VIP Industries Ltd. fell over 5% on Monday after the company informed the stock exchanges that promoter group entities plan to sell a 32% stake in the company to multiple private equity investors, among others.

The sellers include promoter Dilip Piramal and various entities forming part of the promoter group — Kemp and Company Ltd., DGP Securities Ltd., Kiddy Plast Ltd., Piramal Vibhuti Investments Ltd. and Alcon Finance & Investment Ltd., the company shared on Sunday.

Post the stake sale, Dilip Piramal and group's shareholding in the company will come down to 19.73% stake from 51.73%.

The purchasers were identified as Multiples Private Equity Fund IV, Multiples Private Equity Gift Fund IV, Samvibhag Securities, Mithun Padam Sacheti, and Siddhartha Sacheti.

The stake sale will be followed up with an open-offer for the purchase of additional 26% shares, in accordance to a share purchase agreement. This will allow certain purchasers to acquire management control of the company, according to the filing.

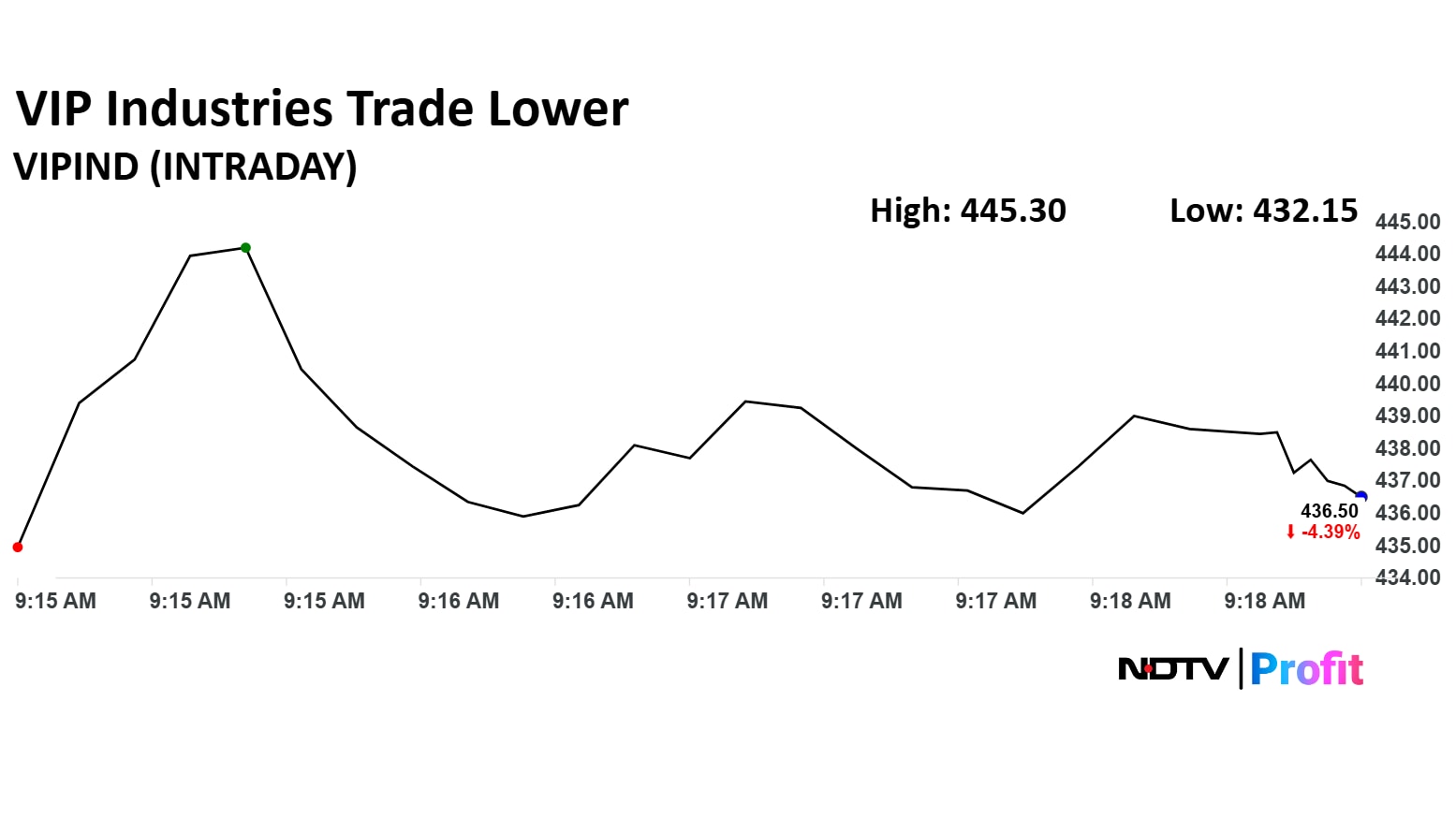

VIP Industries Share Price

Shares of VIP Industries fell as much as 5.34% to Rs 432.15 apiece. They pared losses to trade 4.39% lower at Rs 436.50 apiece, as of 9:20 a.m. This compares to a 0.29% decline in the NSE Nifty 50.

The stock has fallen 5.30% in the last 12 months and 8.22% year-to-date. Total traded volume so far in the day stood at 1.32 times its 30-day average. The relative strength index was at 49.29.

Among the 11 analysts tracking the stock, four have a 'buy' rating, three recommend 'hold' and four 'sell'. The average of 12-month analysts' price target implies a potential downside of 13.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.