Varun Beverages Ltd.'s share price rose as CLSA upgraded the stock's rating to 'high conviction outperform' from 'outperform', noticing its attractive risk-reward ratio. CLSA also hiked the target price to Rs 802 from Rs 770, implying a 70% upside potential.

In last three months, Varun Beverages stock has corrected 28% with its 12-month forward PE multiple lowering from 62.8 times to 43.8 times. The company underperformed due to concern over increased competition from Campa Cola, which is priced at Rs 10, Coca Cola's bottling arm going under restructuring, higher capex guidance, and investors' concern around slowing urban consumption in India, CLSA said in a note.

Nevertheless, concerns are overdone as Varun Beverages' growth and profitability outlook remained robust, according to the brokerage. CLSA adjusted potential price cuts on its Varun Beverages' Rs 12 portfolio. The brokerage has cut its earnings estimates by 4-5% over a calendar years 2025 and 2027.

Price scenario suggest 5.0% and 6.0% bear case Ebitda and EPS downside for calendar year 2025. CLSA suggests a potential downside of 4.0% to its new base case CY25 Ebitda assumption of Rs 5,350 crore under various scenarios of price cuts.

Varun Beverages' capital expenditure peaked in 2023, hence its capex intensity may ease going forward. However, it will remain higher than FMCG firms, CLSA said.

Varun Beverages' total addressable market share remains large and is growing. The brokerage expects large upside for soft drink consumption in a backdrop, where India's soft-drink consumption per capita remained well below peers. The company remained large in both India and Africa.

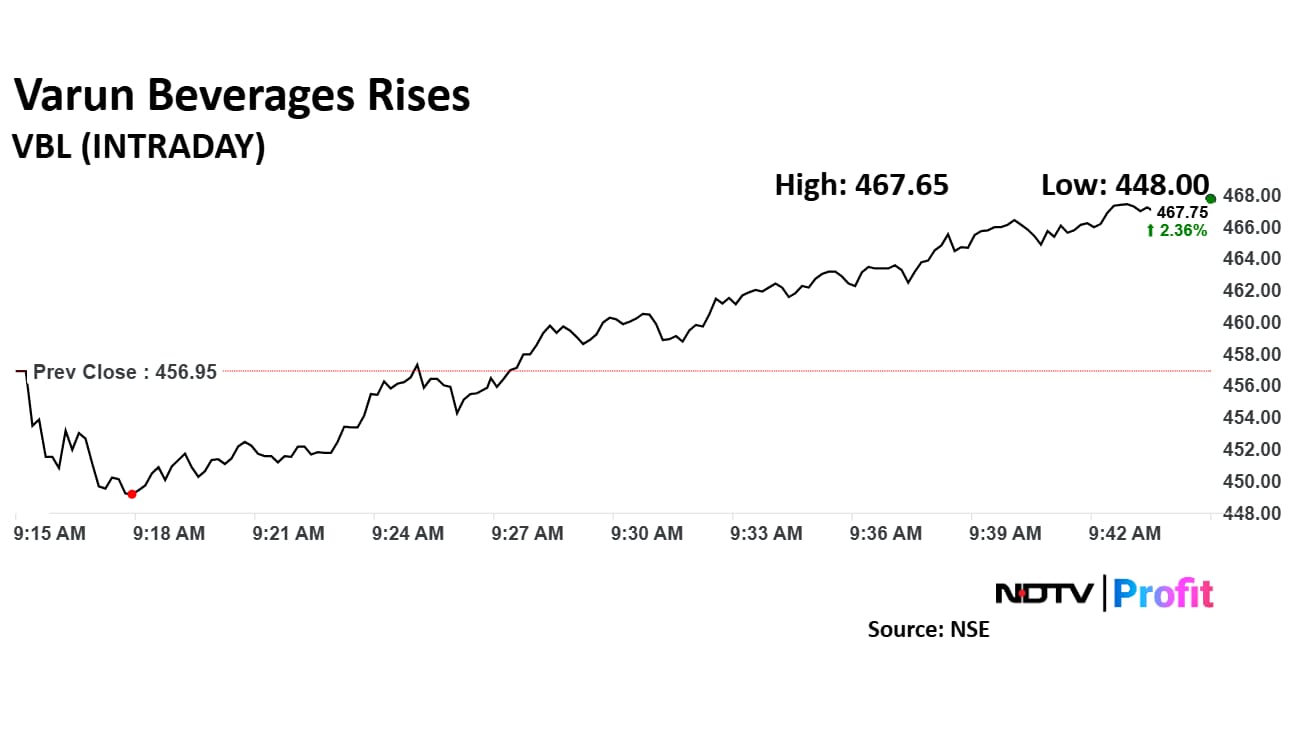

Varun Beverages Share Price

Varun Beverages' share price rose 3.25% to Rs 471.80 apiece. It was trading 2.62% higher at Rs 468.90 apiece as of 11:03 a.m., as compared to a 0.15% decline in the NSE Nifty 50.

The stock has fallen 18.52% in 12 months. Total traded volume so far in the day stood at 2.0 times its 30-day average. The relative strength index was at 39.51.

Out of 26 analysts tracking the company, 23 maintain a 'buy' rating, and three recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 45.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.