Voltas Ltd. share price fell to a three-month low during early trade on Monday after a cooler summer dampened June quarter earnings.

Net profit plummeted 58% in the first quarter of FY26 due to a decline in demand for cooling products, including air conditioners. The quarter witnessed unpredictable weather conditions, with the summer season concluding abruptly due to early monsoon, the company said.

The company's bottom line declined to Rs 140.46 crore, compared to Rs 334.23 crore for the same period last year. Margin contracted to 4.5% compared to 8.6%.

Voltas Q1 results were announced after market hours on Friday.

Analysts at Goldman Sachs reduced their target price on Voltas stock to Rs 1,100 from Rs 1,180. They said the magnitude of margin compression in AC reflects the additional effort to drive sales. It also suggests how brand power is diluting in the industry.

"From hereon, room for positive surprise on AC margins is unlikely even though AC is on a structural growth path," a note said.

Voltas Shares Down

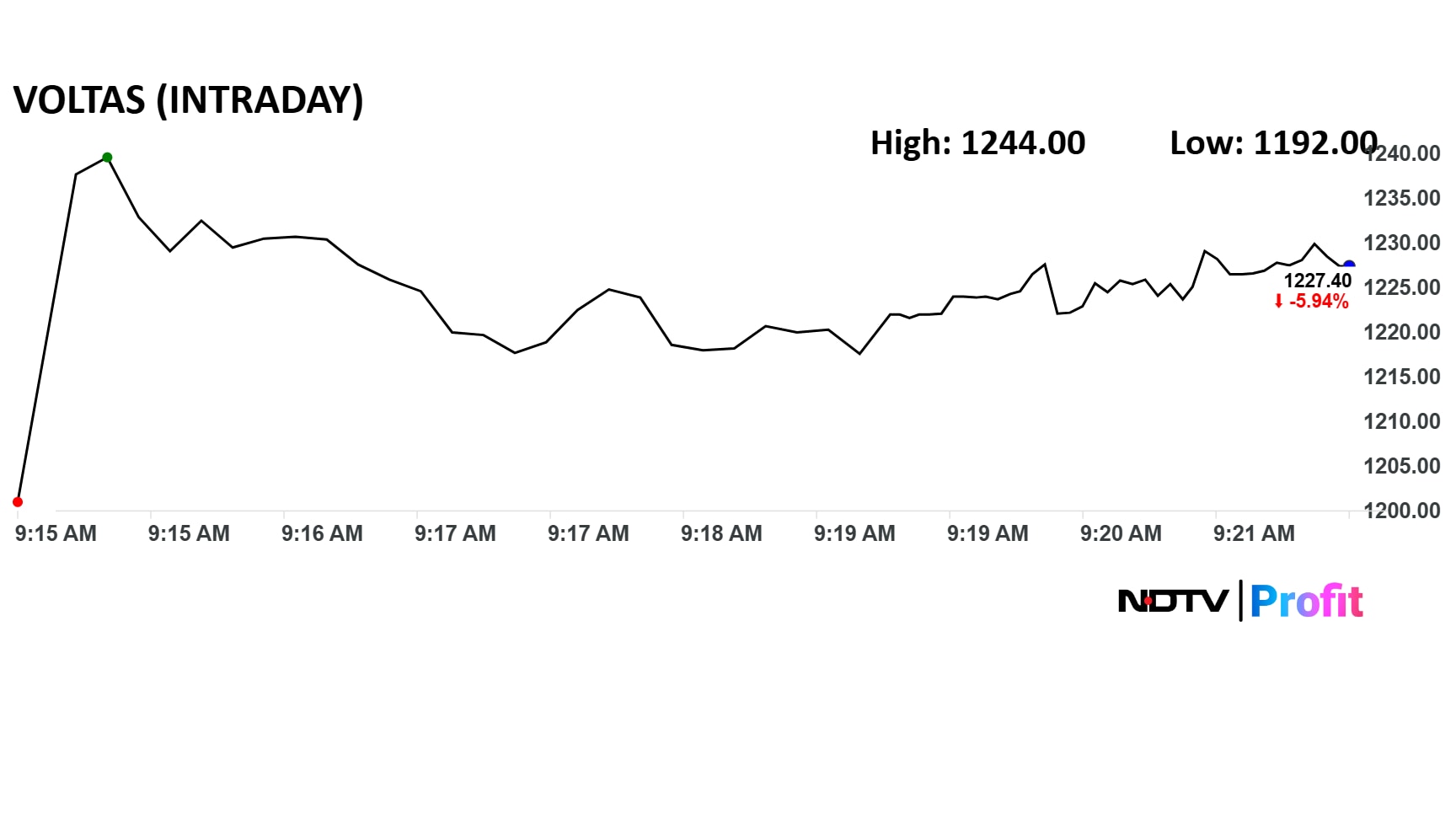

Voltas' share price fell as much as 8.7% to Rs 1,199 apiece, the lowest since May 9.

Voltas' share price fell as much as 8.7% to Rs 1,199 apiece, the lowest since May 9. The benchmark NSE Nifty 50 was up 0.14%. The total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 27, indicating the stock is oversold.

The stock has fallen 13% in the last 12 months and 31% on a year-to-date basis.

Out of the 41 analysts tracking Voltas, 21 have a 'buy' rating on the stock, 13 recommend a 'hold', and seven suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.