Shares of Transformers And Rectifiers (India) Ltd. rose over 8% on Monday after it won an order from Gujarat Energy Transmission Corp.

The company won an order worth Rs 726 crore for the manufacturing and supply of auto transformers and bus reactors, according to an exchange filing on Monday. The project is to be completed within the span of 18 months from the date of issue of Letter of Interest.

Transformers And Rectifiers Q3 Performance

The company posted over three-fold rise in its net profit during October–December quarter. Its net profit surged 253.50% on the year to Rs 55.5 crore in the third quarter from Rs 15.7 crore.

Transformers And Rectifiers recorded 51.4% rise in revenue during the quarter at Rs 559 crore. The heavy electrical-equipment manufacturer's operating profit also more than doubled. The Ebitda rose 120% on the year to Rs 84.7 crore in the third quarter, compared to Rs 38.5 crore. The margin rose 470 basis points on the year to 15.1% during October–December from 10.4%.

The transformer manufacturing company earlier this month told NDTV Profit that it is targeting a transformer manufacturing capacity of 70,000 MVA by the end of financial year 2026.

The company is expected to reach a capacity of 15,000 MVA from April, according to Chief Financial Officer Chanchal Rajora. The company is also targeting a revenue of Rs 3,500 crore in FY25-26, backed by the enhanced production capacity.

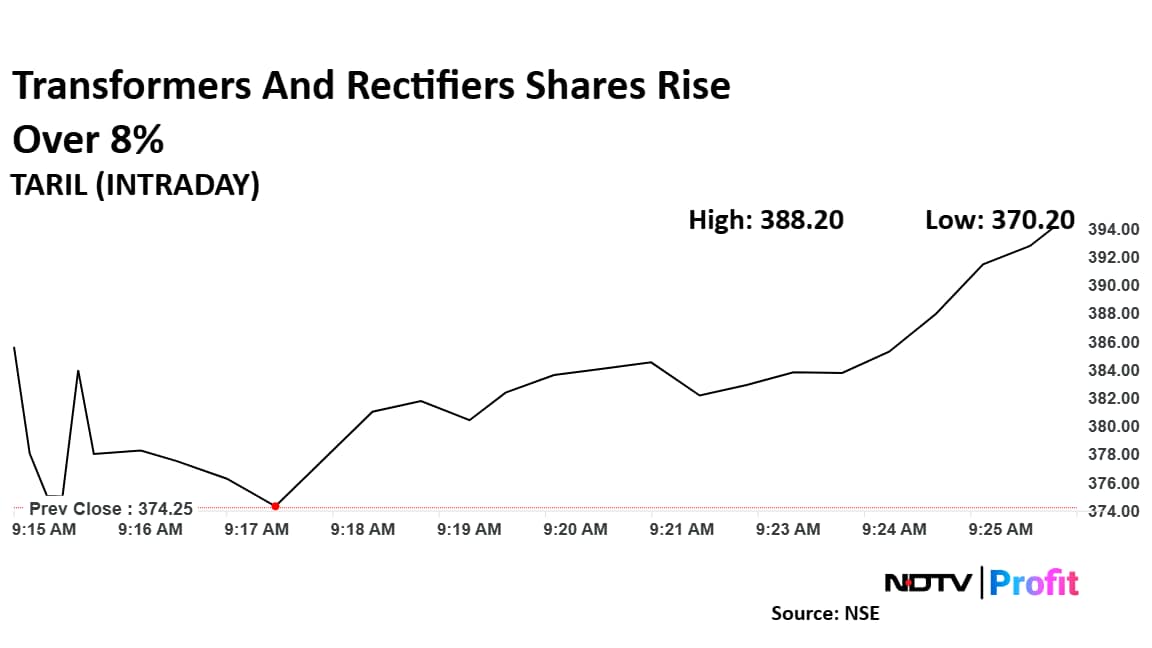

Transformers And Rectifiers Shares Rise

Shares of Transformers and Rectifiers rose as much as 8.22% to Rs 405 apiece, the highest level since March 10. It pared gains to trade 6.08% higher at Rs 397 apiece, as of 10:01 a.m. This compares to a 0.68% advance in the NSE Nifty 50.

The stock has risen 141.40% in the last 12 months and fallen 34.24% year-to-date. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 46.

Both the analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 83%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.