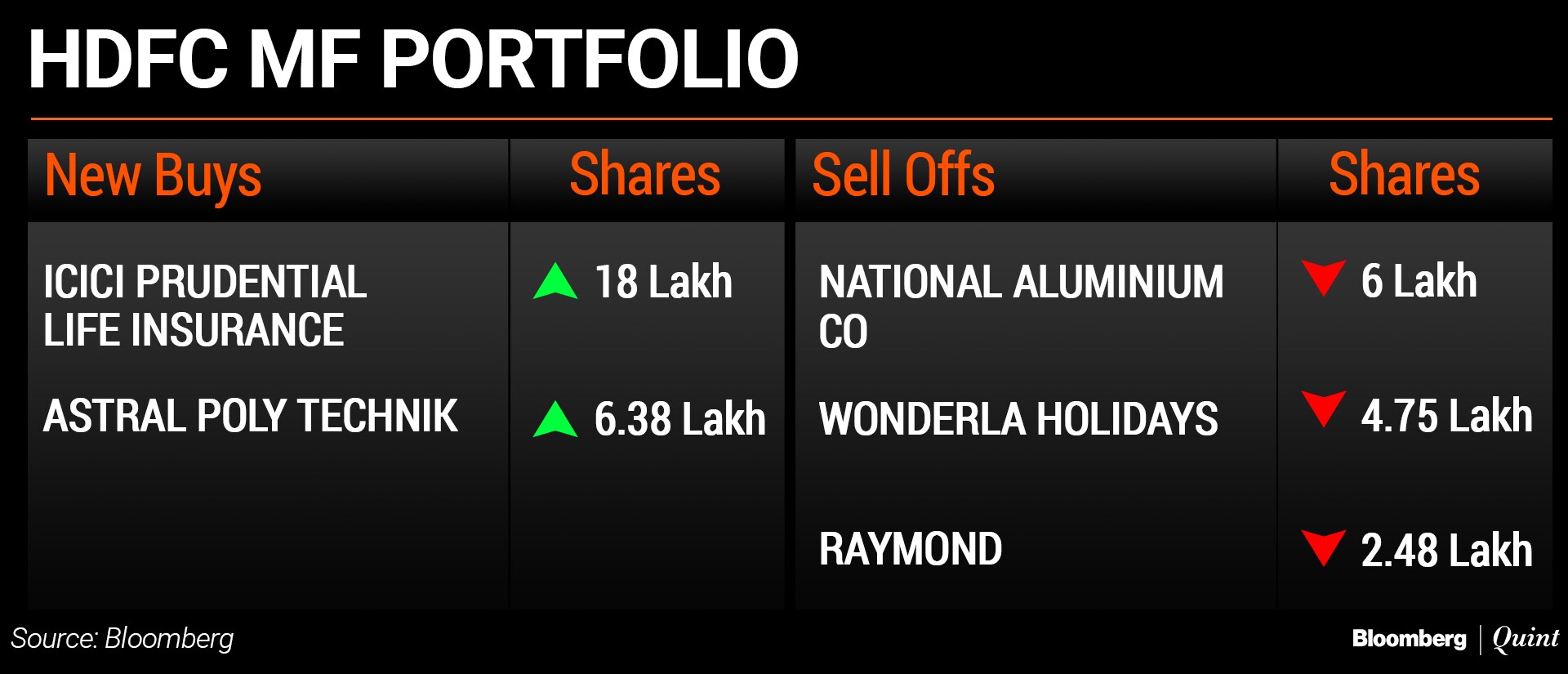

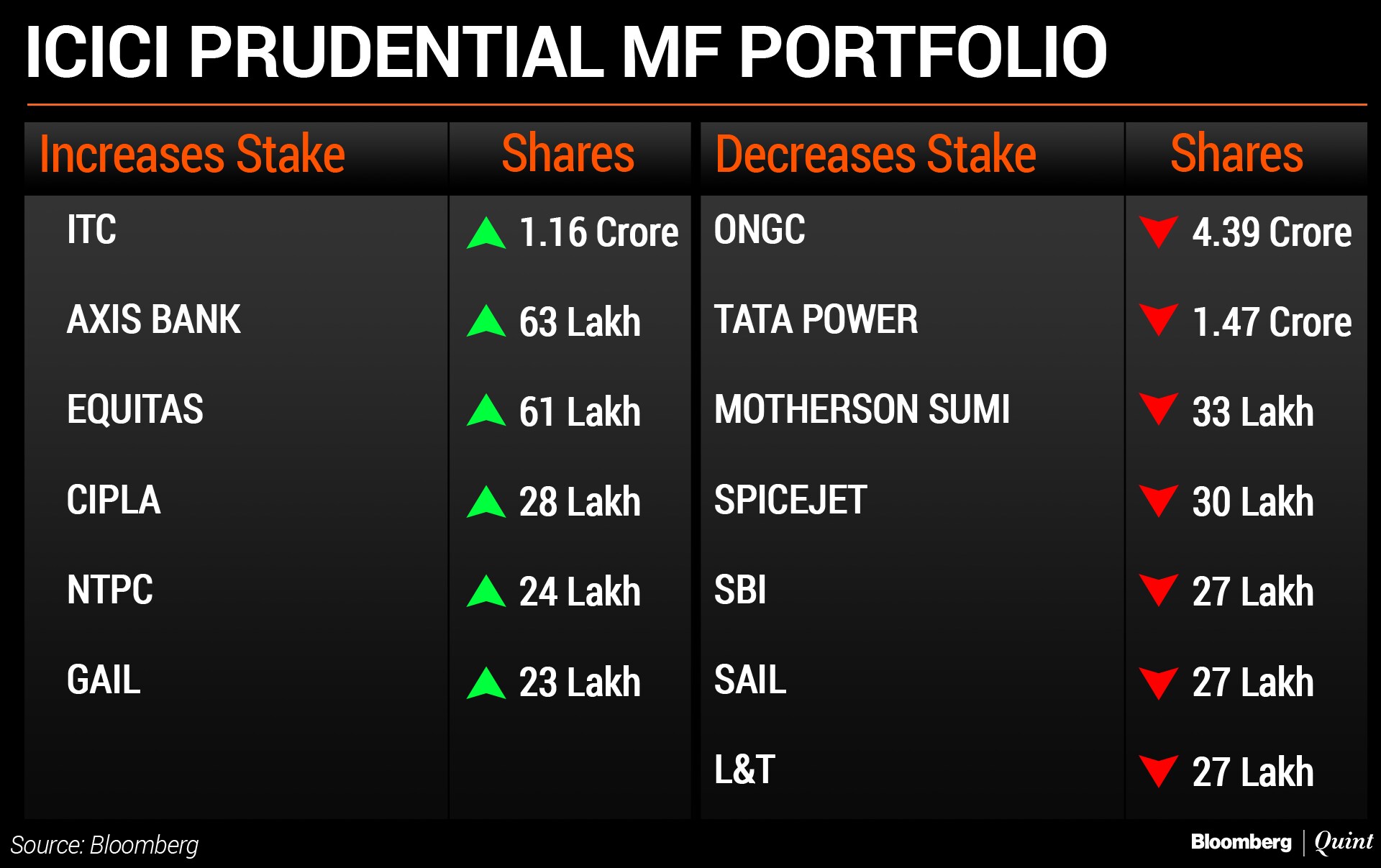

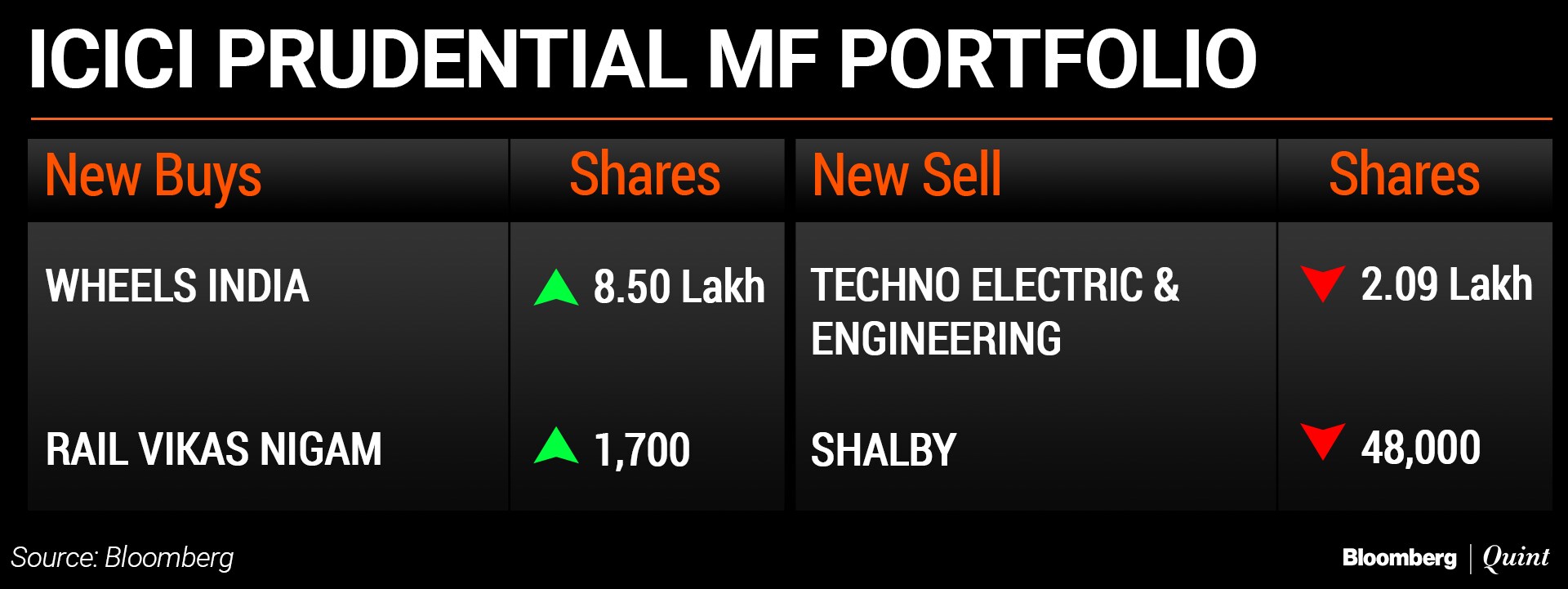

Here's what India's largest asset managers bought and sold last month…

HDFC Mutual Fund

India's largest asset manager has equity assets worth more than Rs 1.46 lakh crore invested in 336 securities. Its largest exposure is in the financial sector at 31.3 percent, followed by industrials at 13.8 percent. Its largest five-year increase is in the financial sector and largest five-year decrease in the communication sector, according to Bloomberg data.

ICICI Prudential Mutual Fund

Total equity assets of the fund house is more than Rs 1.37 lakh crore invested in 634 securities. By industry, its largest exposure is in financials at 27.4 percent, followed by materials at 9.5 percent.

