Share price of Zomato Ltd. dropped nearly 5% in early trade on Tuesday following a downgrade by Jefferies, which reduced its rating on the food delivery company to 'hold' due to increasing competitive pressures.

Jefferies analysts projected that Zomato's stock would experience a year of consolidation after a strong 2024, in which it had doubled in value, in a note on Jan. 6. While the analysts acknowledge Zomato's solid execution and growth potential, they expressed concerns about rising competition in the quick commerce sector.

The brokerage revised its target price for Zomato shares to Rs 275, down from Rs 335, indicating just a 1% upside from the stock's previous closing price.

It anticipates that intensified competition from both established players and new entrants will result in greater discounting, potentially impacting Zomato's medium-term profitability.

Additionally, Jefferies significantly lowered its Ebitda forecast for Blinkit, Zomato's quick-commerce division, for fiscals 2026-27 and reduced its target multiple for Blinkit to six times.

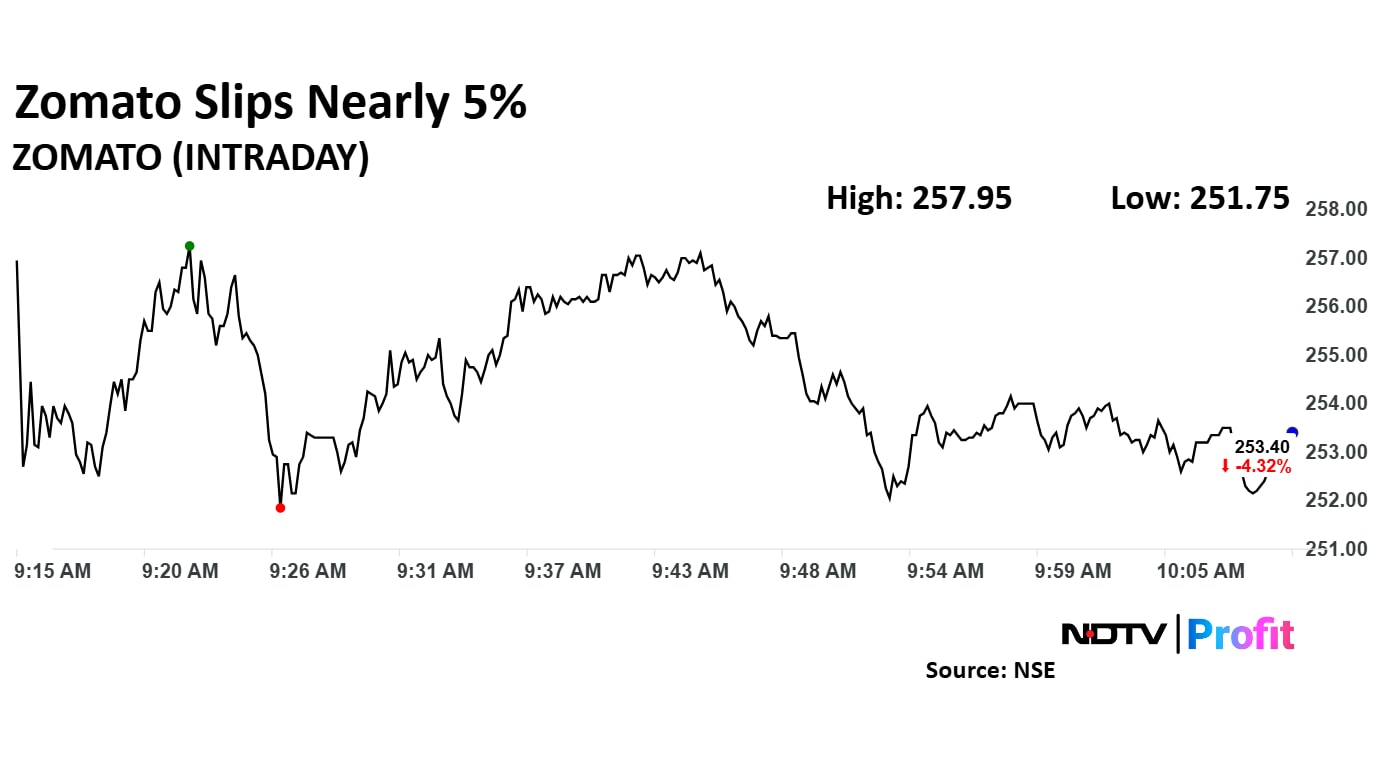

Zomato Share Price Today

Zomato share price fell as much as 4.95%, the lowest level since Nov. 11, 2024, before paring some loss to trade 4.74% lower at Rs 252.30 apiece, as of 10:06 a.m. This compares to a 0.18% advance in the NSE Nifty 50.

The scrip has risen 119.45% in the last 12 months. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 34.5.

Out of 27 analysts tracking the company, 24 maintain a 'buy' rating, one recommends a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 20%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.