Transrail Lighting Ltd.'s share price saw a significant boost after the company announced it had secured new domestic orders worth Rs 1,085 crore. This marks a strong start to the financial year 2026, with the orders enhancing the company's portfolio in the transmission and distribution (T&D) segment, as well as its expertise in civil, railways, and poles & lighting sectors.

On Monday, Transrail Lighting announced that it had obtained these T&D orders within the domestic market. This follows the company's other orders in March, where it secured orders worth Rs 1,647 crore in both the T&D and railways sectors.

Based in Mumbai, Transrail Lighting is a prominent EPC (Engineering, Procurement, and Construction) player in the T&D sector.

The company also operates in civil, railways, poles, and lighting, with a presence in 59 countries.

Over the years, Transrail has successfully completed more than 200 projects in the power transmission and distribution field, showcasing its extensive project execution capabilities, including manpower and material supply, with many products being self-manufactured.

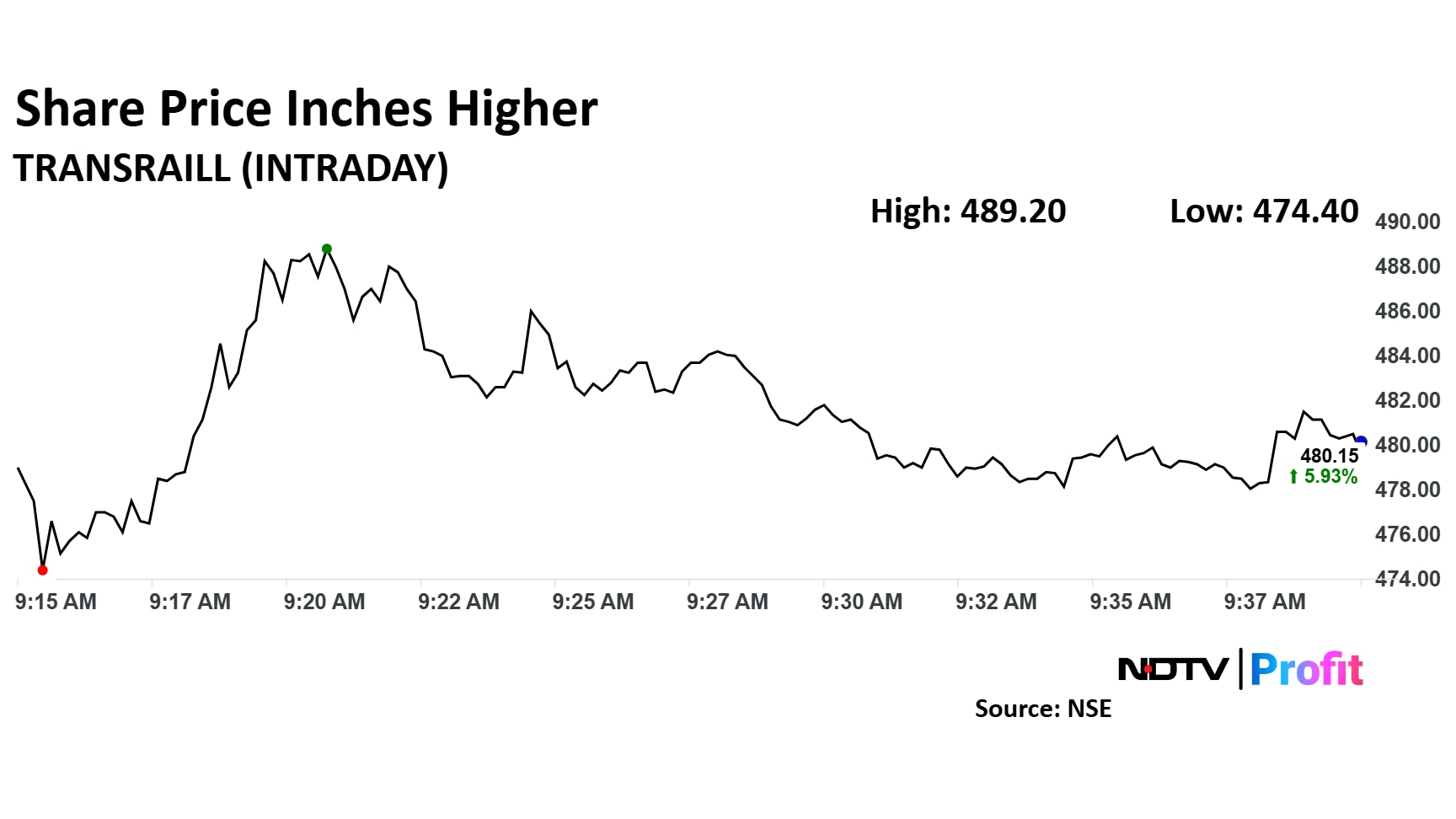

The scrip rose as much as 7.93% to Rs 489 apiece. It pared gains to trade 5.79% higher at Rs 479.50 apiece, as of 09:38 a.m. This compares to a 2.05% advance in the NSE Nifty 50 Index.

It has fallen 13.38% in the last 12 months. Total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 47.

Only one analyst is tracking the company, and they maintain a 'buy' rating on the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 55.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.