Inflows into equity mutual funds declined for the fourth straight month in August even as markets scaled new peaks during the period.

Yet the mutual fund industry witnessed a total inflow of Rs 1.74 lakh crore, led by the liquid/money market category, according to data released by the Association of Mutual Funds in India. Total assets under management touched a record of over Rs 25 lakh crore in August. Total equity assets, too, rose 4.2 percent to Rs 8 lakh crore.

Here's what India's top three mutual funds bought and sold in August.

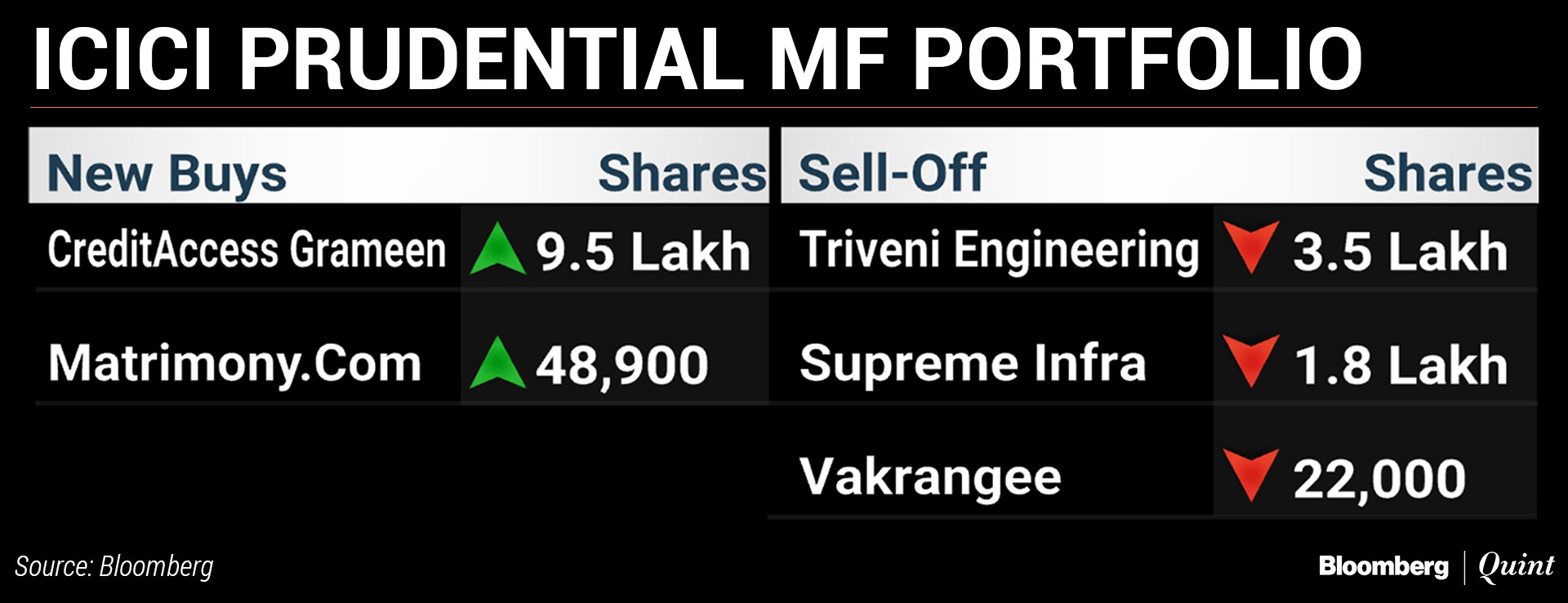

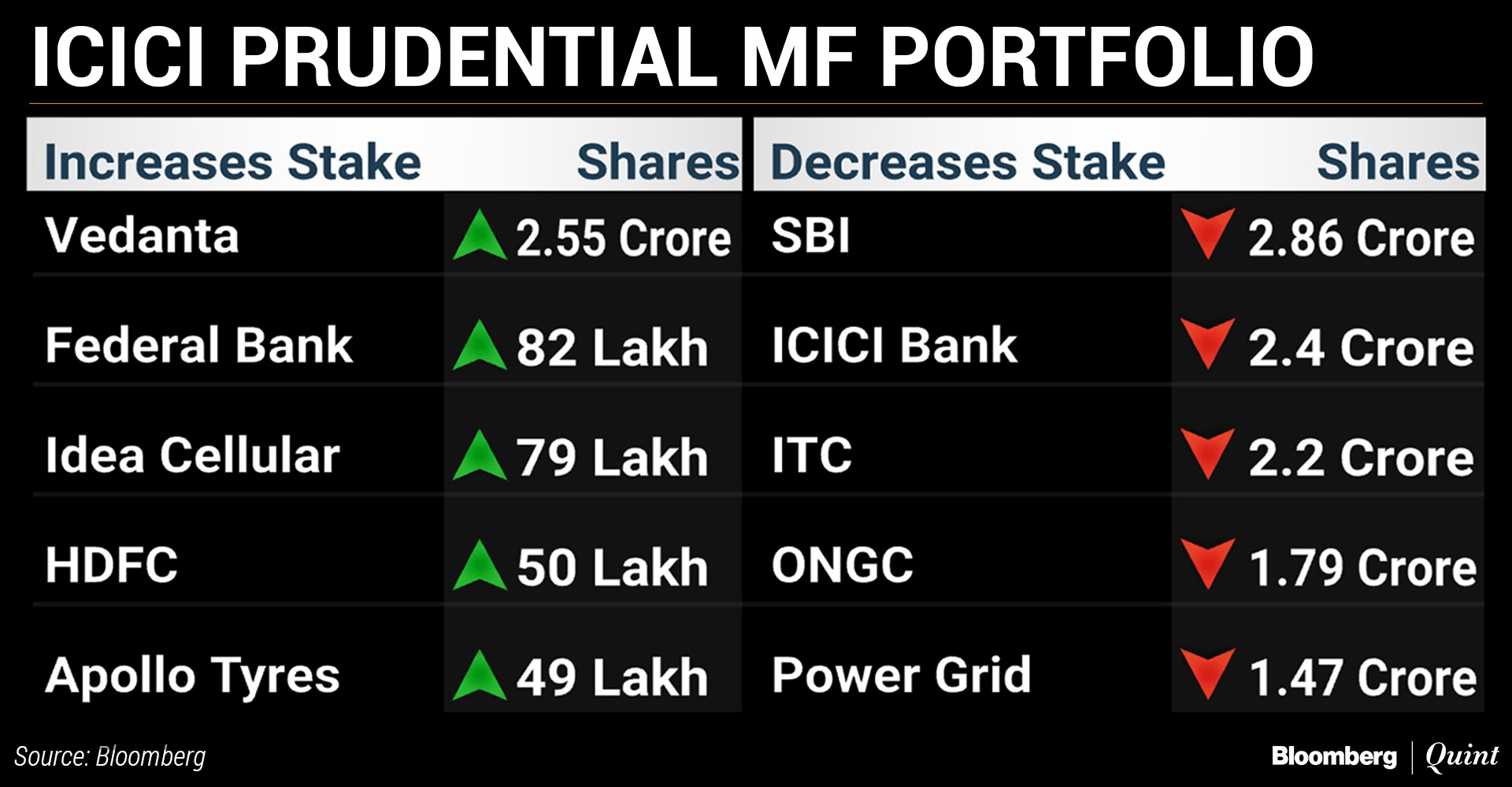

ICICI Prudential Mutual Fund

India's largest asset manager manages equity assets worth more than Rs 1.15 lakh crore invested in a portfolio of 619 stocks. It allocated 22. 9 percent of the portfolio to financials and 10.8 percent to utilities.

