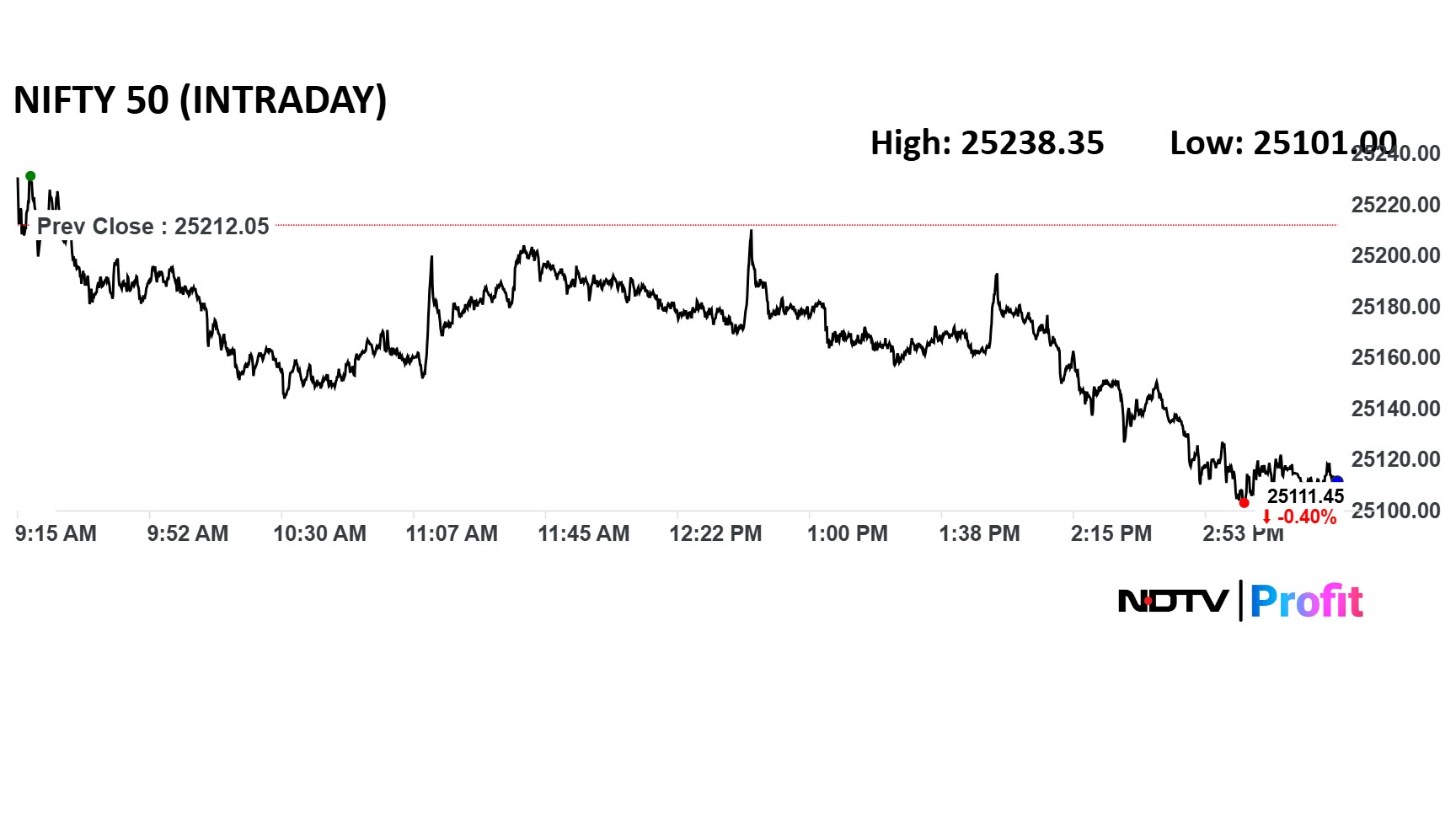

The NSE Nifty 50 has found support at 25,000 on the downside, followed by stronger support zones near 24,900–24,700, according to Hardik Matalia, derivative analyst at Choice Broking.

A decisive breach below these levels can intensify the decline. The Nifty formed a bearish engulfing candlestick, indicating a possible short-term reversal and building selling momentum, Matalia said.

On the upside, 25,250 is the immediate resistance, with a strong hurdle placed around 25,400–25,500. A decisive move above this zone can help the index regain its bullish trajectory, according to Matalia.

