The NSE Nifty 50 can face immediate resistance near 23,400, while the downside is apparently limited at the 23,000 levels, according to analysts.

"On the upside, 23,400 will serve as an immediate hurdle for the index, where the 200-day exponential moving average is placed," Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd., said.

"If the index sustains above 23,400, the rally can extend further towards 23,600–23,800," Yedve added.

The analyst recommended traders to monitor the 23,000–23,400 range, where it may continue consolidating for potential buying opportunities.

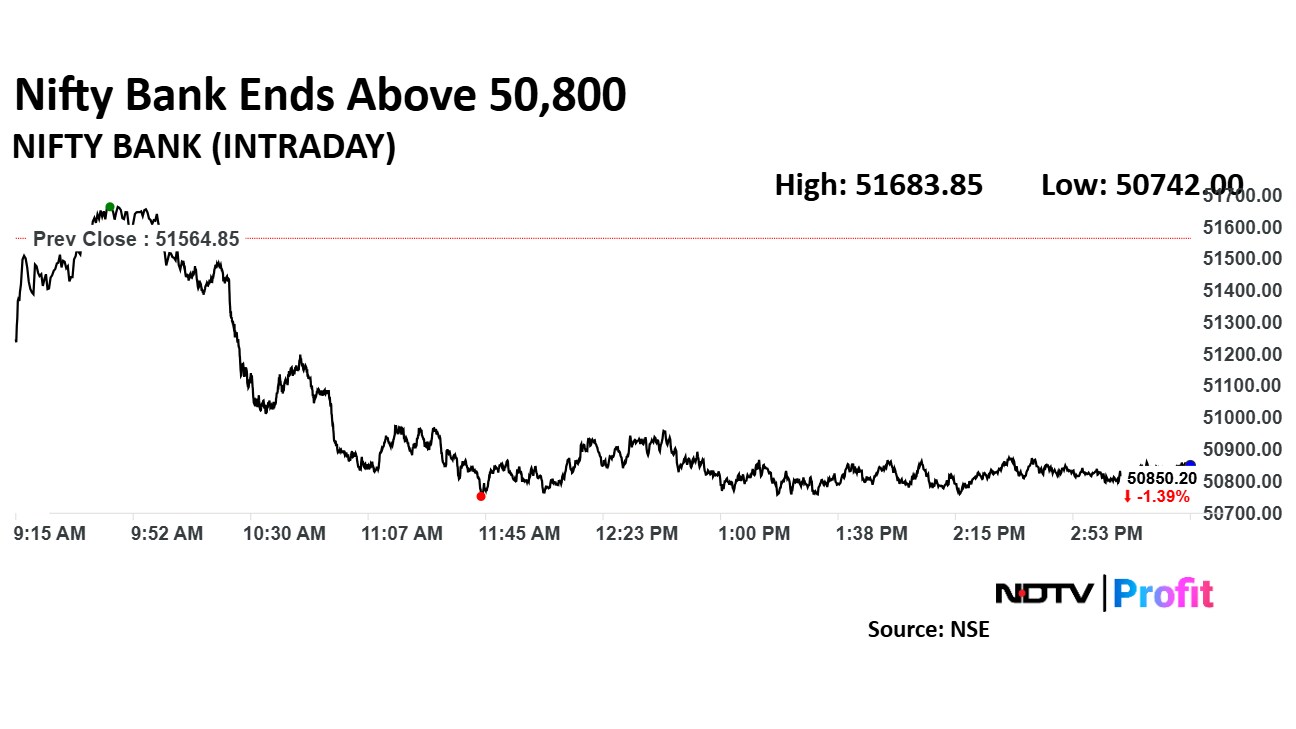

For Bank Nifty, the 51,500–52,000 region may be a critical resistance, according to Dhupesh Dhameja, a derivatives research analyst at Samco Securities.

The analyst credited this to trading consistently employing a 'buy' call option in the range mentioned above, which turned the former support into a resistance.

On the downside, the 51,000–50,500 range acts as a vital support area, according to Dhameja, due to a strong put writing and psychological support.

"A decisive breakout above 51,500 could reignite bullish momentum, but persistent call writing and ongoing put accumulation at lower levels signal continued consolidation," Dhameja said.

As long as Nifty Bank trades within the 52,000-50,700 range, Dhameja recommends a buy-on-dip and sell-on-rise approach to traders.

He also said that a break below 50,700 could trigger fresh selling pressure, potentially dragging the index lower.

