Axis Securities has initiated coverage on UPL Ltd. with an 'add' rating, citing favourable risk-reward dynamics. The firm has set a target price of Rs 605 per share for UPL.

The brokerage sees green shoots in the global agri-chem demand, with channel inventory levels receding across most geographies, except Brazil, and just-in-time ordering driven by high interest rates. Axis Securities projects a 27% compound annual growth rate for UPL's Ebitda over FY24-27E, aided by expected growth and stable pricing, which should prevent significant rebates and provisioning for the company in the second half.

Despite a lower-than-expected Ebitda growth of around 15% for FY25, compared to the company's 50% growth target, Axis remains optimistic about UPL's financial outlook. The firm anticipates a sharp margin rebound in the second half of FY25, as the company clears high-cost inventory and stabilises pricing. This is expected to lead to an Ebitda of approximately Rs 6,800 crore for FY25E, with a significant boost in FY26.

UPL's strategy to ramp up its differentiated and sustainable product portfolio is expected to aid margin recovery. Although, the brokerage forecasts future growth to be largely volume-driven due to aggressive capacity expansion in China. Axis also highlighted UPL's improving balance sheet, with debt reduction, supported by funds from a rights issue and stake sale in Advanta Enterprises.

Key risks to this outlook include delays in demand revival and further pricing pressures in global generics.

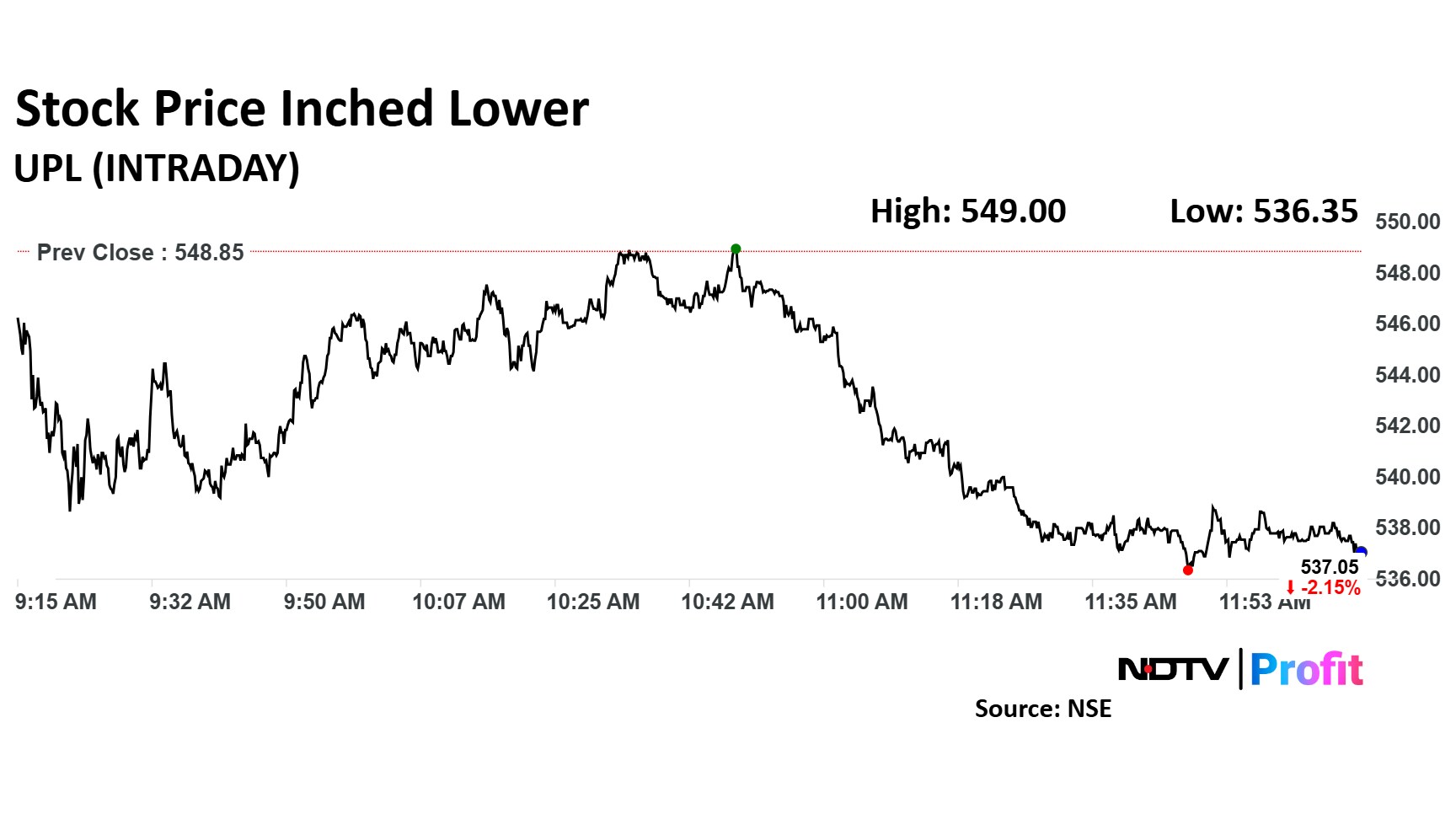

UPL Share Price Today

The scrip fell as much as 2.28% to Rs 536.35 apiece. It pared losses to trade 2.03% lower at Rs 537.70 apiece, as of 12:07 a.m. This compares to a 0.89% decline in the NSE Nifty 50.

It has fallen 1.27% in the last 12 months. Total traded volume so far in the day stood at 0.8 times its 30-day average. The relative strength index was at 54.

Out of 26 analysts tracking the company, 18 maintain a 'buy' rating, four recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 9.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.