The NSE Nifty 50 continues to display resilience with immediate support at 23,900 and resistance at 24,130. Analysts suggest a breakout above 24,130 could propel the index toward 24,650, while a dip below 23,900 might lead to 23,650.

"Technically, on the daily chart, the Nifty formed a red candle, indicating profit booking, while on the weekly chart, it formed a green candle, indicating overall strength," Hrishikesh Yedve, research analyst at Asit C. Mehta Investment Interrmediates Ltd., said. "The index continues to hold above the 200-day simple moving average, which is currently placed near 23,900."

It remains above the breakout zone of the short-term consolidation range 23,500–23,900. As long as the index maintains above 23,900, a buy-on-dips strategy is recommended for Nifty. according to Yedve.

"The Nifty is currently moving within a symmetrical triangle formation, with key support at 23,900 (200 DMA) and resistance at 24,130 (50 DMA)," Aditya Gaggar, director of Progressive Share Brokers, said. "Breakout above 24,130 could lead to a rise towards 24,650, while a drop below 23,900 could push it down to 23,650."

The Bank Nifty index settled the day on a negative note at 50,989. The index is also stuck in a range, with the resistance at 51,800 and support at 50,600, Gaggar said. "Traders are likely to watch for a breakout from this range."

Technically, the Bank Nifty has formed a bearish candle on a daily scale, indicating profit-booking, Yedve said. "However, the index is still placed above trend line support and maintained above the 200-DEMA, which is near 50,500 level. On the upside, the index is facing resistance near 52,000 levels."

Yedve said that as long as the index remains in the band of 50,500–52,000, ongoing consolidation will continue. Either side breakout will set the next direction of a Bank Nifty.

FII/DII Activity

Foreign portfolio investors turned net sellers after a day on Friday and offloaded stocks worth Rs 4,227.3 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors have been buyers for 13 consecutive sessions and bought stocks worth Rs 820.6 crore.

F&O Action

The Nifty January futures were down by 0.86% to 24,092 at a premium of 88 points, with the open interest down by 1.48%.

The open interest distribution for the Nifty 50 Jan. 9 expiry series indicated most activity at 26,500 call strikes, with the 21,850 put strikes having maximum open interest.

Market Recap

The NSE Nifty 50 and BSE Sensex snapped a two-day winning streak on Friday as private bank stocks declined. ICICI Bank Ltd. and HDFC Bank Ltd. share prices dragged the Nifty 50 the most. However, the benchmarks rose for the second consecutive week.

The Nifty closed 183.90 points or 0.76% down at 24,004.75 and the BSE Sensex ended 720.60 points or 0.90% lower at 79,223.11.

Major Stocks In News

Vedanta: The company, in its business update, reported that aluminium production increased 3% year-over-year to 614 KT. Quarterly zinc international volumes grew by 12% year-on-year, while alumina production rose by 7% year-on-year.

JSW Energy: The Central Electricity Regulatory Commission did not adopt the proposed tariff for battery energy storage systems project. They said that the proposed tariff is not aligned with current market prices due to SECI's delay in signing battery energy storage purchase agreement.

Brigade Enterprises: The company signed a definitive agreement for a prime land parcel located in Bengaluru for developing a residential project spanning about 20 acres.

Global Cues

Asian equities saw mixed movement on Monday, following a recovery on Wall Street that broke a five-day losing streak, buoyed by renewed interest in major tech stocks.

In Australia, shares climbed by 0.4%, while Japan's benchmark Nikkei 225 index dipped 0.75% to 39,557 in its first session after a prolonged holiday. South Korea's Kospi was trading near 2,450, up 0.26%.

US futures showed little change after the S&P 500 rose by 1.3% on Friday, reversing a downturn that had wiped out over $1 trillion from the market. The S&P 500 finished 1.26% higher at 5,942.5, while the Nasdaq Composite advanced 1.77% to 19,621.68. The Dow Jones also increased by 0.8%, closing at 42,732.13.

