.png?downsize=773:435)

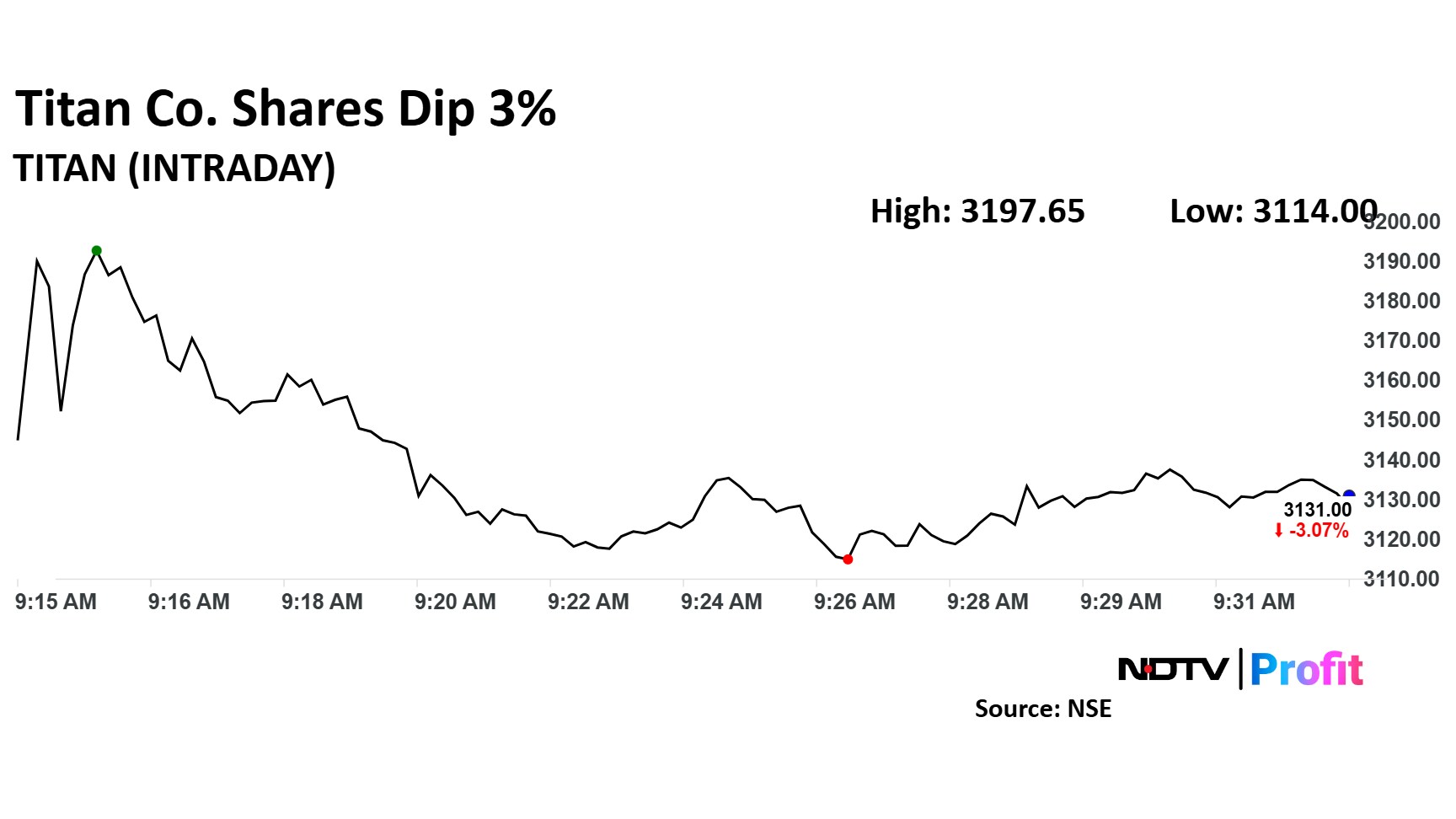

Titan Co.'s share price declined over 3% on Wednesday after its second-quarter profit missed analysts' estimates, keeping several brokerages divided on the company's outlook.

The company reported a 23% year-on-year decline in consolidated net profit and missed market expectations. Brokerages concur that a shift in the product mix and the impact of a 9% reduction in customs duties on the company's inventory impacted its margins.

While most analysts remain positive about Titan's top-line growth, they have varying outlook on its pace. Goldman Sachs maintains an optimistic view, reiterating a "buy" rating with a target price of Rs 3,650, supported by expectations of strong festive demand and robust wedding season sales in the latter half of the year.

However, Jefferies and Citi are more cautious, keeping "hold" and "neutral" ratings, respectively, on the stock. They caution that urban consumption may slow due to heightened competition, which could weigh on Titan's revenue growth momentum.

Titan Q2 FY25 Earnings Highlights (Consolidated, YoY)

Revenue up 16% to Rs 14,534 crore (Bloomberg estimate: Rs 13,425 crore).

Ebitda down 12% to Rs 1,236 crore (Bloomberg estimate: Rs 1,566 crore).

Margin narrows 280 basis points to 8.5% (Bloomberg estimate: 11.7%).

Net profit down 23% to Rs 704 crore (Bloomberg estimate: Rs 969 crore).

Shares of the company fell as much as 3.60% to Rs 3,114 apiece, the lowest level since June 4. The stock pared losses to trade 3.32% lower at Rs 3,123 apiece as of 09:41 a.m. This compares to a 0.5% advance in the NSE Nifty 50 Index.

The stock has fallen 15.50% on a year-to-date basis and 4.38% in the last 12 months. Total traded volume so far in the day stood at 9.8 times its 30-day average. The relative strength index was at 25.29.

Out of 34 analysts tracking the company, 17 maintain a 'buy' rating, 12 recommend a 'hold,' and five suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 17.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.