Vedanta's share price declined over 5.5% on Friday, in line with the Nifty Metal index, which fell nearly 4%. This decline outpaced the benchmark Nifty 50, which dipped by 1.07%.

The metal index's drop is attributed to global economic uncertainty and concerns about potential trade wars, following US President Donald Trump's announcement of new tariffs.

The US tariffs on steel and aluminum are expected to have minimal direct impact on metals, given the low export volumes to the US. However, there's a higher risk of a severe US recession, which could significantly affect commodity prices.

Despite the decline in its share price, Vedanta released a strong business update on Thursday.

The company reported a 2% increase in aluminium production, reaching 2,421 kilotonnes. Refined metal production also grew by 2%, totalling 1,052 kt.

Additionally, Vedanta's Q4 Zinc International production saw a year-on-year increase of 52%, while Q4 iron ore saleable production rose by 22% year-on-year. The company also reported an 18% quarter-on-quarter increase in total power sales.

The positive business update was overshadowed by broader market concerns, leading to a decline in Vedanta's share price. The global economic uncertainty and fears of potential trade wars have weighed heavily on the metal and iron sectors, contributing to the overall decline in the Nifty Metal.

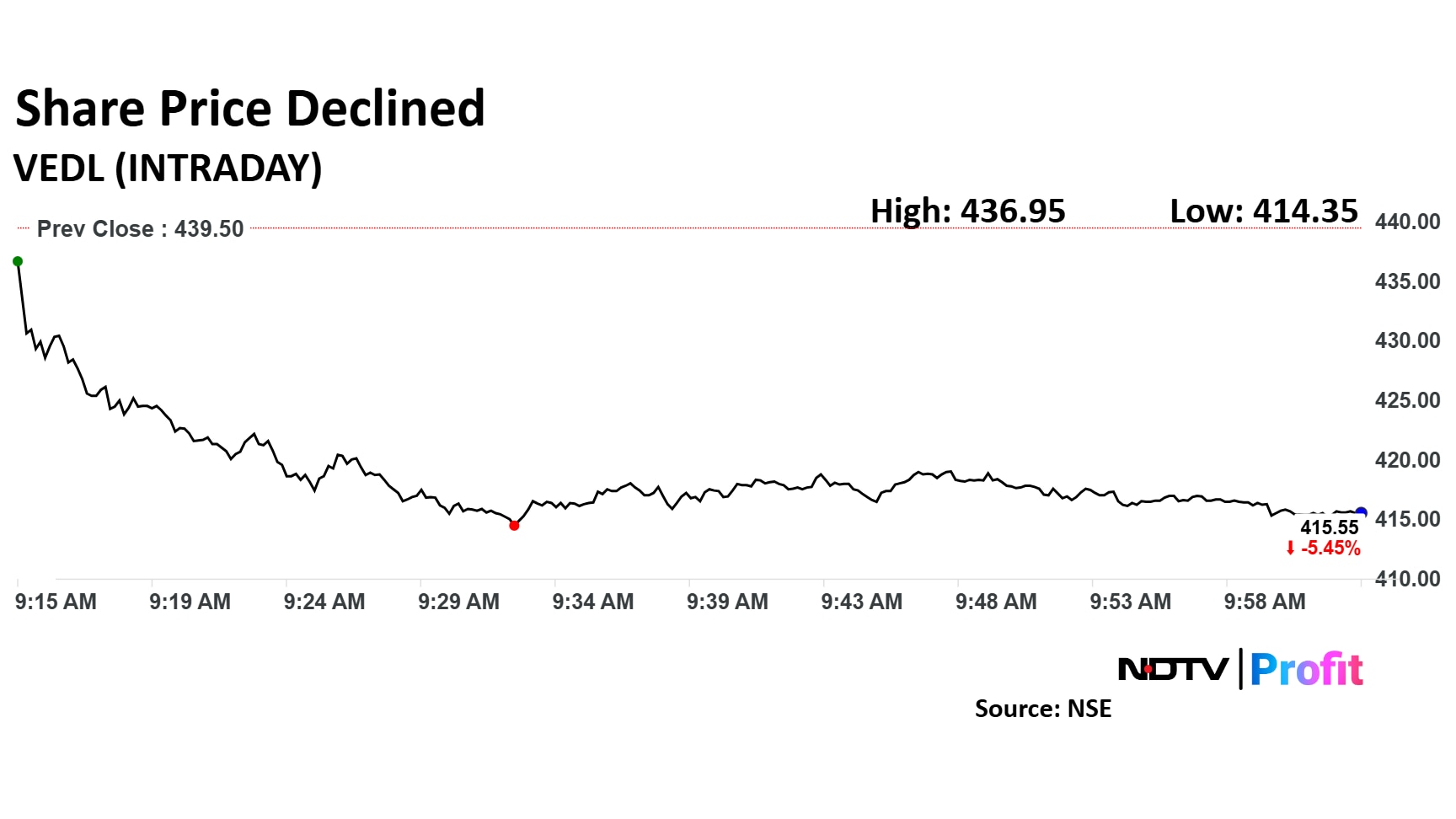

Vedanta Share Price

Shares of Vedanta fell as much as 5.72% to Rs 414 apiece. It pared losses to trade 5.44% lower at Rs 415 apiece, as of 10 a.m. This compares to a 1.23% decline in the NSE Nifty 50.

The stock has risen 33.97% in the last 12 months. Total traded volume so far in the day stood at 4.5 times its 30-day average. The relative strength index was at 36.

Out of 15 analysts tracking the company, nine maintain a 'buy' rating, five recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 24.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.