Shares of Uno Minda Ltd. gained on Tuesday after it partnered with Singapore-based Starcharge Energy Pte. to sell electric vehicle supply equipment in India.

The company signed a technical license agreement with the Starcharge on Thursday for manufacture and sale of EV supply equipment. These includes manufacturing wall mounting AC charger, which are designed for charging vehicles at home, the company said in an exchange filing.

With this agreement, Uno Minda strengthens its electric vehicle portfolio to serve the passenger car segment, the exchange filing said.

Further, Nomura maintained a 'buy' rating on Uno Minda Ltd. and raised the target price to Rs 820 apiece from Rs 650 apiece.

Here's what the brokerage said:

Nomura's View On Uno Minda

New TLA with Starcharge Energy is expected to expand firm's capability in EV- passenger car segment

The agreement to help develop local manufacturing base for home chargers.

Addressable opportunity is to be limited to OEM sales for now.

Higher growth potential is dependent on EV-car industry pick over longer term.

Expect healthy ramp-up as it starts EVSE production over next 1 year.

Larger opportunity from ability to add more EV car components.

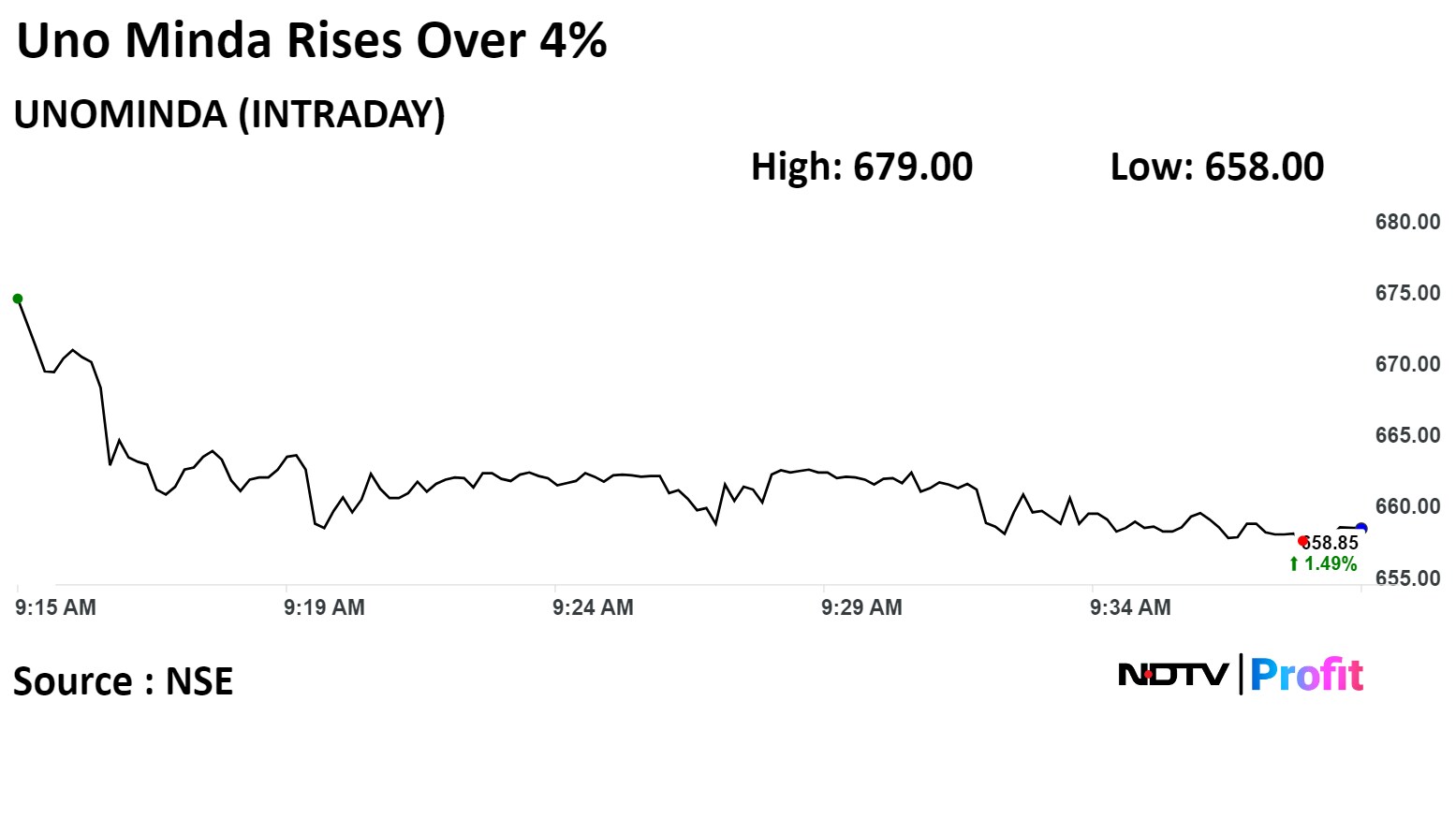

Shares of Uno Minda rose as much as 4.59% to Rs 679 apiece, the highest level since Feb 9. It was trading 1.97% higher at Rs 662.00 apiece as of 9:34 a.m. This compares to a 0.29% decline in the NSE Nifty 50.

The stock has risen 45.46% in past 12 months. Total traded volume so far in the day stood at 8.9 times its 30-day average. The relative strength index was at 55.64.

Out of 17 analysts tracking the company, 13 maintain a 'buy' rating, three recommend a 'hold', and one suggests a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.