Market Recap

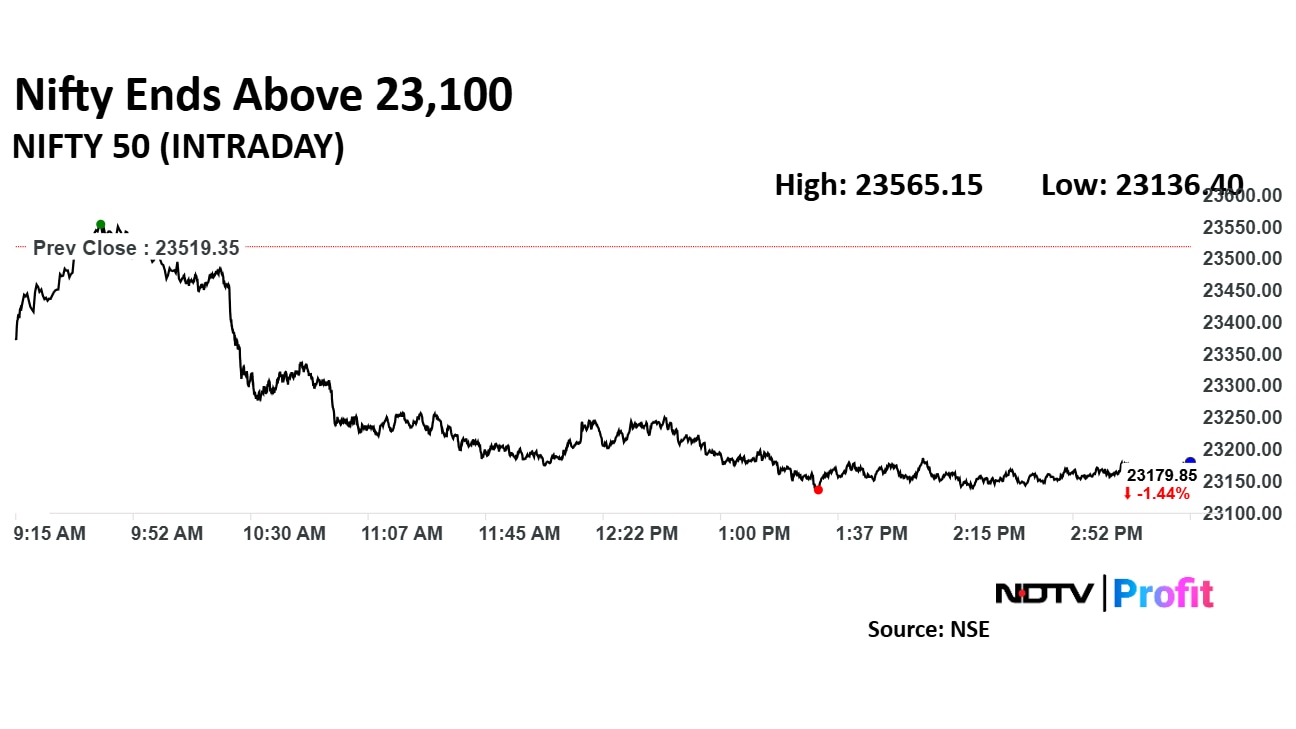

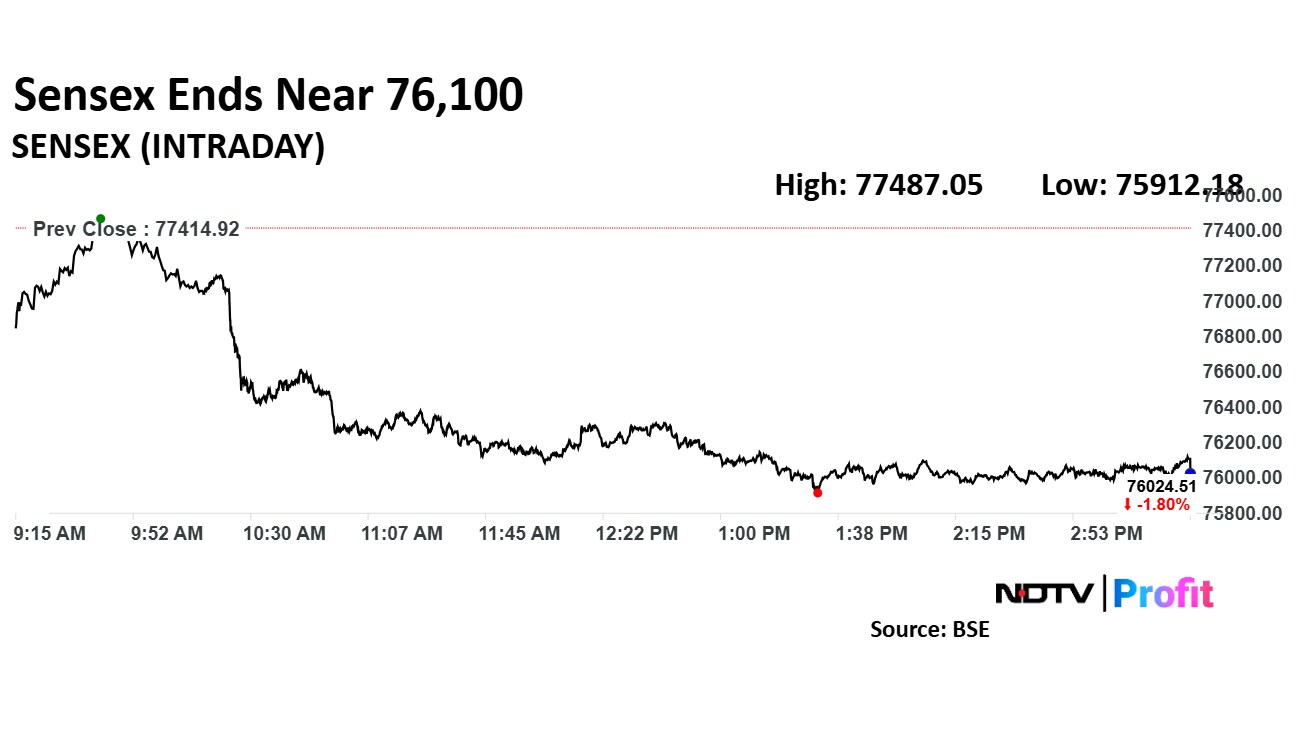

India's benchmark equity market indices snapped a two-day losing streak on Wednesday, tracking a rise in HDFC Bank Ltd.

The NSE Nifty 50 ended 165.2 points or 0.71% higher at 23,330.9, and the BSE Sensex ended 592.93 points or 0.78% higher at 76,617.44.

F&O Cues

The Nifty April futures rose 0.49% to 23,438.95 at a premium of 106.6 points, with the open interest down 1.59%.

The open interest distribution for the Nifty 50 April 3 expiry series indicated most activity at 23,500 call strikes, and the 23,000 put strikes had the maximum open interest.

FII/DII

The FPIs net sold equities worth Rs 5,901.63 crore on Tuesday, according to provisional data from the National Stock Exchange.

Meanwhile, the domestic institutional investors remained net buyers for the third consecutive session, as they mopped up equities worth Rs 4,322.58 crore.

Global Cues

The Nikkei 225 slumped over 4% and Kospi nearly 3% after US imposed tariffs higher than expected which spoilt the sentiment for Asia-Pacific share indices. US President Donald Trump imposed 10% base tariff on all exports, and additional tariffs on his top trading partners — China, Vietnam and the European Union.

