14_05_2024..jpg?downsize=773:435)

Shares of Zomato Ltd. declined over 2% on Friday after the food delivery platform received a tax demand from the Goods and Services Tax department.

The notice, issued by the Joint Commissioner of CGST & Central Excise in Thane, Maharashtra, outlined a penalty of Rs 803.4 crore for the period between October 29, 2019, and March 31, 2022.

The penalty includes Rs 401 crore in GST dues, along with an equal amount in interest and additional fines. The tax demand pertains to non-payment of GST on delivery charges, which has now attracted both interest and penalty charges from the authorities.

Zomato, in its filing to the stock exchanges on Dec. 12, acknowledged the receipt of the demand order and emphasised its intention to challenge the notice. The company confirmed that it would take appropriate steps to address the issue.

Zomato had also received a GST demand order in September over alleged non-payment of GST on delivery charges. Combined with interest, the demand order amounted to Rs 17.7 crore. The notice was issued by West Bengal's tax authority and pertained to the period between April 2021 and March 2022.

Zomato, which is the leading player in India's food delivery market, had posted a 30% year-on-year decline in its September-quarter net profit to Rs 176 crore. The company's revenue from operations, however, had increased 14% year-on-year to Rs 4,799 crore.

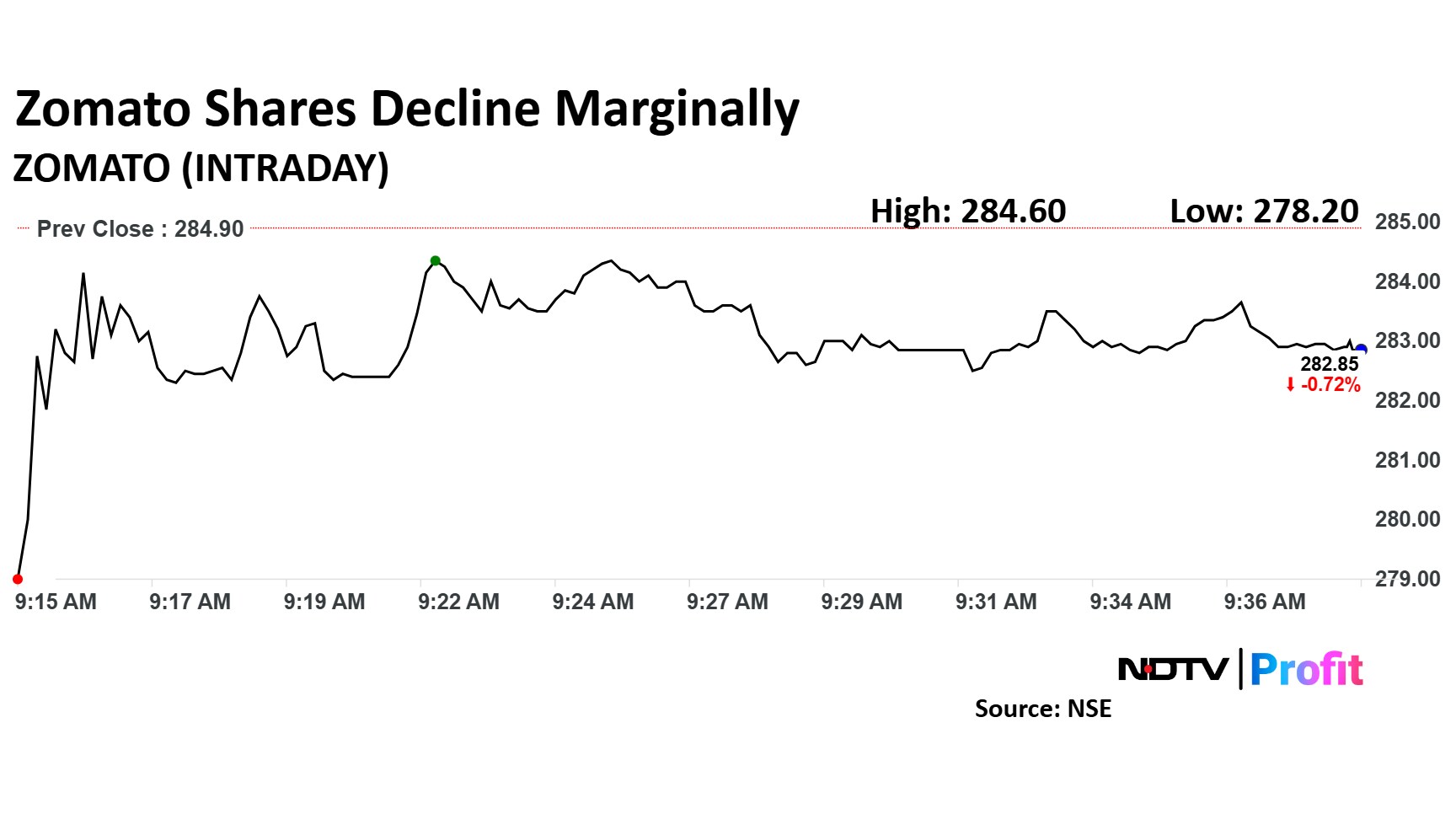

Zomato Share Price Today

Share price of Zomato fell as much as 2.35% before paring loss to trade 0.63% lower at Rs 283.10 apiece, as of 09:36 a.m. This compares to a 0.64% decline in the NSE Nifty 50.

The stock has risen 135.92% in the last 12 months. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 53.

Out of 26 analysts tracking the company, 24 maintain a 'buy' rating and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 6.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.