Money managed by mutual funds grew at the fastest pace in April as redemptions fell.

Total assets under management during the month rose to a record Rs 23.25 lakh crore. Equity assets too touched a record of Rs 8 lakh crore. Investors pumped in Rs 1.38 lakh crore across schemes in April after withdrawing Rs 50,752 crore in the previous month. Equity inflow, excluding equity-linked savings schemes, increased multifold to Rs 11,962 crore.

Here's what the top three asset managers bought and sold during the month:

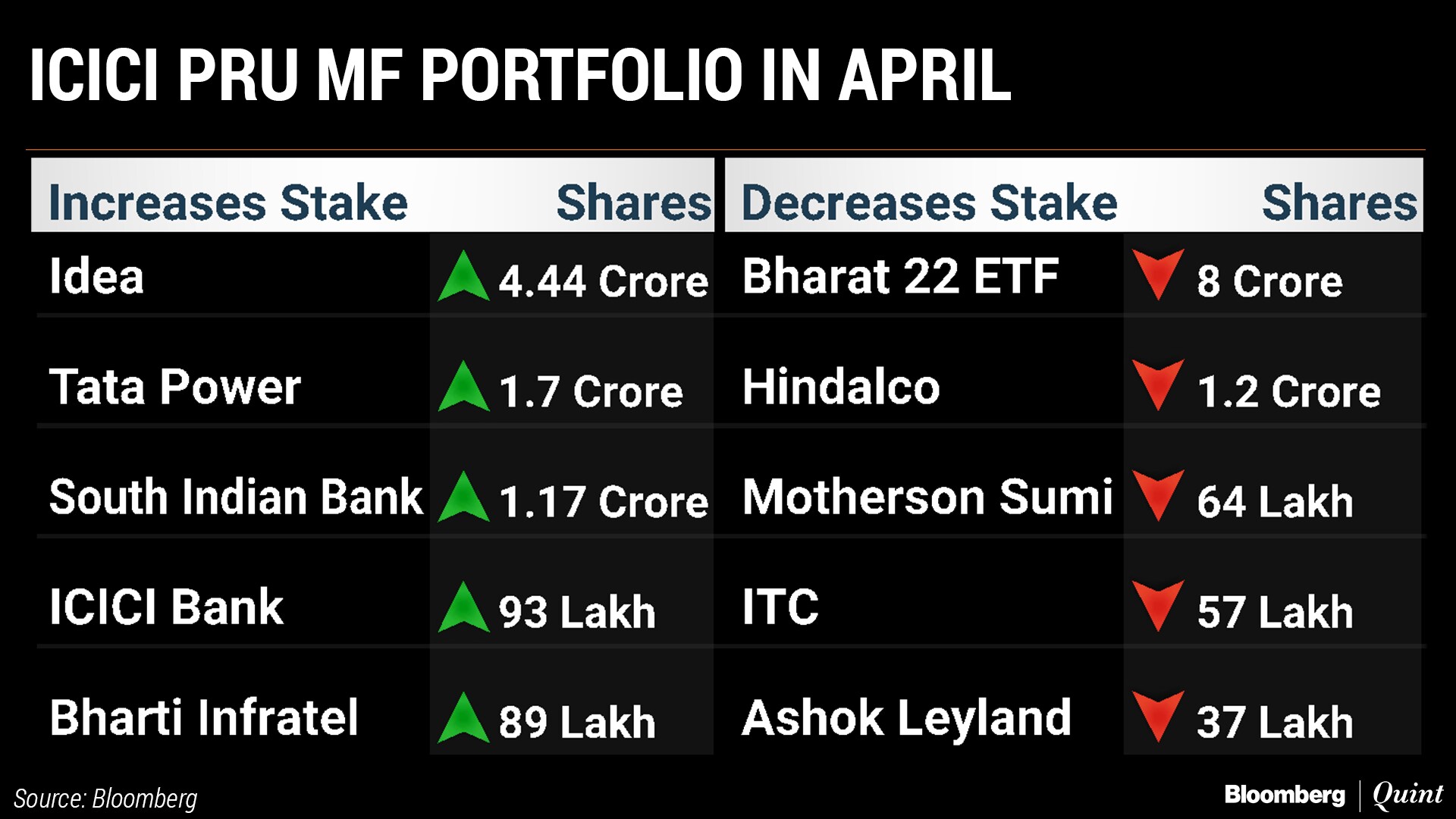

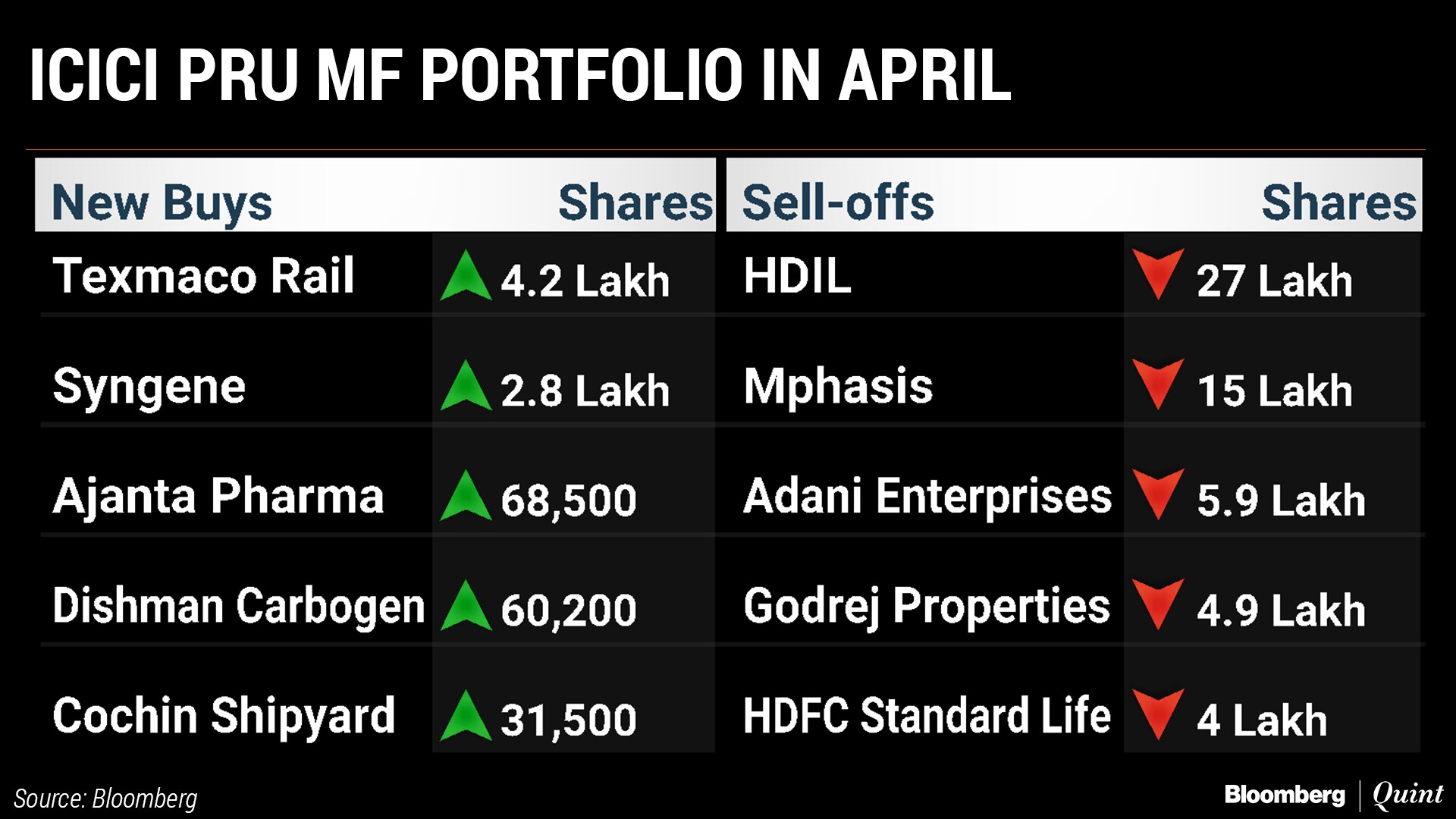

ICICI Prudential Mutual Fund

Total equity assets managed by the fund house stood at Rs 1.18 lakh crore, invested across 419 securities, Bloomberg data showed. Financials comprised 25.1 percent of the overall portfolio while Utilities stood at 11 percent.

