ICICI Securities believes that food delivery businesses are being ignored as quick-commerce expansions started to capture attention. Food delivery businesses displayed some sort of slowdown in growth in the third quarter of the financial year 2025. However, there's nothing substantial to worry about.

ICICI Securities reiterated a 'Buy' rating on Zomato Ltd. and Swiggy Ltd. as they think the recent meltdown of the stocks' prices is temporary. The stock will likely recover as discretionary spending started to pick up.

There's an increase in cash burns in quick commerce as contender Zepto started offering higher discounts, the brokerage said. These concerns have been over-baked into Zomato and Swiggy's share prices. The stocks corrected 45% and 30%, respectively. Swiggy is trading at a discount to par value for the food delivery business, which indicated negative value for the optionality of success in quick commerce. Zomato's current trading value ascribes nothing to quick commerce.

Nevertheless, food delivery businesses have continued to scale profitably over the past two years, according to ICICI Securities. There's no worry about structural growth drivers in the space. The income tax cuts will trigger consumption revival among the middle class, who are the target audience for hyper-local food delivery and quick commerce businesses. Hence, the food delivery space is likely to be a key beneficiary as consumption starts to pick up.

Investors have deeply discounted quick commerce valuations because of intensifying competition and high capital investment in the space, ICICI Securities said. Item-level discounts have peaked. Companies are now focusing on increasing order values by increasing the cart-level discounts.

Quick commerce businesses have reduced their marketing expenses, which should yield some improvement in Ebitda contribution. Despite the absence of visibility on contribution margin improvement in the near term, ICICI Securities sees valuations for quick commerce business as compelling for investors with an investment horizon of one year.

Swiggy & Zomato Share Prices Rise As ICICI Securities Re-iterates Buy

ICICI Securities has discounted cash flow-based target prices for Swiggy and Zomato. The target price for Zomato is Rs 310, which implies a 39.55% upside from Monday's closing price. Swiggy's target price is Rs 740, which implies a 126.79% upside from the previous close of Rs 326.30 apiece.

The key risks for Zomato and Swiggy are a fall in discretionary consumption, disruptive business operations, and negatives in the external environment.

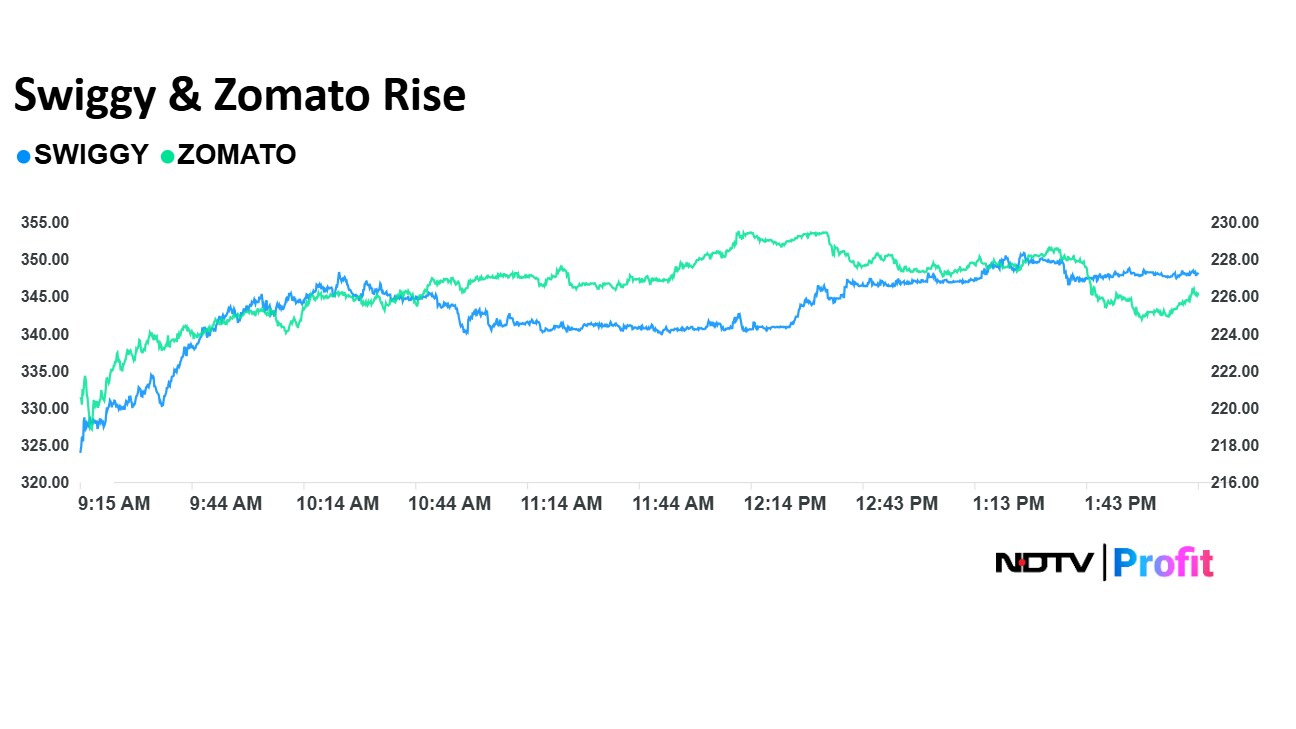

Swiggy and Zomato's share prices rose 7.88% and 3.39%, respectively, so far today. The stocks were trading 7.42% and 2.03% higher, respectively, as of 2:25 p.m., as compared to a 0.15% decline in the NSE Nifty 50 index.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.