Wipro Ltd.'s share price hit the highest level in over two years after NDTV Profit reported the company secured a $100-million deal from the Italian unit of Marelli, an automotive solution firm. The IT firm has extended partnership with the company for four years.

As a part of the deal, Wipro FullStride Cloud will migrate Marelli's Milan Data Centre and server rooms to the cloud to centralise operations and provide more agile and stable ecosystem, Wipro said in the exchange filing.

The project will empower Marelli, which has its global headquarters in Japan, to respond fast to the changes in the market, enable continuous innovation across their business, and strengthen their competitive edge, the filing said.

Wipro first entered into a partnership with Marelli in 2020.

The modernisation project will enhance employee support services with artificial intelligence-powered virtual assistants, vulnerability management services, comprehensive application maintenance services. These offerings from Marelli, in collaboration with Wipro, will drive innovation, optimise cost, reduce the need of future reworks through solutions designed for long–term efficiency, Wipro said in the exchange filing.

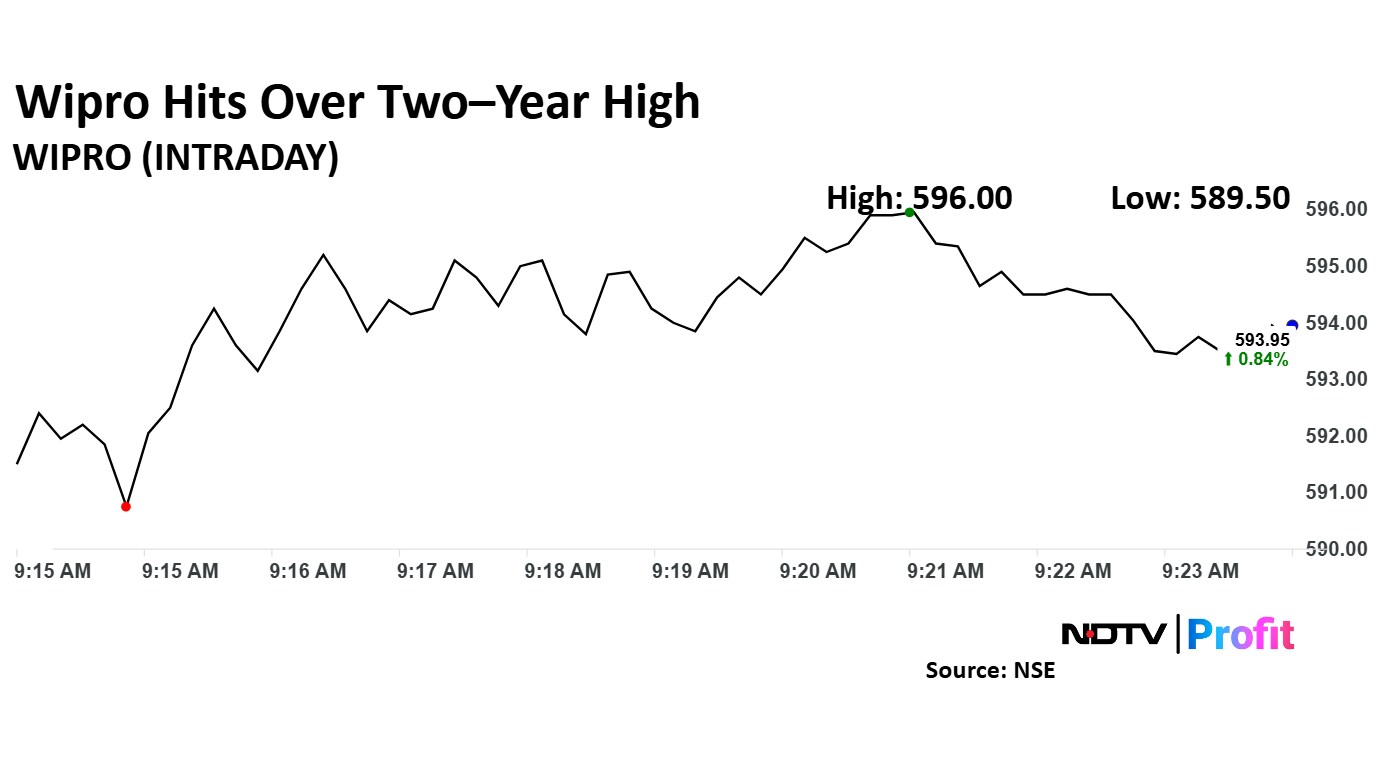

Wipro Share Price Today

Wipro's share price rose 1.19% to Rs 596.00 apiece, the highest level since April 6, 2022. The stock extended its gains to fourth session. It erased gains to trade flat at Rs 589.00 as of 09:50 a.m., as compared to a 0.10% decline in the NSE Nifty 50.

The stock gained 48.42% in 12 months, and 25.2% on year-to-date basis. Total traded volume on NSE so far in the day stood at 0.25 times its 30-day average. The relative strength index was at 66.22.

Out of 45 analysts tracking the company, eight maintain a 'buy' rating, 12 recommend a 'hold' and 25 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 10.0%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.