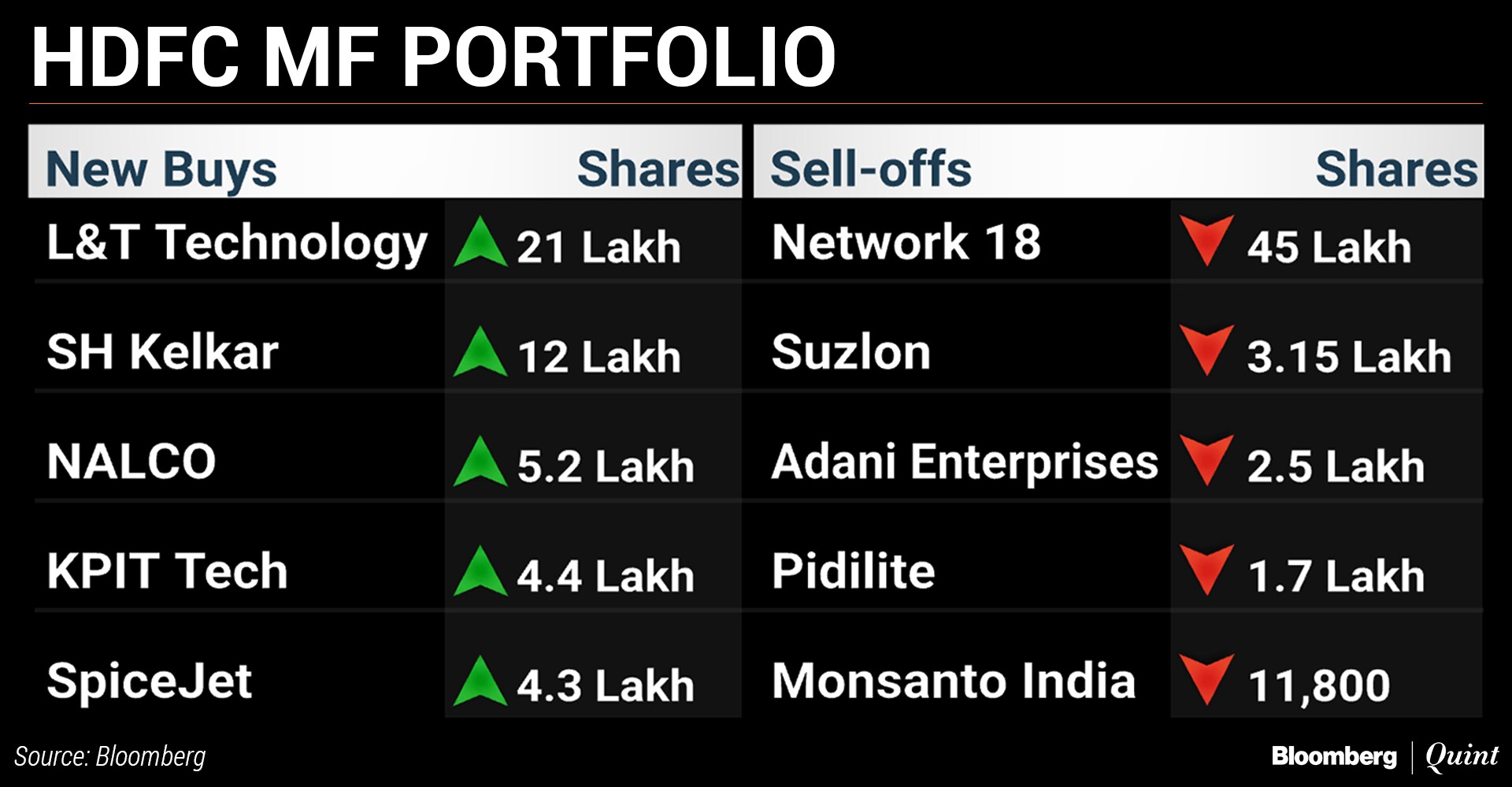

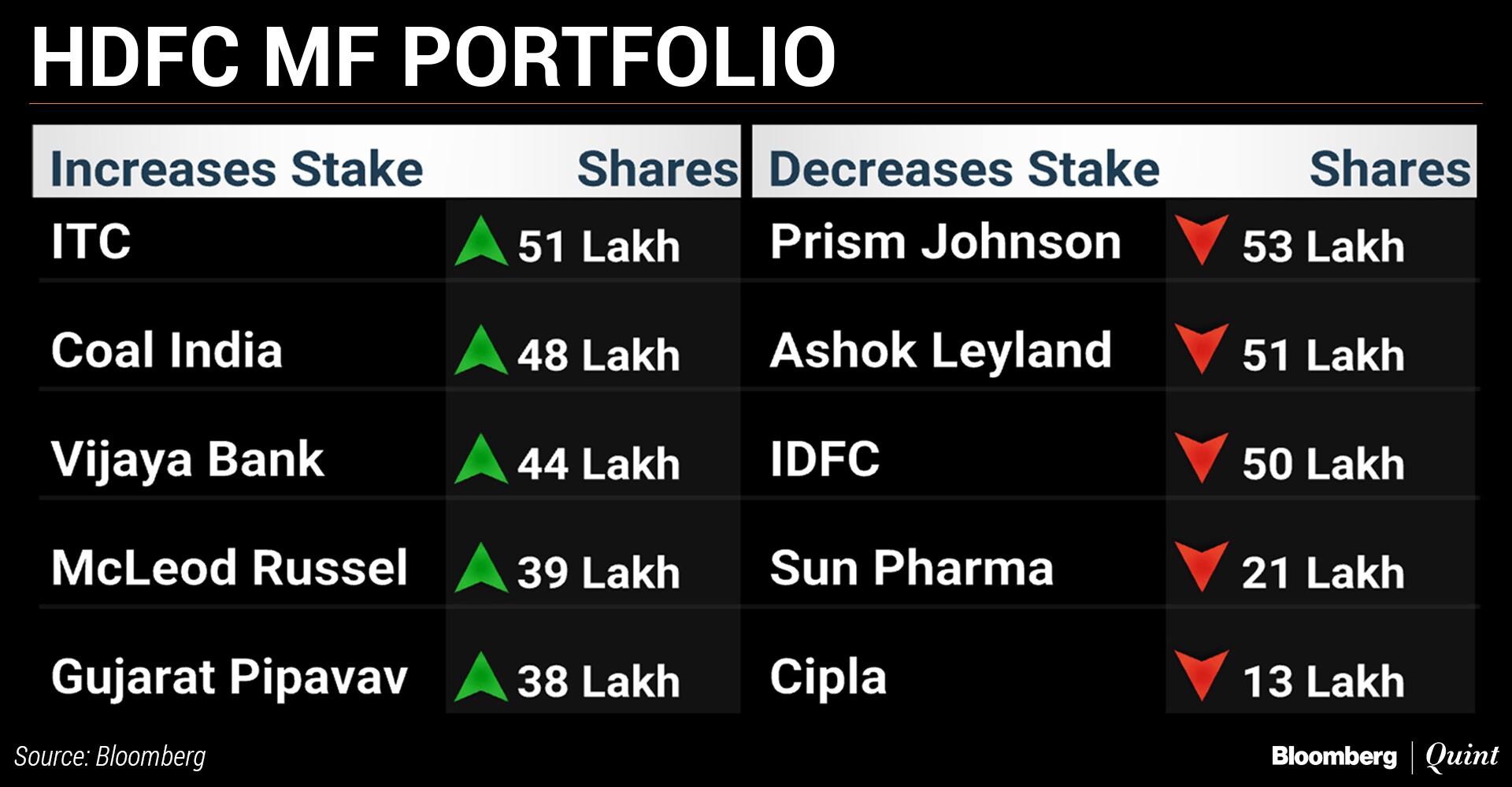

HDFC Mutual Fund

The country's largest equity asset manager has over Rs 1.3 lakh crore invested in 394 securities. By industry, its highest exposure is towards financials at 30.1 percent, followed by industrials at 14 percent.

