Morgan Stanley has reiterated its 'equal-weight' rating on Bharat Forge Ltd., with a target price of Rs 1,170, but has cited a potential slowdown in the United States as a more pressing concern than shifting trade tariffs.

North America accounted for 41% of Bharat Forge's standalone sales in the third quarter, exposing the company to risks associated with softening demand in the US commercial vehicle market, the brokerage said. The outlook for Class 8 truck sales has weakened significantly in recent weeks, prompting Morgan Stanley's US Machinery team to revise its forecasts downward.

The brokerage now expects a decline in Class 8 sales in 2025, followed by only a modest recovery in 2026. Additionally, the team has removed any expectations of pre-buy activity, which typically occurs when fleets advance purchases ahead of new regulatory norms.

While the upcoming EPA'27 engine standards could offer a regulatory incentive to pre-buy, concerns over financial capacity and risk appetite in a volatile macroeconomic environment are likely to limit such behaviour.

The commercial vehicle backdrop in the US has turned more uncertain, with the freight industry facing growing pressure, amid ongoing macroeconomic headwinds, Morgan Stanley said. This uncertainty has caused market participants to adopt a more cautious, wait-and-see stance, which could undermine the expected second-half 2025 recovery and any associated pre-buy momentum.

Beyond industry-specific factors, the broader economic landscape also poses risks. Morgan Stanley's Chief Global Economist, Seth Carpenter, has warned that rising tariff tensions could increase the likelihood of a recession, further complicating the outlook for global capex and, by extension, companies like Bharat Forge.

Given Bharat Forge's reliance on international markets and capital expenditure cycles, the company remains vulnerable to a broader global slowdown. The evolving tariff environment, while important, is overshadowed by the more immediate impact of a US economic slowdown, according to the brokerage.

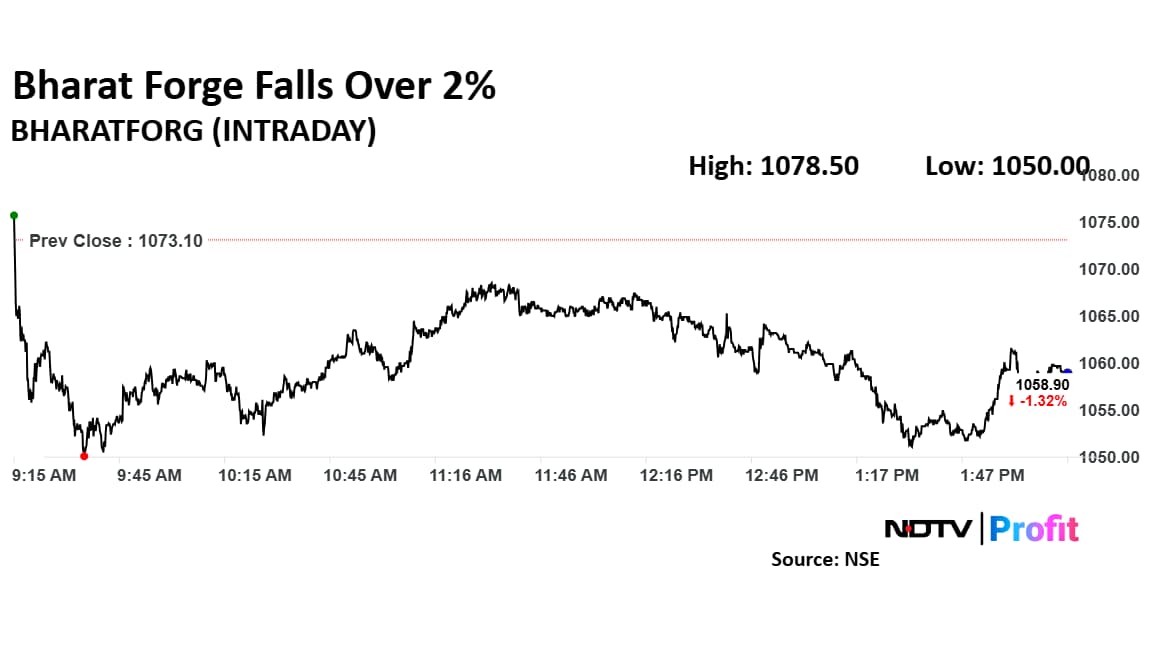

Bharat Forge Shares Decline

Shares of Bharat Forge fell as much as 2.15% to Rs 1,050 apiece, the lowest level since April 15. It pared losses to trade 1.25% lower at Rs 1,059.70 apiece, as of 2:16 p.m. This compares to a 0.38% advance in the NSE Nifty 50.

The stock has fallen 10.36% in the last 12 months and 18.56% year-to-date. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 44.

Out of 26 analysts tracking the company, 14 maintain a 'buy' rating, five recommend a 'hold', and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 10.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.