The Nifty found its immediate support level at its 50-day simple moving average of 25,000. Below 25,000, the chances of hitting 24,900-24,850 will increase, according to Shrikant Chouhan, head of equity research of Kotak Securities.

On the upside, a break above 25,200 can lead the market to retest the levels of 25,280. he said. "A successful breakout above 25,280 could push the market up to 25,350-25,425."

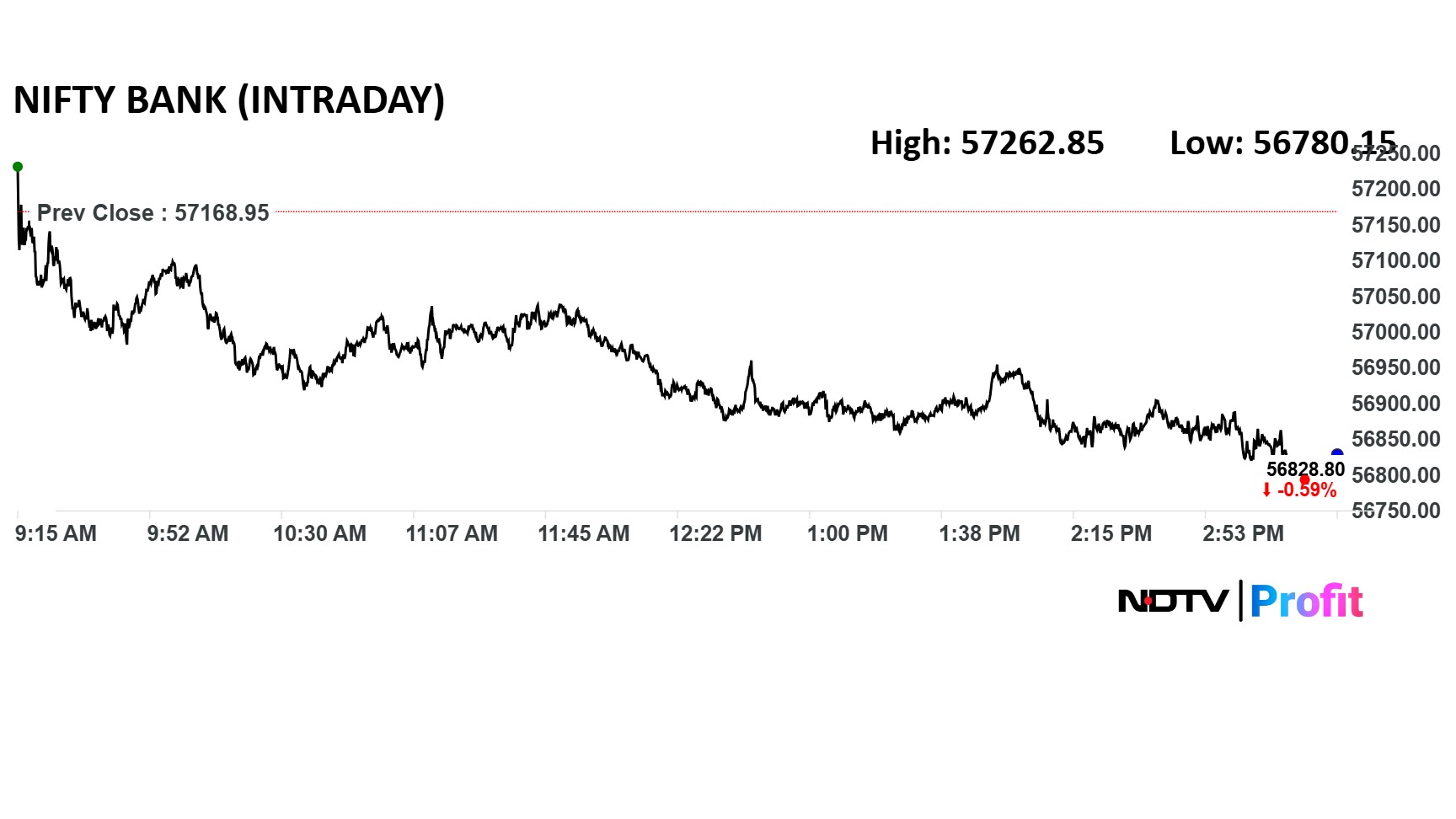

The Bank Nifty finds key short-term support at 56,000–55,500 and the broader trend remains positive, according to Bajaj Broking.

