Shares of Trent Ltd. remained the top loser in the benchmark NSE Nifty 50 on Monday, as the selloff in the once-favourite stock extended, with analysts cutting their target on waning outlook.

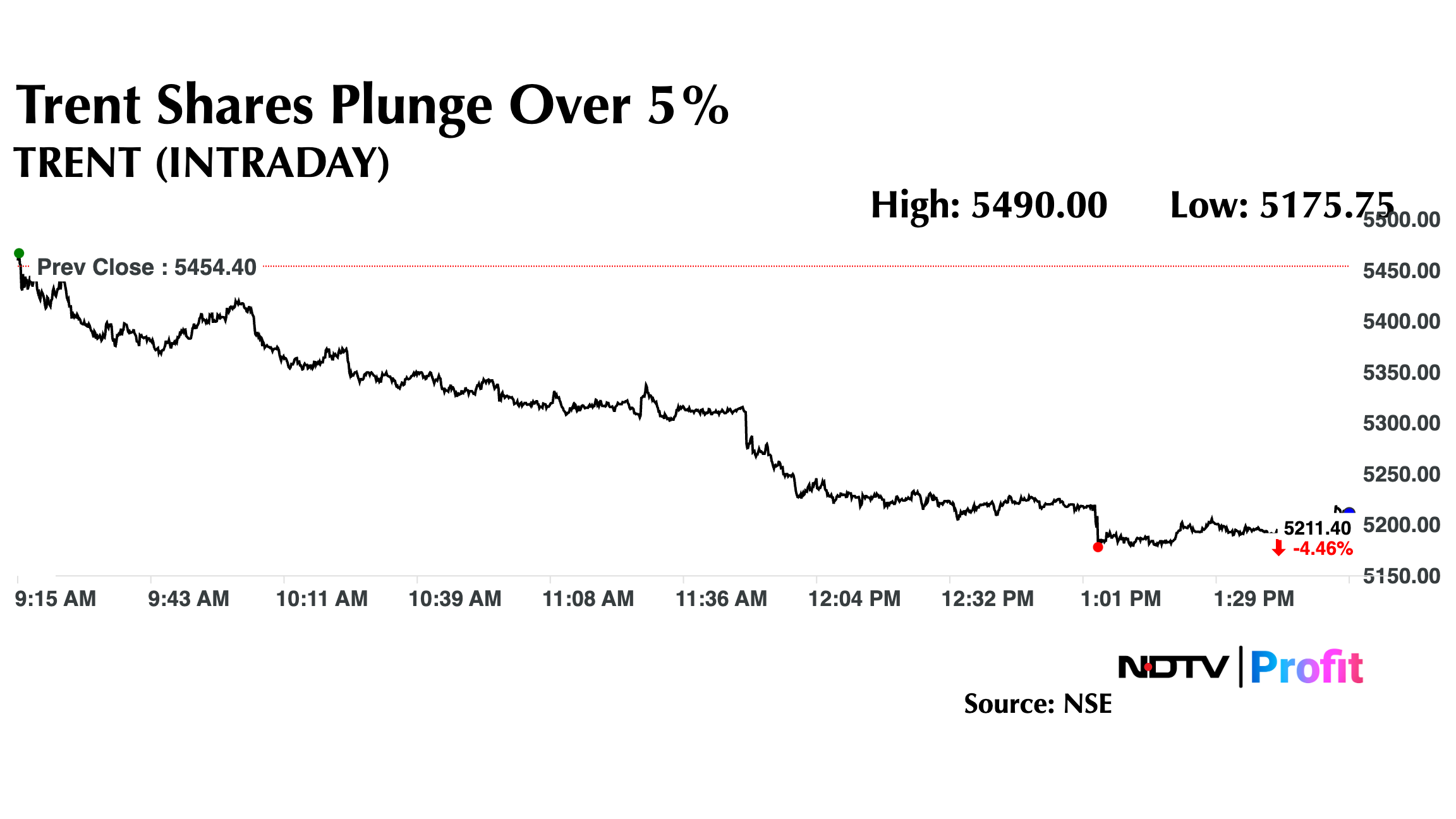

The value retailer's shares fell as much as 5.1% on Monday, compared to the 1.03% decline in the benchmark Nifty 50.

Trent's net profit increased by 37% to Rs 344 crore in the third quarter of fiscal 2025, but missed analysts' estimates of Rs 520 crore. Revenue rose 37% to Rs 4,535 crore, compared to the estimate of Rs 4,621 crore.

However, analysts had mixed reactions as they flagged lower same-store sales growth, even as numbers missed estimates.

Trent currently trades at 42 times its fiscal 2027 estimated enterprise value-to-Ebitda—well above peers like Titan and DMart at 36 times—even though it is expected to post better revenue growth over three years, according to Citi.

Bernstein highlighted key positives from the third quarter, such as retail area additions and stable margins, but flagged lower same-store sales growth, which led to a reduction in earnings projection.

Citi: Maintained 'buy', with target price reduced to Rs 7,800 from Rs 9,350.

Bernstein: Maintained 'outperform' with target price reduced to Rs 6,900 from Rs 8,100 per share.

Jefferies: Maintained 'hold' with target price reduced to Rs 5,800 from Rs 5,900.

Despite some investor concerns, stable operating margins provided relief, even as the stock corrected 8% post-results, amid a pause in the earnings upgrade cycle and relatively high valuations, Jefferies said. The brokerage also reduced revenue growth and margin assumptions.

Trent Share Price

The stock has risen 38.51% in the last 12 months. Total traded volume so far in the day stood at 1.32 times its 30-day average. The relative strength index was at 51.69.

Fifteen of the 23 analysts tracking Trent have a 'buy' rating on the stock, three each recommend a 'hold' and four a 'sell', according to Bloomberg data. The average of 12-month analysts' price target of Rs 6,486 implies a potential upside of 22%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.