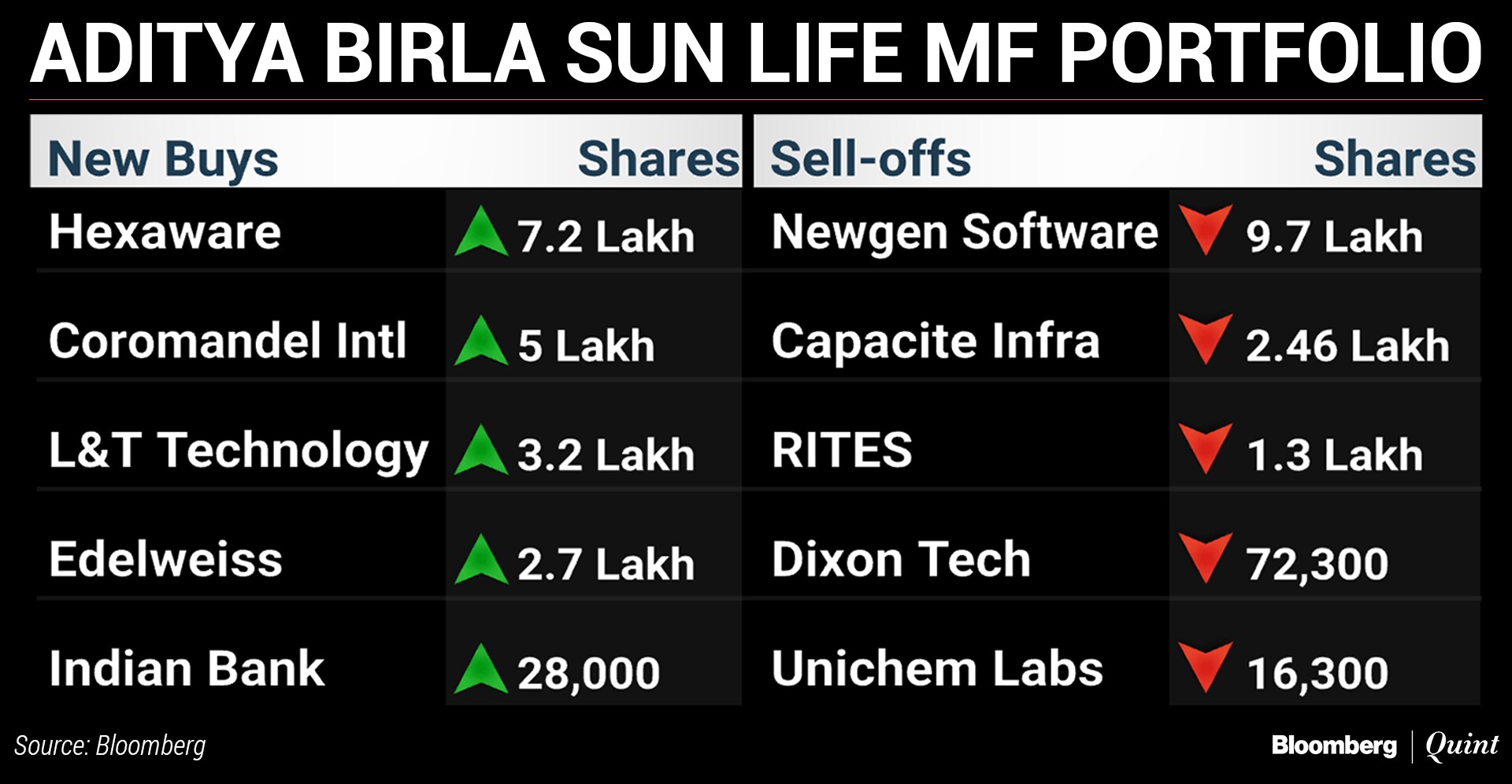

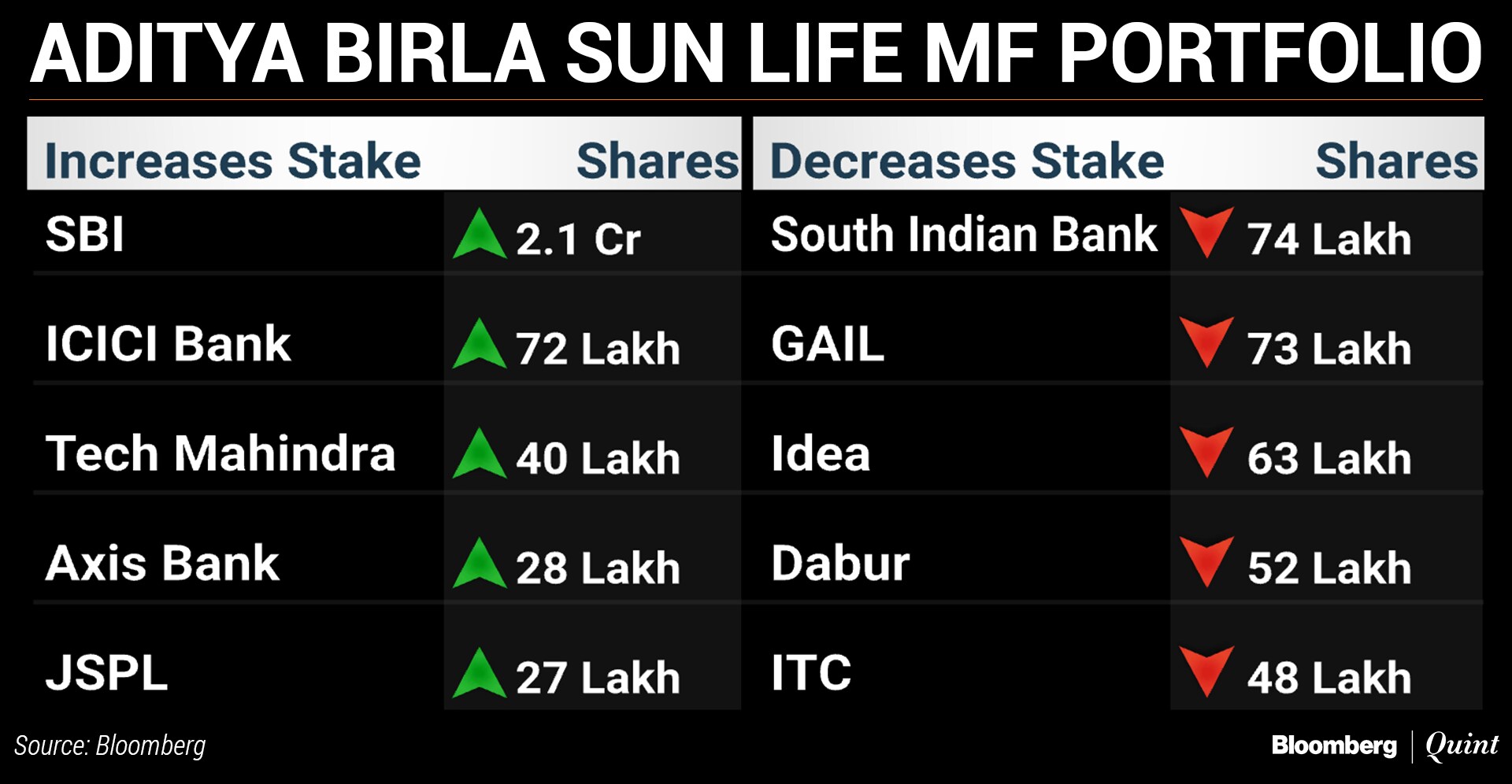

Aditya Birla Sun Life Mutual Fund

The fund house manages equity assets worth more than Rs 82,000 crore invested in a portfolio of 498 securities. Its highest exposure is in financials at 31.2 percent, followed by materials at 12.2 percent.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.