V-Mart Retail Ltd.'s share price increased by nearly 7% on Wednesday following the release of strong business updates for the fourth quarter of fiscal 2025.

The company's total revenue from operations rose by 17% to Rs 780 crore in the fourth quarter, compared to Rs 669 crore in the same period of the previous fiscal year.

For the entire fiscal, V-Mart's total revenue reached Rs 3,254 crore, representing a 17% overall increase. Excluding its subsidiary, the LimeRoad digital marketplace, the company achieved an 18% year-on-year growth in total revenue.

The retailer's same-store sales growth was 8% for the quarter. V-Mart opened 13 new stores and closed four stores during the quarter.

The new store launches included four in Uttar Pradesh, two each in Bihar and Jharkhand, and one each in West Bengal, Jammu and Kashmir, Assam, Arunachal Pradesh, and Tamil Nadu, according to the company's disclosure.

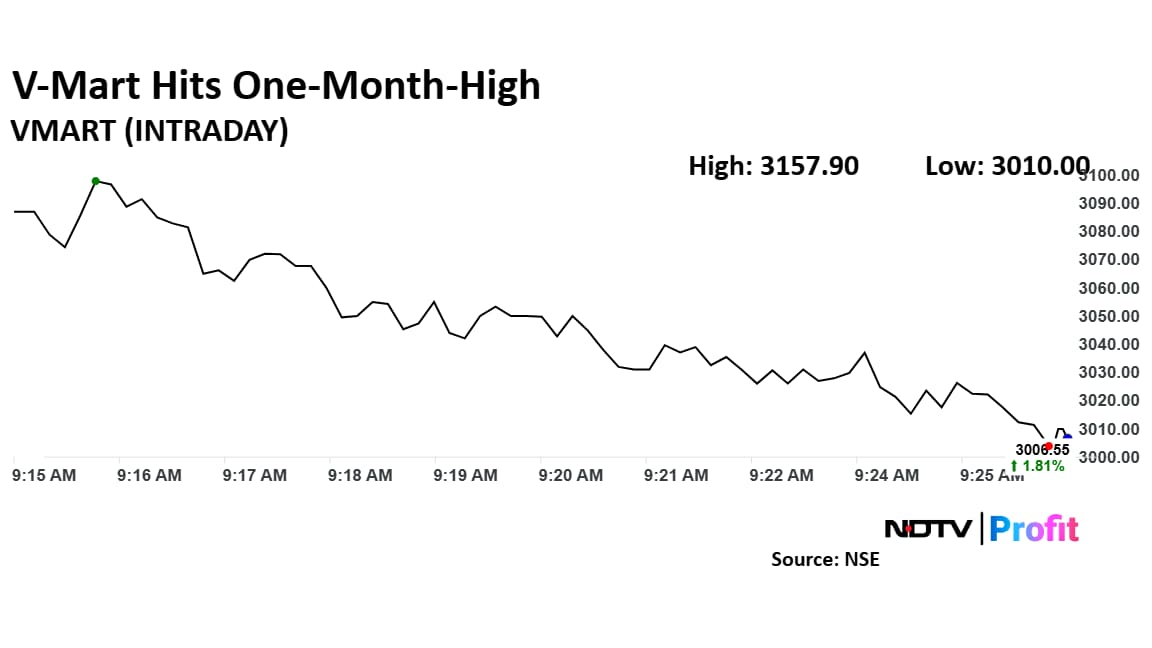

V-Mart Retail Share Price Today

The scrip rose as much as 6.94% to Rs 3,157.90 apiece, the highest level since Feb. 20. It pared gains to trade 2.93% higher at Rs 3,039.70 apiece, as of 9:24 a.m. This compares to a 0.04% advance in the NSE Nifty 50 Index.

It has risen 44.94% on a year-to-date basis and fallen 21.87% in the last 12 months. The relative strength index was at 56.

Out of 17 analysts tracking the company, 11 maintain a 'buy' rating, four recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 42.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.