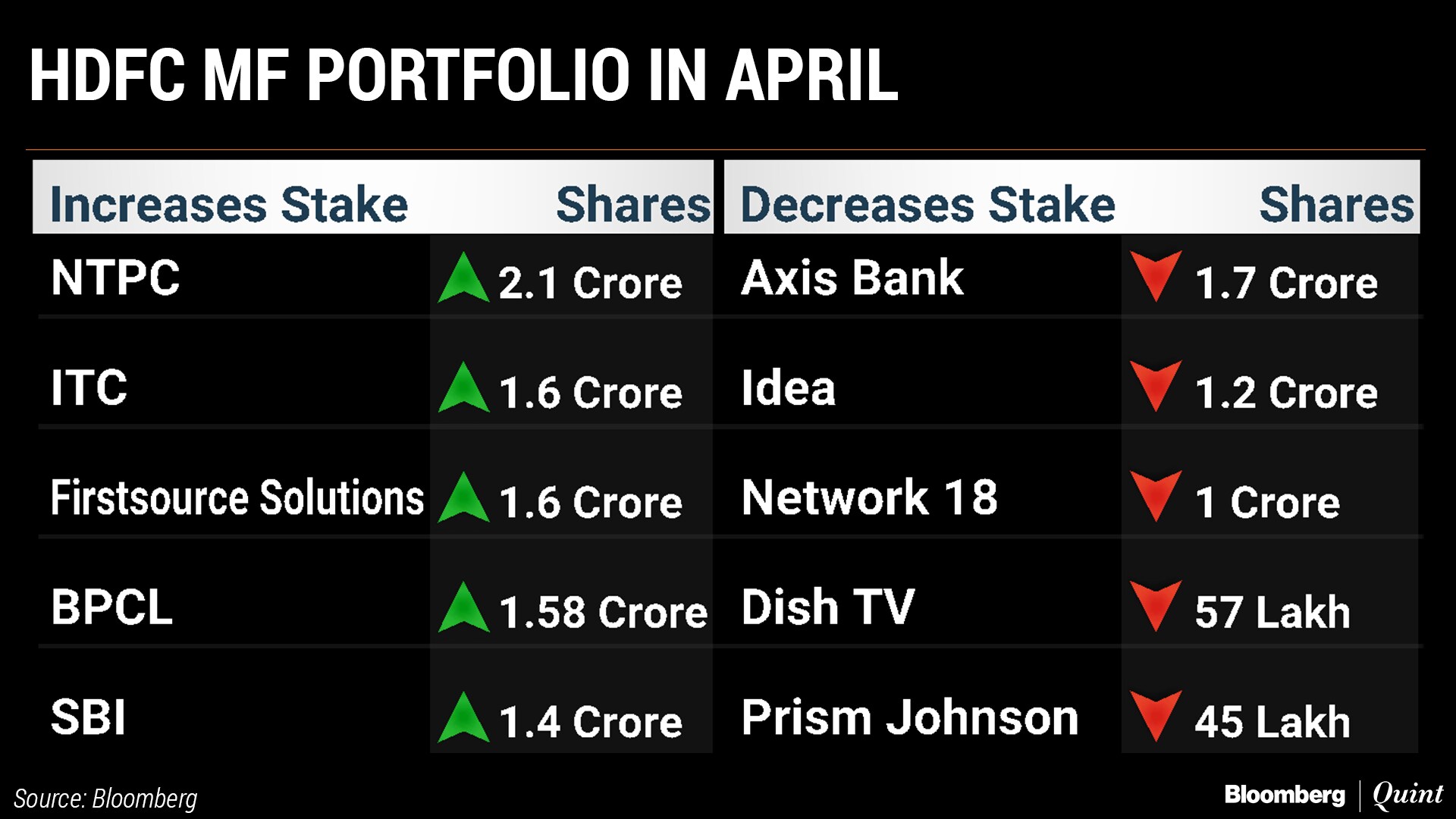

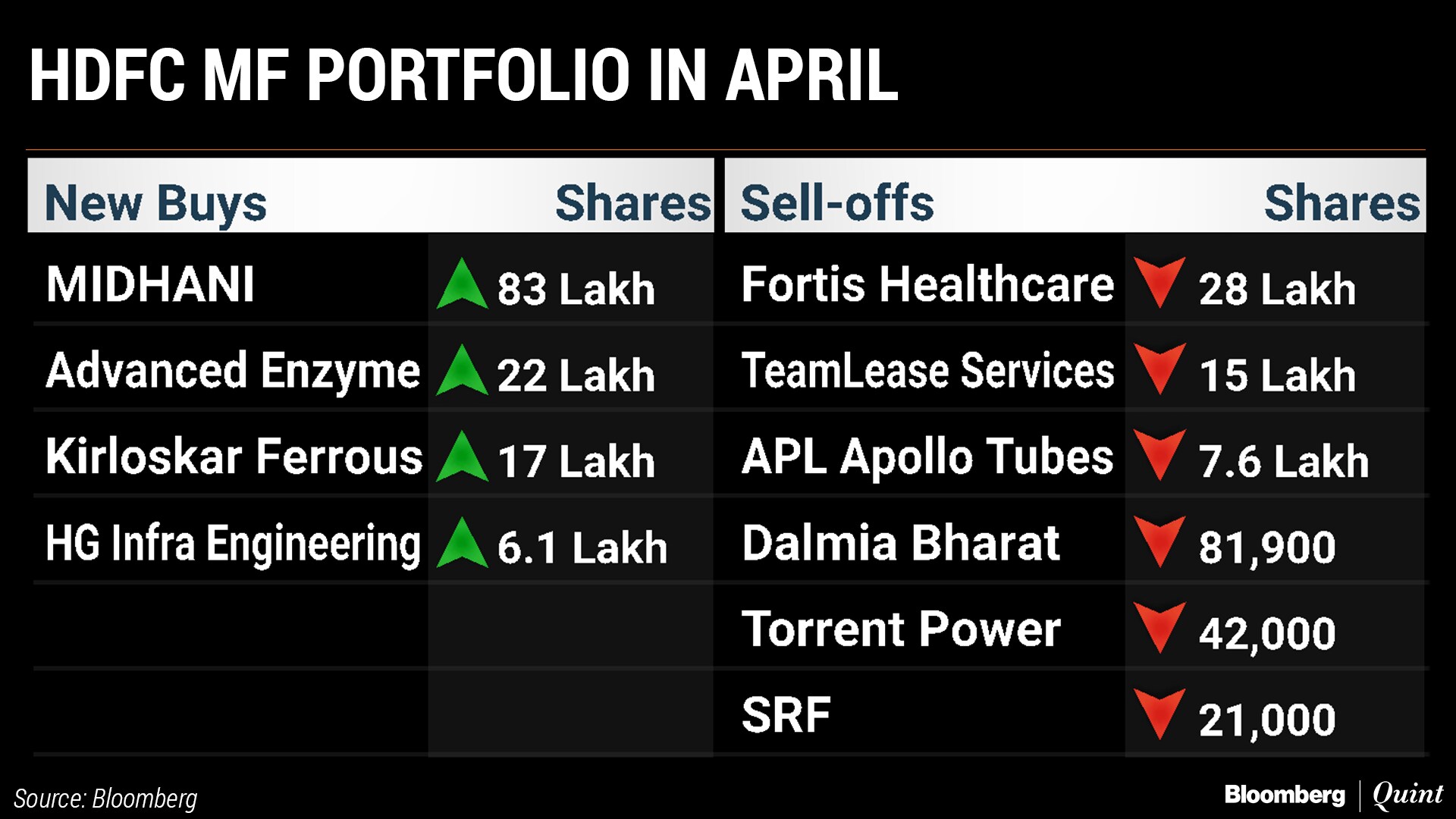

HDFC Mutual Fund

The fund house has equity assets worth Rs 1.34 lakh crore, invested across 396 securities. It has the highest exposure in financials at 31.1 percent, followed by industrials at 15.5 percent.