The dollar showed mixed results against major currencies early on Monday, with the yen retreating slightly from its late-week gains, trading around 157 per dollar. The US Dollar Index stood at 109.01.

Crude oil prices were unchanged. The international benchmark Brent crude was trading flat at $76.48 a barrel as of 6:30 a.m. IST.

Spot gold prices was up 0.08% at $2,641.28.

Money Market

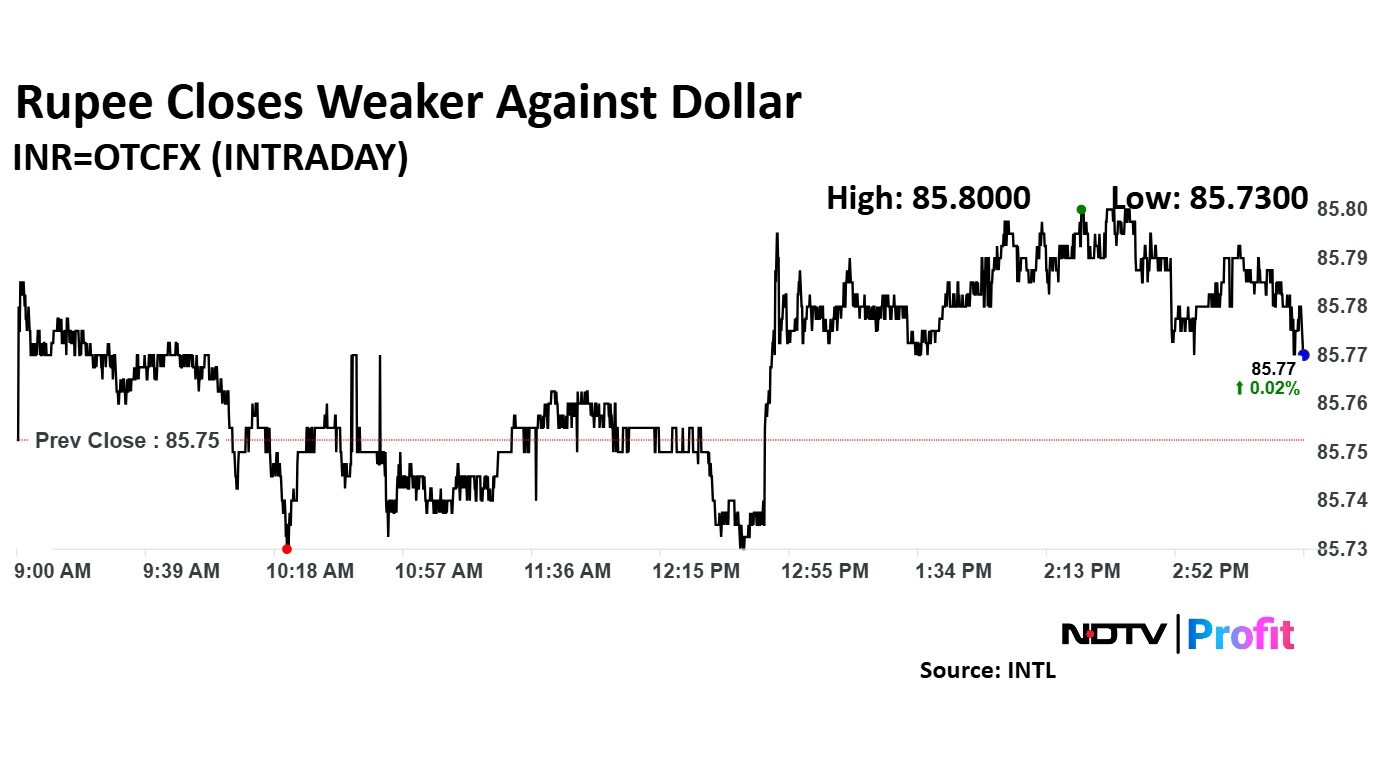

The Indian rupee weakened by two paise to close at 85.78 against the US dollar, after opening five paise weaker at 85.80 against the greenback on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.