.jpg?downsize=773:435)

Indian equity benchmarks fell for the fourth week in a row and posted their worst September since the Lehman Brothers crisis of 2008 as liquidity concerns continue to spook investors.

The S&P BSE Sensex Index fell 1.7 percent this week to 36,227 and the NSE Nifty 50 Index slumped 1.91 percent to 10,930.

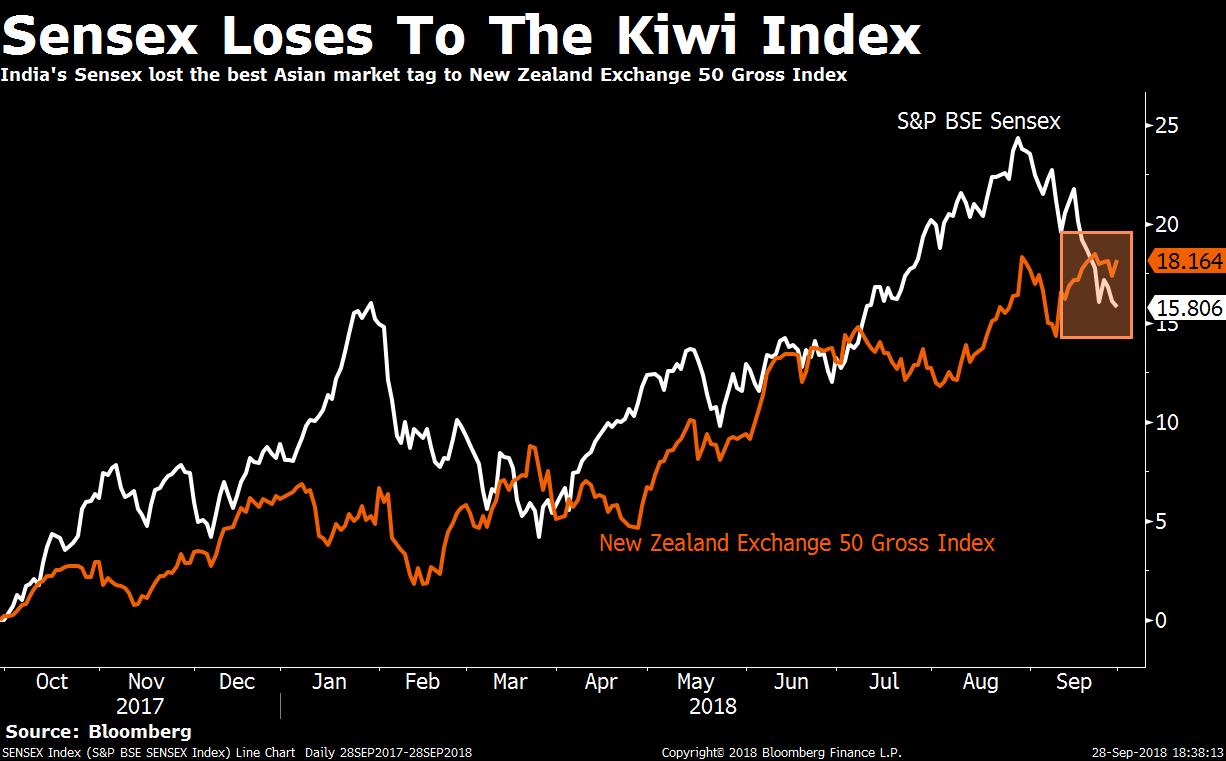

The extended decline in benchmarks led to India losing the title of best Asian market to New Zealand.

The markets had been rallying on easy liquidity and now it's moving out after the U.S. Federal Reserve hiked rates and hinted at another hike later this year, AK Prabhakar, head of research at IDBI Capital Market Ltd., told BloombergQuint over phone. Over and above the Fed hike, the IL&FS default has accelerated the pace of outflows from equities, he said, adding “Banks and NBFCs will continue to face pressure.”

Pain-point is in financials as they have 40 percent weightage in the Nifty and the forthcoming months can be worse as people are withdrawing money and that's making the markets nervous, Prabhakar said.

Indiabulls Housing Finance Ltd. and Yes Bank Ltd. were among the top Nifty losers this week. Indiabulls Housing Finance fell as much as 19.33 percent on rising worries over the non-banking finance companies in the aftermath of the Infrastructure Leasing & Financial Services Ltd. default.

Yes Bank reeled under pressure for the second week and slumped 19 percent after it refuted allegations of evergreening of corporate loans and inflating its share price ahead of key fund-raising activities. The bank also said that it had no dealings with Rana Kapoor's family office, which manages personal investments of Kapoor's three daughters.

On the other hand, Tata Consultancy Services Ltd. and Infosys Ltd. were among the top performers as the rupee fell for the fifth week in a row. A week rupee augurs well for information technology companies as they earn a sizeable chunk of their revenues in U.S. dollars.

Among the other big movers of the week Infibeam Avenues Ltd. nosedived 71 percent on Friday after a WhatsApp message circulating among traders raised concerns about the e-commerce company's accounting practices, Bloomberg reported.

All sector gauges barring the Nifty IT Index ended lower led by the Nifty Realty Index's 11.7 percent dive following a selloff in NBFCs and housing finance companies on concerns that tight liquidity may slowdown home sales.

The Indian rupee fell for the fifth week in a row, declining 0.4 percent, or 28 paise, to 72.49 per dollar.

In some respite to bond traders, the government on Friday said that it would borrow lesser than earlier planned in the second half of the current fiscal, in order to ensure that bond markets remain calm and liquidity remains comfortable. The government assured the markets that it intends to stay within its fiscal deficit target of 3.3 percent set for the current year.

Big Stories Of the Week

- India plans raising $2.8 billion by merging power firms.

- Why IL&FS picked this route to solvency.

- Yes Bank board seeks to extend Rana Kapoor's term as CEO.

- Aadhaar: A quick summary of the Supreme Court majority order.

- Alleged forgery at a promoter entity adds to 8K Miles' woes.

- RBI allows lenders to dip further into SLR, assures of liquidity support.

- Higher import duties: Has the government picked the right targets?

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.