- Shares of Zomato, now Eternal Ltd., rose 1.26% before Q1 FY26 earnings announcement

- Zomato expected to report 13.5% revenue growth to Rs 6,624.2 crore for Q1 FY26

- EBITDA projected at Rs 178.4 crore with margins of 2.6% for the quarter

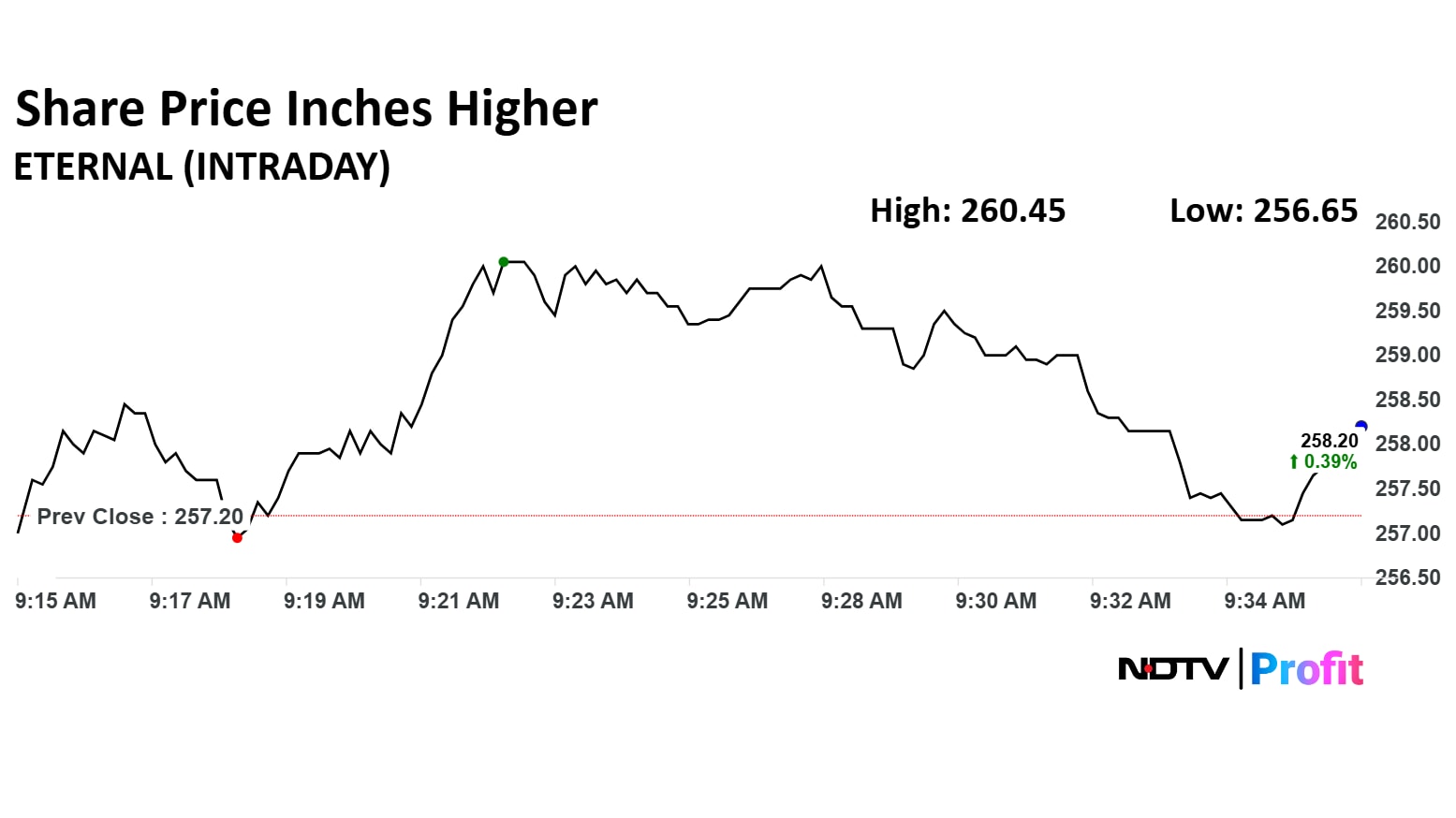

Shares of Zomato, now rebranded as Eternal Ltd., traded 1.26% higher on Monday morning, ahead of the company's first-quarter earnings announcement for FY26.

Market analysts remain optimistic about Zomato's performance, with brokerages such as Goldman Sachs and HDFC Securities maintaining a bullish stance. Their confidence stems from Zomato's continued product innovation and expansion into newer verticals like Bistro, which are seen as key growth drivers. The company's food delivery business and quick commerce arm, Blinkit, are both expected to contribute significantly to revenue this quarter.

According to consensus estimates, Zomato is likely to report a 13.5% year-on-year increase in revenue to Rs 6,624.2 crore. Ebitda is projected at Rs 178.4 crore, with margins expected to come in at 2.6%. Net profit is seen rising to Rs 105 crore, signaling a potential turnaround from the previous quarter's sharp decline.

However, analysts remain cautious about profitability. While Blinkit's margins are expected to improve gradually as the business scales, brokerages acknowledge that the path to sustained profitability may be uneven due to ongoing reinvestments and intense competition in the quick commerce space.

As Zomato prepares to release its earnings later today, investors will be watching closely for signs of margin stability and strategic clarity, especially in its high-growth segments. The stock's performance ahead of the results suggests that the market is pricing in a positive surprise, but expectations around profitability remain tempered.

The scrip rose as much as 1.26% to Rs 260.45 apiece. It pared gains to trade 0.29% higher at Rs 257.95 apiece, as of 09:38 a.m. This compares to a 0.22% decline in the NSE Nifty 50 Index.

It has risen 21.03% in the last 12 months. The relative strength index was at 50.

Out of 31 analysts tracking the company, 25 maintain a 'buy' rating, two recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.