The Nikkei 225 pared some losses to trade 2.88% down. The KOSPI was down 1.57%. The S&P ASX 200 was trading 1.55% down as of 6:27 a.m.

On Wednesday, the Dow Jones Industrial and S&P 500 ended 0.56% and 0.67% higher, respectively. The Nasdaq Composite ended 0.87% higher.

The dollar index was trading 0.61% down at 103.17 as of 6:21 a.m. Brent crude was trading 2.70% down at $72.93 a barrel. The Bloomberg spot gold was trading 0.20% high at $3,173.20 an ounce.

The GIFT Nifty was trading 0.72% or 168.00 points down at 23,060.50 as of 6:32 a.m.

Major Stocks In The News

Maruti Suzuki: The company will raise car prices due to rising input costs and operational expenses from April 8 onwards. The price of Grand Vitara will go up by Rs 62,000.

IndusInd Bank: External auditor PwC submitted its report on the bank's accounting discrepancies to the private lender's board, sources told NDTV Profit. The bank, however, has denied receiving the report.

Reliance Industries: The firms plans to make an investment of Rs 65,000 crore for 500 compressed bio-gas plants in Andhra Pradesh.

Currency Market

The Indian rupee weakened by five paise against the US dollar on Wednesday ahead of US President Donald Trump's tariff announcement. The local currency ended at 85.51 against the greenback.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.