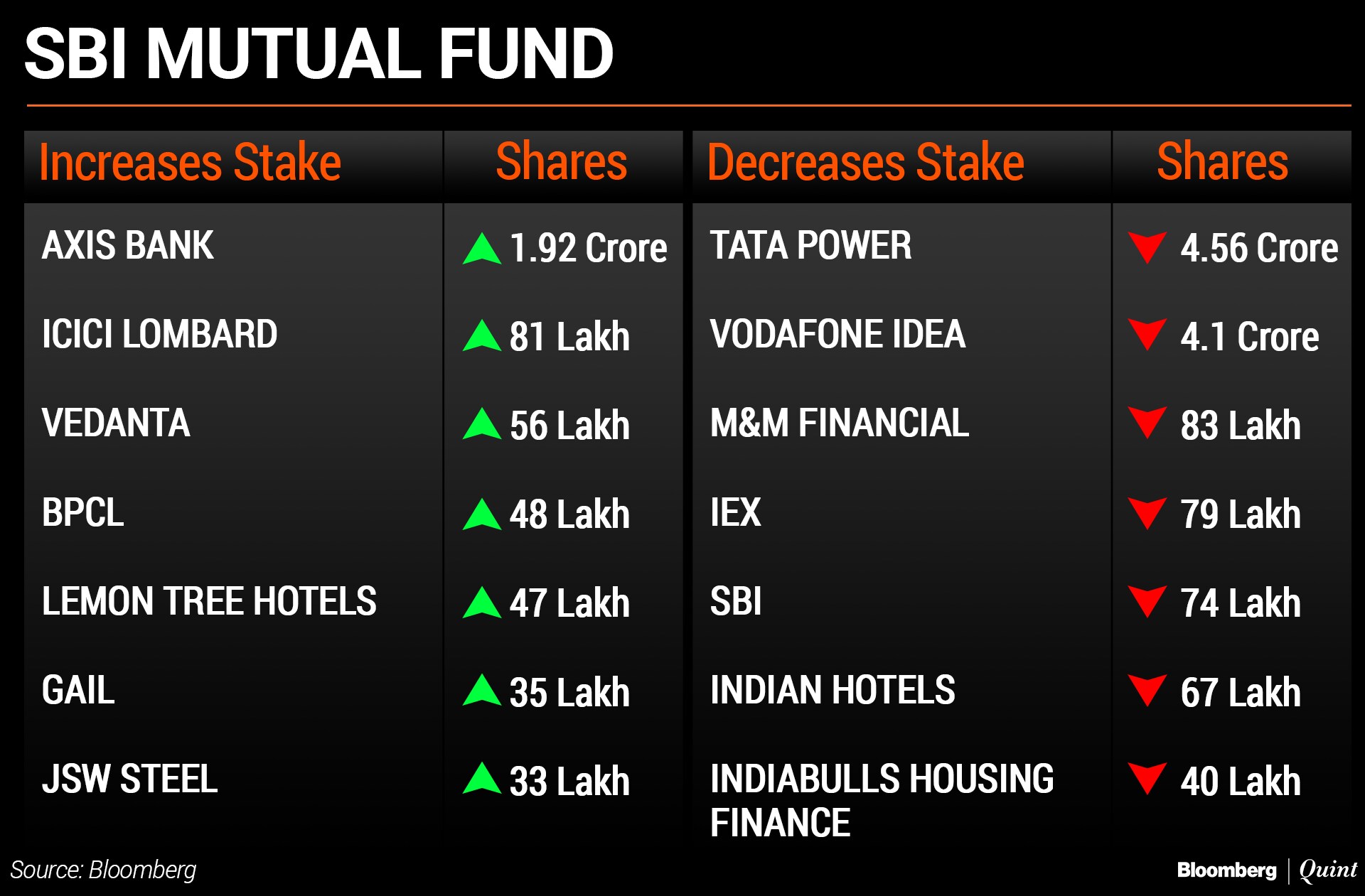

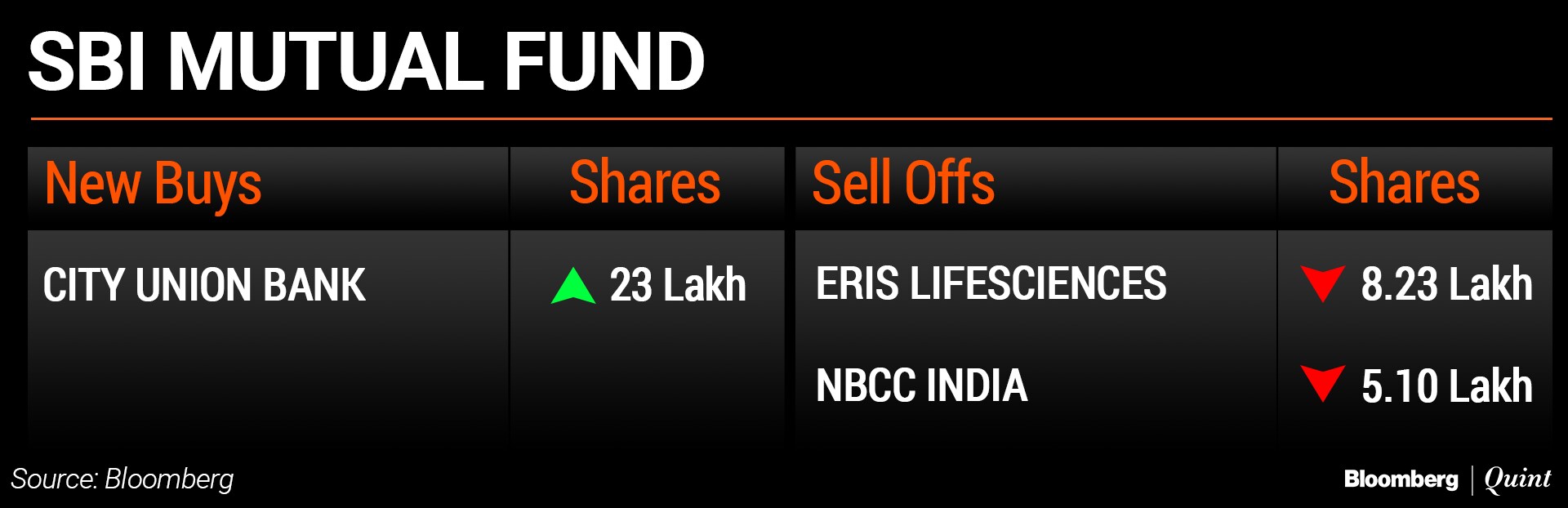

SBI Mutual Fund

The money manager has equity assets of more than Rs 1.7 lakh crore invested across 331 securities. It has the highest exposure in the financials sectors at 39.8 percent, followed by technology at 9.6 percent. Over 70 percent of its portfolio is invested into large-cap stocks and 19.2 percent in mid-cap stocks, according to Bloomberg data.

(Note: HDFC MF and SBI MF figures has been updated to show the latest data.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.