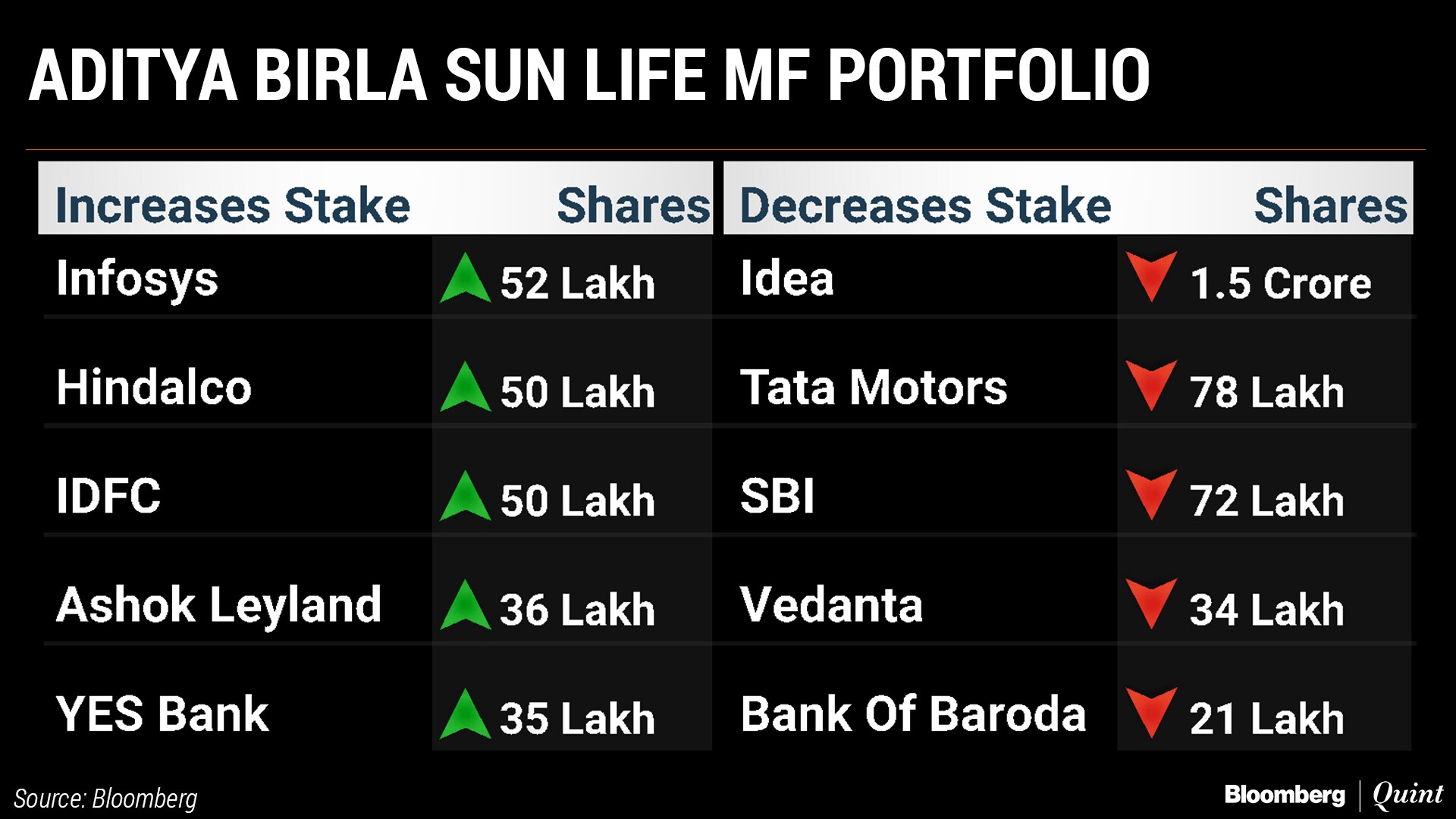

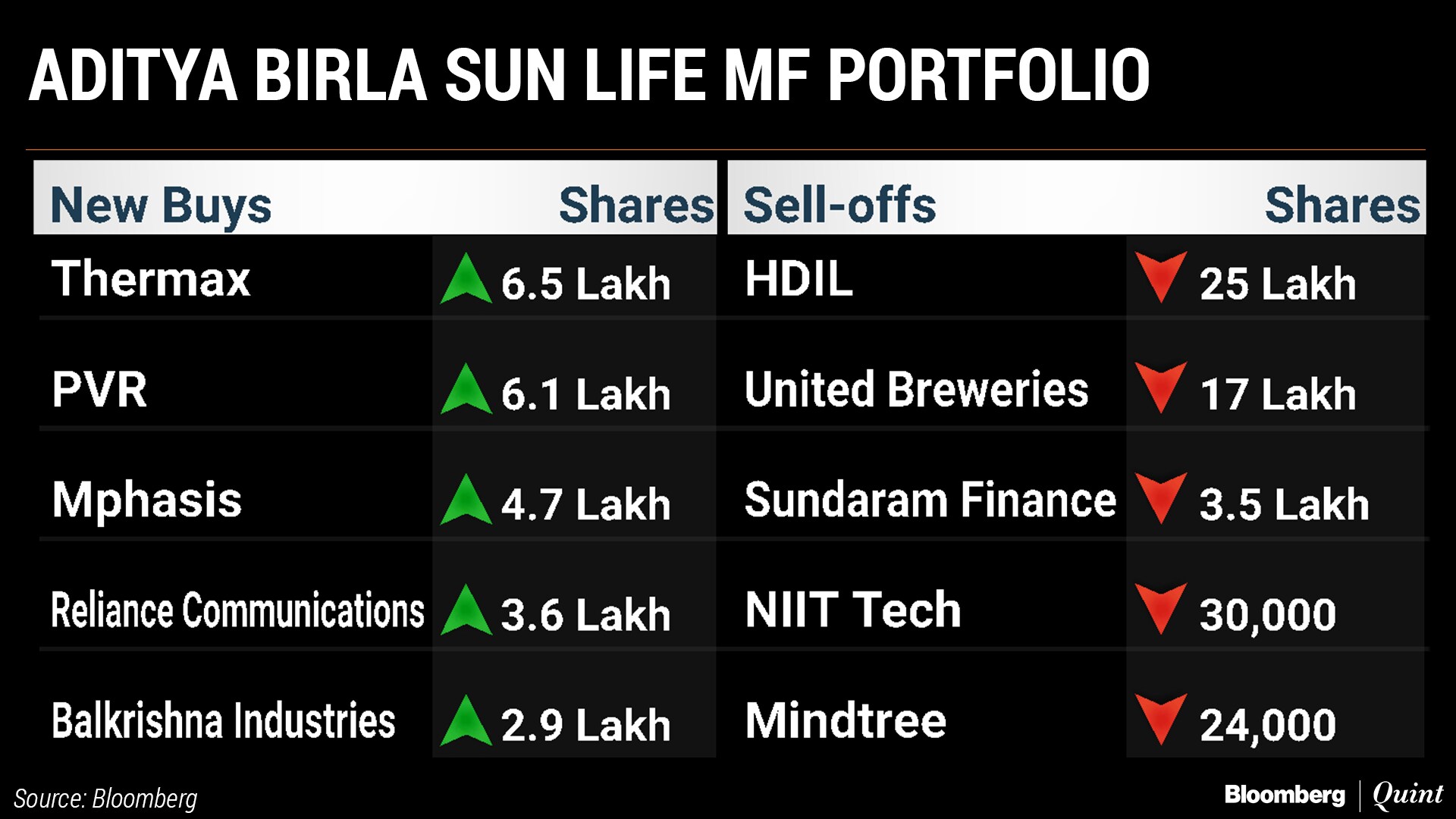

Aditya Birla Sun Life Mutual Fund

The asset manager has equity assets at just over Rs 81,000 crore in as many as 508 securities. Its exposure into financials is the highest at 29.7 percent. Materials make up 13.1 percent of the portfolio.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.