- Whirlpool Corp plans to reduce its stake in Whirlpool India from 51% to 20% via private sale

- Axis Capital has a sell rating on Whirlpool India with a target price of Rs 897, 16% below current levels

- Whirlpool India's performance improved with new products despite competition and ownership changes

As Whirlpool Corporation offloads another 11.2% stake in its Indian subsidiary, Whirlpool of India, brokerage firm Axis Capital has turned bearish on the counter.

Axis Capital has a 'sell' call on Whirlpool of India with a target price of Rs 897 apiece, implying a 16% downside from its current levels.

The parent company had earlier announced that it intends to reduce its holding in Whirlpool India from 51% to 20% through a private sale, with proceeds expected to be used for debt repayment.

Whirlpool Corp. currently carries gross debt of Rs 57,000 crore as of September 2025. Axis Capital's calculations indicate that even if the corporation divests the full 31% stake, it would reduce less than 10% of its total debt, or cover only around 1.5 years of interest cost.

The brokerage noted that Whirlpool Corp. has already diluted its holding in Whirlpool India from 75% to 51% in 2024.

Despite these ownership changes, Axis Capital stated that Whirlpool of India has performed well over the past three years, even amid stiff competition. The company has improved its pricing strategy and launched new products such as glass-door direct-cool (DC) refrigerators and 3-star frost-free (FF) models.

Axis Capital cautions that the lack of clarity on ownership and control following Whirlpool Corporation's stake reduction may impact Whirlpool India's market share and business trajectory.

The brokerage, however, flags a strong balance sheet for Whirlpool India, with cash and cash equivalents of Rs 2,550 crore, CFO of Rs 570 crore, and an RoCE (ex-other income) of 38% in FY25.

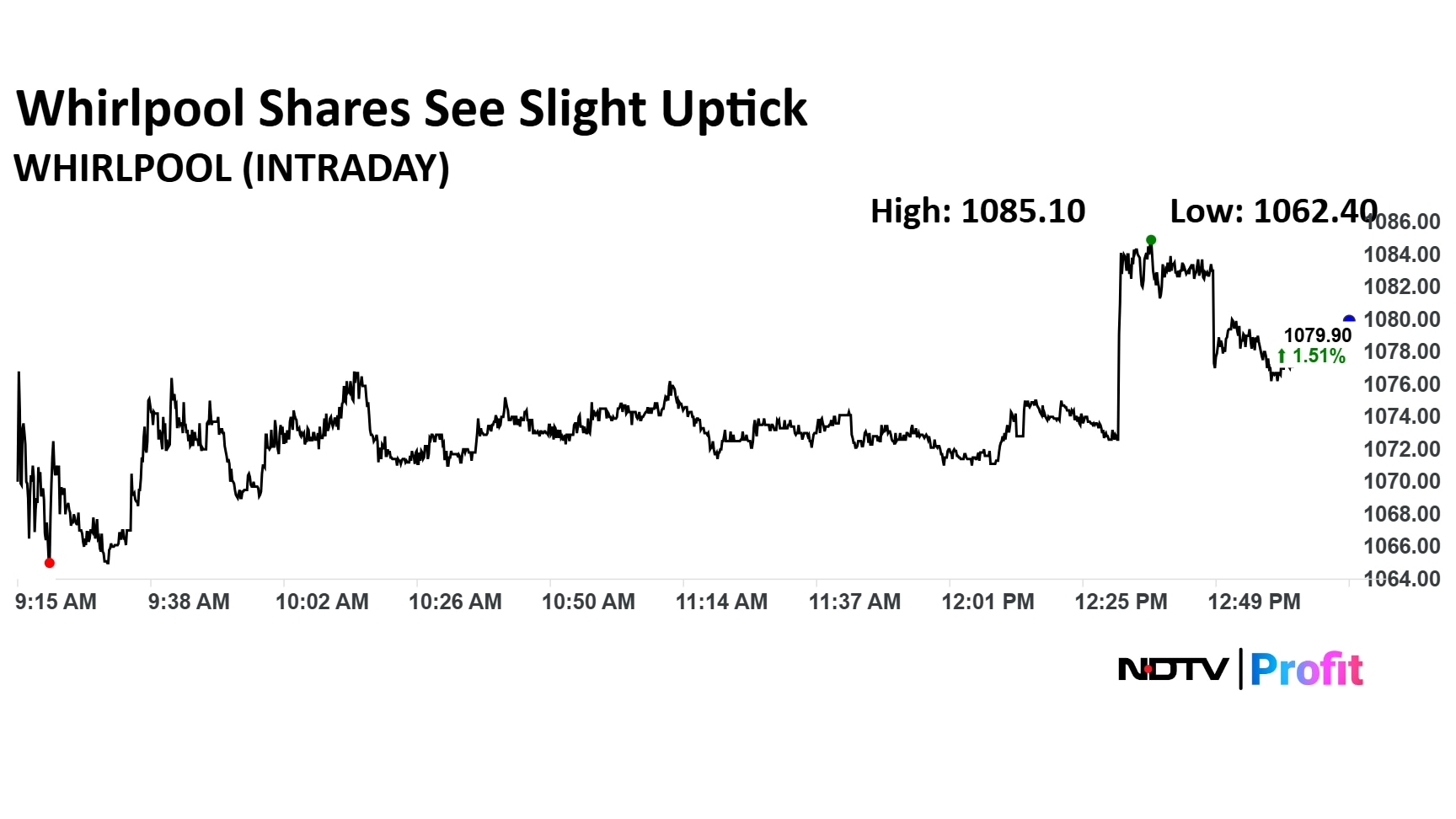

Whirlpool Share Price Today

The scrip rose 2% to Rs 1,085.10 apiece, paring gains to trade 1.46% higher at Rs 1,079.30 apiece, as of 01:15 p.m. This compares to a largely unchanged movement in the NSE Nifty 50 Index.

Whirlpool's share price has fallen 41.31% on a year-to-date basis. Total traded volume so far in the day stood at 1.24 times its 30-day average. The relative strength index was at 18.11.

Out of 13 analysts tracking the company, seven maintain a 'buy' rating, four recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 31%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.