Vodafone Idea Ltd.'s share price declined over 4% on Friday, as Macquarie remained cautious on the stock due to concerns over cash flow generation. Macquarie downgraded the stock to 'underperform' rating, with a target price Rs 6.50 apiece, which implied 26% downside from Thursday's closing price.

The brokerage deemed the Government of India's decision to convert its dues for financial year 2026 into equity as a 'bandage work'. Vodafone Idea has net debt of $26.7 billion as of Dec. 31, 2024. Post equity conversion, the debt will reduce to $22.5 billion. However, the level of debt will remain high with net debt 10 times FY26 Ebitda, Macquarie said.

The brokerage was expecting timeline extension. The support from the government highlights the intent for a telecom market, which will have three players. After the conversion, the Government of India will have 48.99% stake in Vodafone Idea, compared to 22.6% stake earlier. Promoters Aditya Birla Group will have 9.5%, and Vodafone Group will have 16.1%.

As Vodafone Idea's cash flow generation remains inadequate, its debt repayment capability is reduced. Macquarie sees further equity dilution risk for minority stake holders in medium term. Keeping in mind the equity dilution risk, the brokerage gave a very low target price.

Positive catalyst for Vodafone Idea would be debt financing, new capex plans, and government concession on past dues, Macquarie said.

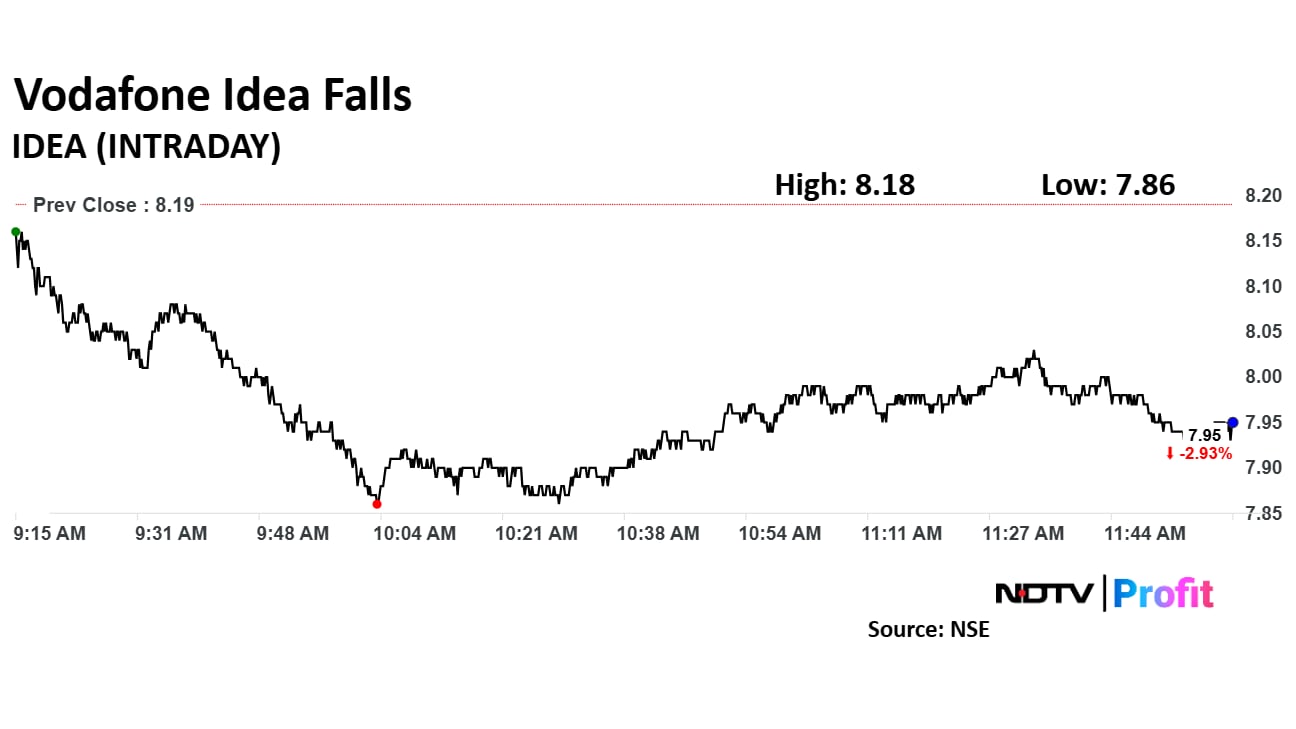

Vodafone Idea Share Price

Vodafone Idea share price declined 4.03% to Rs 7.86 apiece. The scrip was trading 3.30% down at Rs 7.94 apiece as of 12:07 p.m., as compared to a 1.22% decline in the NSE Nifty 50.

The stock declined 40.60% in 12 months, and remained flat on year to date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 54.46.

Out of 21 analysts tracking the company, five maintain a 'buy' rating, four recommend a 'hold' and 12 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 6.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.