Morgan Stanley has reaffirmed its bullish stance on Eternal Ltd., reiterating it as a top pick with a price target of Rs 320, implying a 33% upside, after it initiated an 'overweight' call on rival Swiggy Ltd. earlier in the day. The brokerage believes Eternal's leadership in both food delivery and quick commerce, along with its favorable cost structure and strong balance sheet, sets it apart from peers.

The firm now expects India's quick commerce total addressable market to expand to $57 billion by 2030, up from the earlier estimate of $42 billion, on account of faster customer additions and expansion into more cities. Eternal's quick commerce gross order value assumptions for the next two fiscals have been raised by 9-11%.

While adjusted Ebitda losses in quick commerce are expected to peak in the March quarter, Morgan Stanley anticipates more gradual margin improvement due to heightened competition. Food delivery, on the other hand, is expected to benefit from better monetisation and operating leverage, with adjusted Ebitda margin estimates revised upwards.

Despite minor adjustments to estimates, the firm has made no change to the Rs 320 price target.

Key catalysts highlighted include sustained quick commerce growth, improvement in food delivery unit economics, and stability in competitive intensity over the next six months. Morgan Stanley maintains its view that Eternal is well-positioned to dominate a large profit pool in the medium term.

The brokerage had assigned Swiggy a price target of Rs 405, implying a 22% upside from current levels.

Swiggy, Morgan Stanley projects, is expected to reach adjusted Ebitda break-even by fiscal 2028. The brokerage expects Swiggy's food delivery business to grow at a 15.8% CAGR from fiscal 2025 to 2029, and its quick commerce gross order value to grow at a 63% CAGR over the same period.

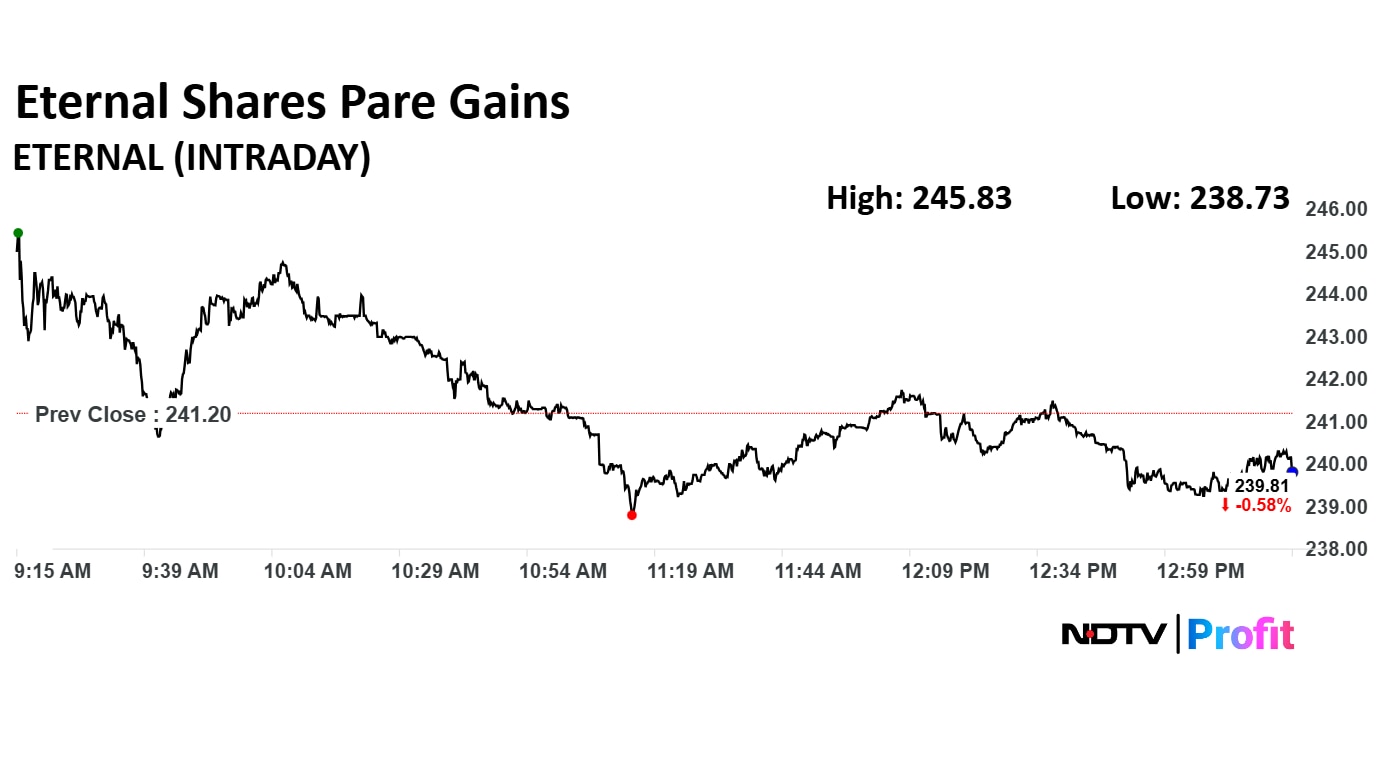

Zomato Share Price Today

The scrip rose as much as 1.92% to Rs 245.83 apiece, the highest level since May 19. It pared gains to trade 0.37% lower at Rs 240.31 apiece, as of 01:22 p.m. This compares to a 0.65% decline in the NSE Nifty 50 Index.

It has fallen13.63% on a year-to-date basis, but has gained 36.87% in the last 12 months. The relative strength index was at 49.37.

Out of 30 analysts tracking the company, 24 maintain a 'buy' rating, two recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 14%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.