Waaree Renewable Technologies Ltd.'s share price decline by over 10% after the company reported a drop in profit for the third quarter of financial year 2025. The stock price later pared losses to trade over 4% lower.

The solar power producer, which operates as an EPC subsidiary of the Waaree Group, reported a 16.7% year-on-year decline in its net profit for the quarter ending December 2024. The company's net profit stood at Rs 53.5 crore, compared to Rs 64.2 crore in the same period the previous year. The drop in profitability was attributed to a significant contraction in margins, which shrank by 700 basis points.

Despite the decline in profits, the company reported a growth in revenue. Waaree Renewable Technologies' revenue rose by 11% to Rs 360 crore, up from Rs 324 crore in Q3 FY24. However, the company's operating performance showed signs of pressure as Ebitda dropped by 18%, from Rs 88 crore to Rs 72 crore. Ebitda margin also decreased from 27% to 20%.

The main factors contributing to the decline in margins were increased costs across various segments. The cost of EPC (Engineering, Procurement, and Construction) contracts surged by 31% year-on-year, reaching Rs 275.93 crore. Additionally, employee benefit expenses rose by 64% to Rs 7.92 crore, and other expenses more than doubled to Rs 4.57 crore, putting further strain on the company's bottom line.

Waaree Renewable Technologies also declared an interim dividend of Rs 1 per equity share, with the record date set for Jan. 24, 2025, to determine eligibility for the dividend.

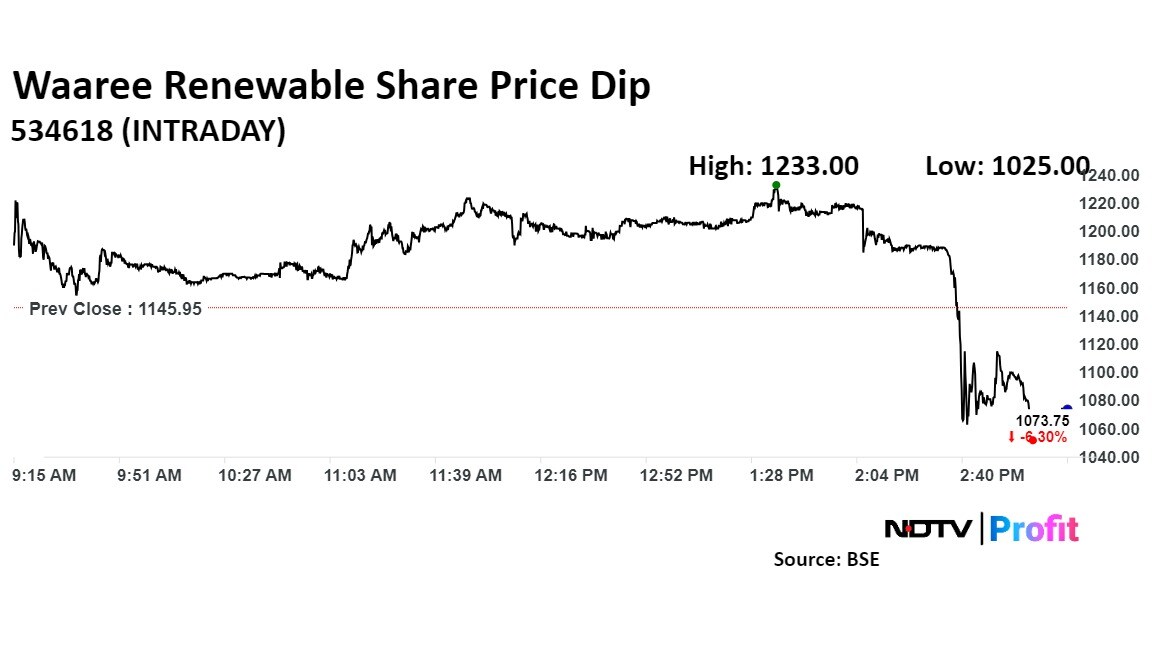

Waaree Renewable Technologies Share Price

Shares of Waaree Renewable fell as much as 10.55% to Rs 1,025 apiece. It pared losses to trade 6.65% lower at Rs 1,069.80 apiece, as of 03:18 p.m. This compares to a 0.42% advance in the NSE Nifty 50.

The stock has risen 107.21% in the last 12 months. Total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 34.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.