Indian markets closed lower for six out of the last seven weeks, as high valuations and the threat of a trade war weighed in on investor sentiment. The Nifty 50 index lost 0.3-percent in the last five trading sessions to close below the 10,200 mark for the first time since March 7. The selloff intensified on Friday, making it the second-sharpest single day fall this year.

Sectoral Indices

It was the volatility index popularly called as the India VIX that surged the most among other key indices by gaining 4.8-percent last week. Surprisingly, the sector impacted the most by the Indian banking fraud i.e. the PSU banks was the top sectoral gainer. The Nifty PSU Bank Index closed 2.6-percent higher for the week but is still down nearly 5-percent for this month. Among the weekly losers, Nifty Energy and Nifty Metal indices lost 0.9-percent and 0.6-percent respectively.

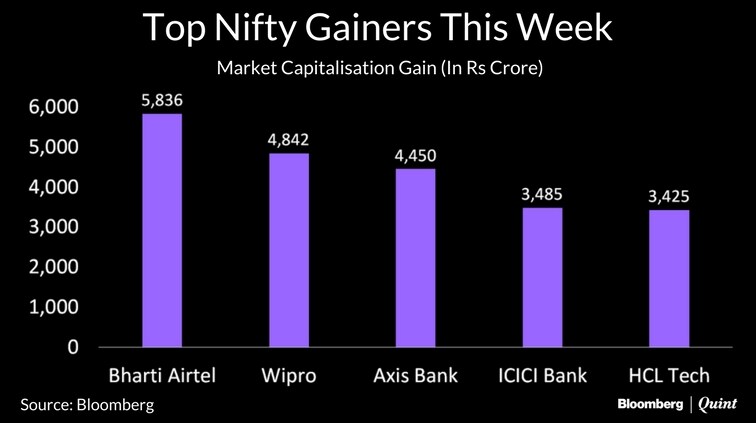

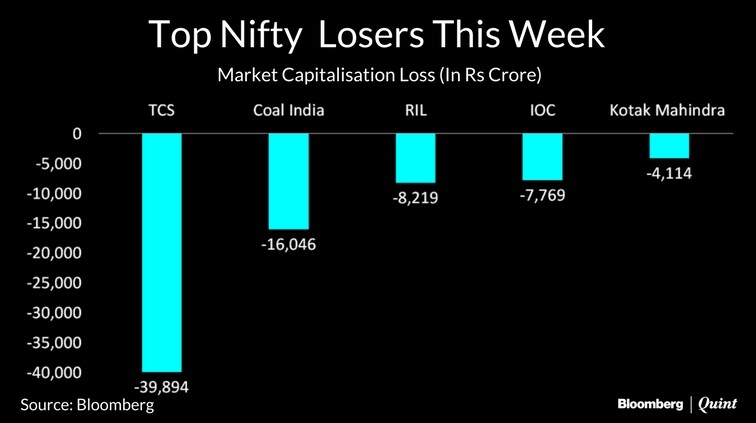

Individual Stocks

The 50 stocks making up the benchmark index cumulatively lost more than Rs 50,000 crore in market capitalisation this week. The biggest contributor to this loss was Tata Consultancy Services Ltd. losing nearly Rs 40,000 crore market cap in the last five trading sessions alone, after parent Tata Sons Ltd. sold 1.5 percent stake in the company on Tuesday. It also paved the way for Reliance Industries to regain its crown of being the most valued company in the country.

Here's a list of the Nifty's top gainers and losers by market capitalisation...

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.