- Waaree Energies reported an 89% rise in consolidated net profit to Rs 745 crore in Q1 FY26

- Revenue increased 30% year-on-year to Rs 4,426 crore in the first quarter of fiscal 2025-26

- Company achieved highest quarterly module production of 2.3 GW in Q1 FY26

Shares of Waaree Energies Ltd. surged over 5% on Tuesday after the company reported its first-quarter results for fiscal 2025-26. The company reported a rise of 89% in consolidated net profit to Rs 745 crore, compared to Rs 394 crore in the corresponding period last year.

The solar equipment manufacturer's topline (revenue from operations) in the first quarter of current fiscal rose 30% to Rs 4,426 crore, compared to Rs 3,409 crore in the year-ago period. Higher revenues boosted the bottom line.

The company said it achieved the highest quarterly module production of 2.3 GW in the first quarter of FY26, driven by strong operational focus, and cell production continues to ramp up. The Board of Directors approved an additional capex of Rs 2,754 crore for the expansion of cell capacity by 4 GW in Gujarat and Ingot-wafer by 4 GW in Maharashtra.

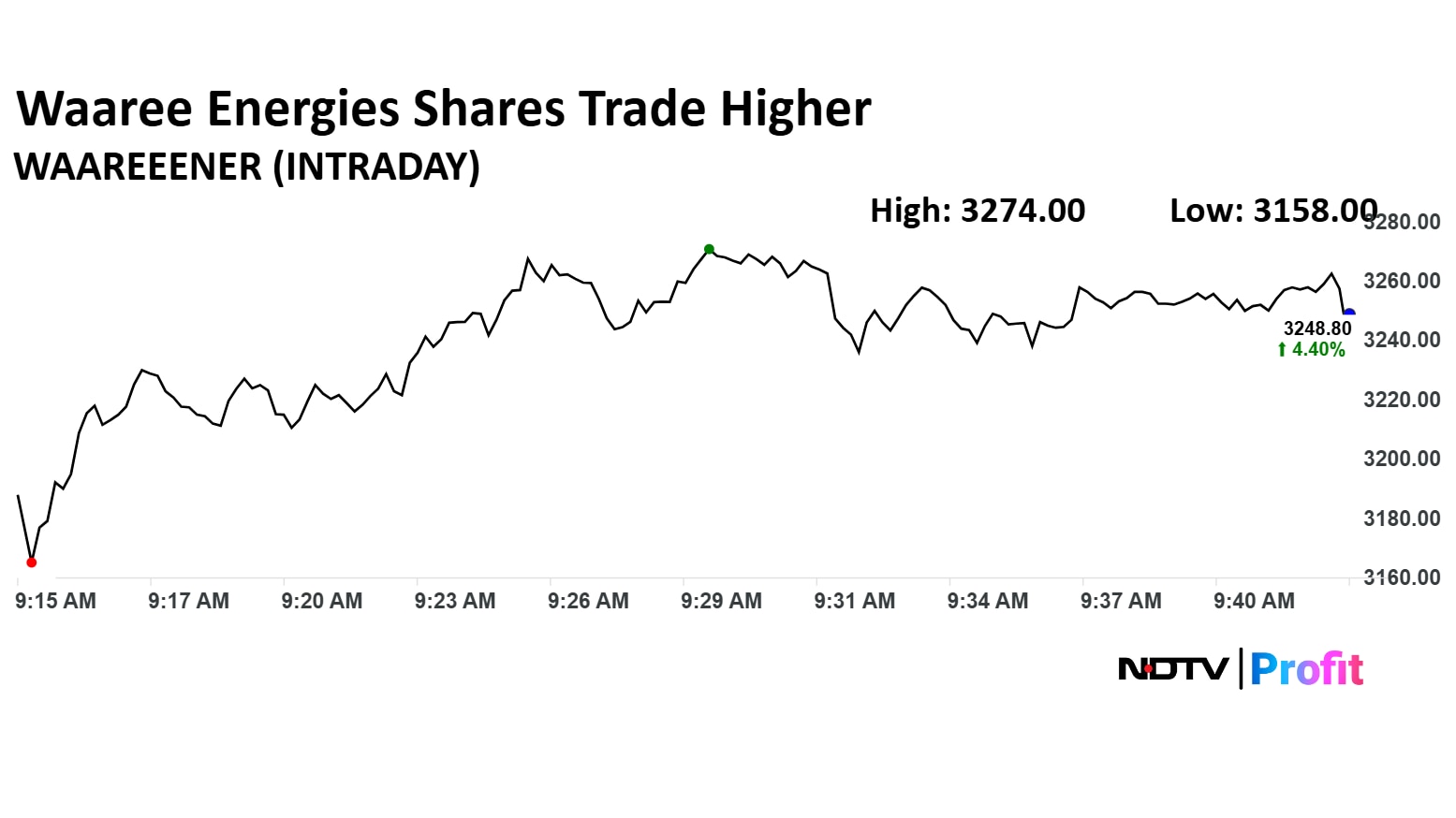

Waaree Energies Share Price

Shares of Waaree Energies rose as much as 5.21% to Rs 3,274 apiece. They pared gains to trade 4.40% higher at Rs 3,248.80 apiece, as of 9:43 a.m. This compares to a 0.03% advance in the NSE Nifty 50.

The stock has risen 37.56% in the last 12 months and 13.03% year-to-date. Total traded volume so far in the day stood at 2.90 times its 30-day average. The relative strength index was at 45.42.

Out of four analysts tracking the company, one maintains a 'buy' rating, and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 19.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.