Market Recap

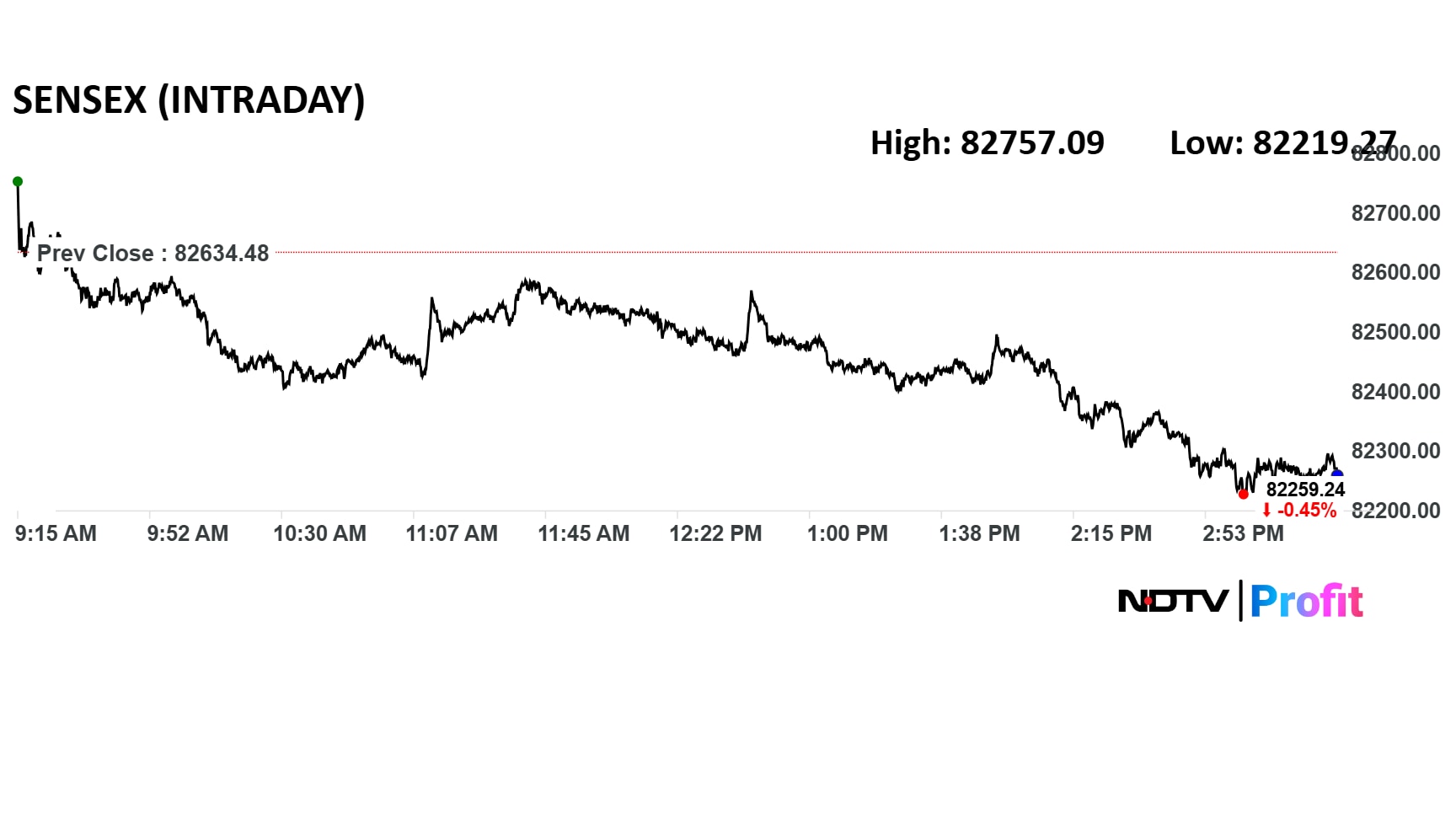

India's benchmark equity indices pulled back on Thursday after two days of gains, weighed by heavyweights Infosys Ltd. and HDFC Bank Ltd. The BSE Sensex lost 375.24 points or 0.45% to close at 82,259.24, while the NSE Nifty 50 ended 100.6 points or 0.4% lower at 25,111.45.

Currency Update

The Indian rupee closed weaker for the second day on Thursday, slipping by 13 paise to trade at 86.07 against the US dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.