.jpg?downsize=773:435)

India's benchmark Nifty 50 has lost nearly all the gains made this year amid uncertainty in the market. That's reflected in the performance of some of the equity-oriented mutual fund schemes.

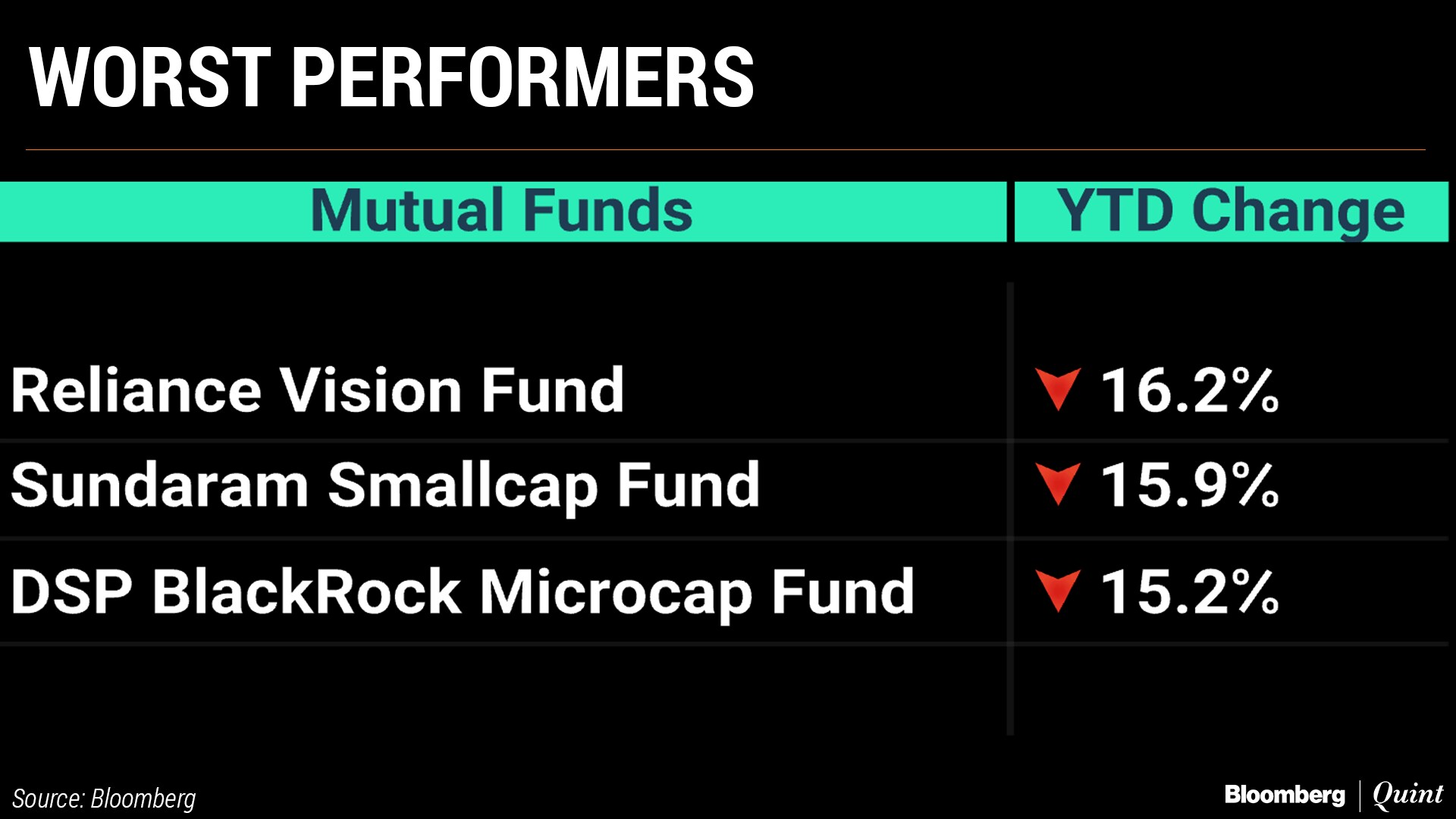

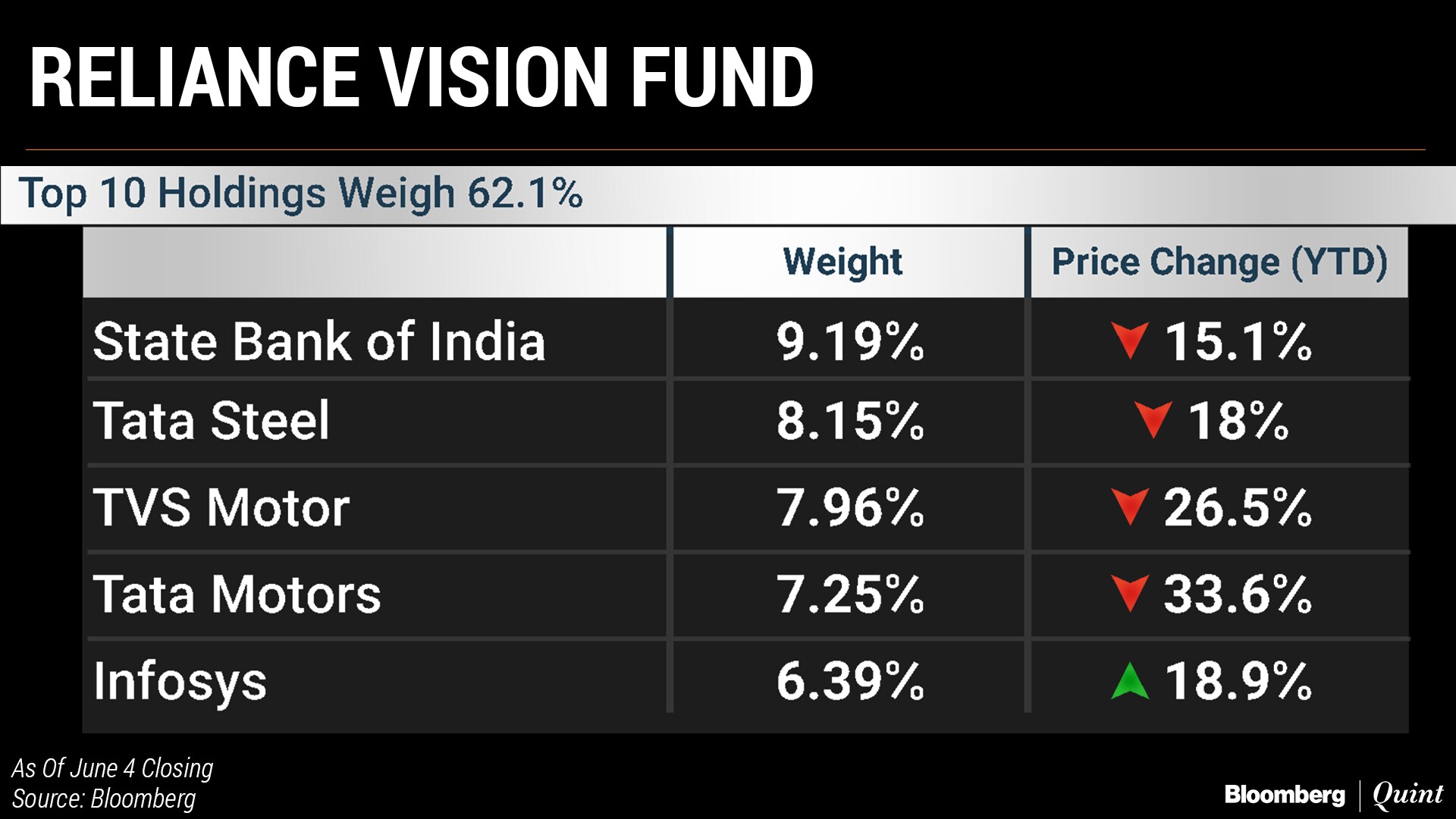

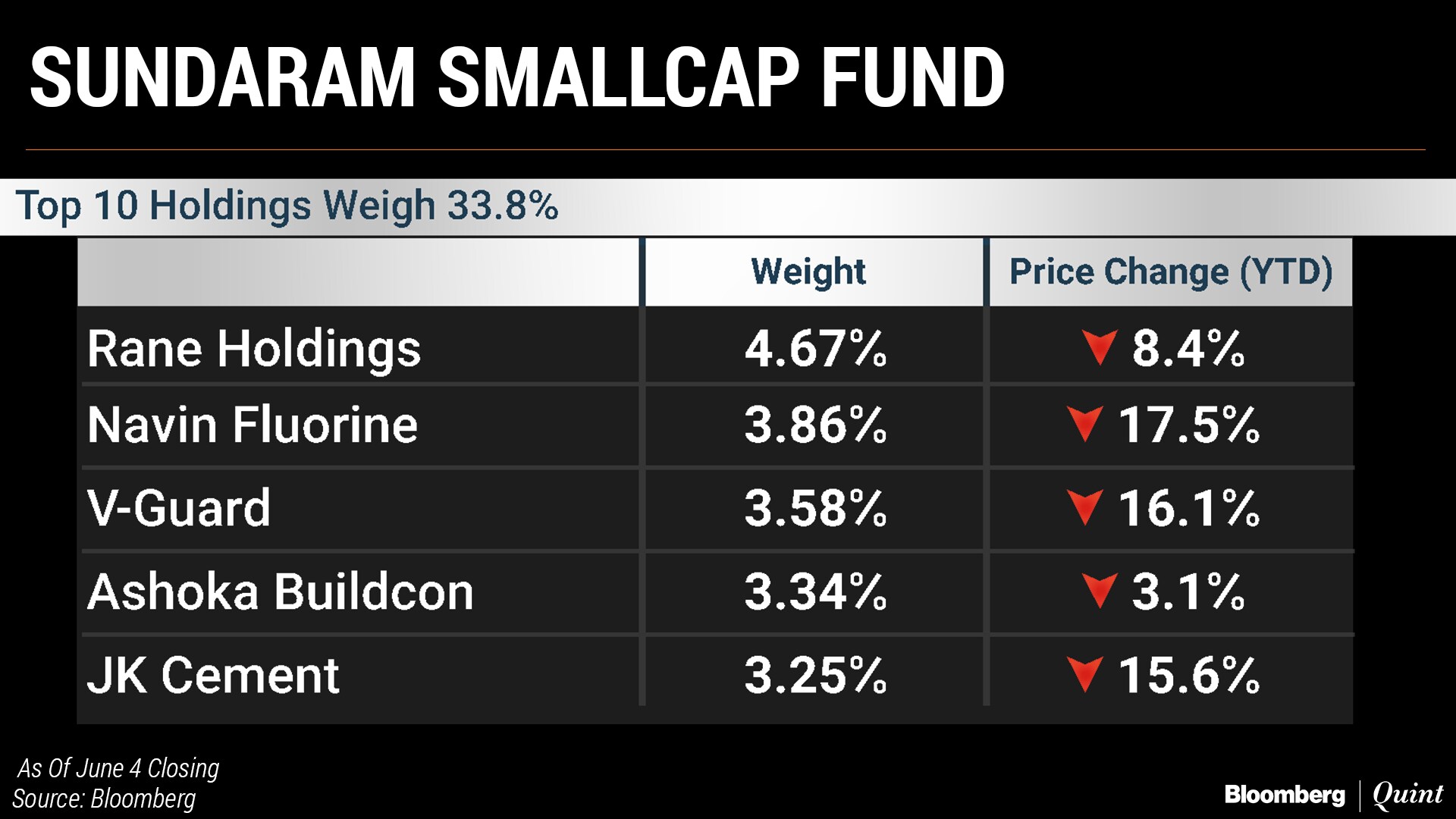

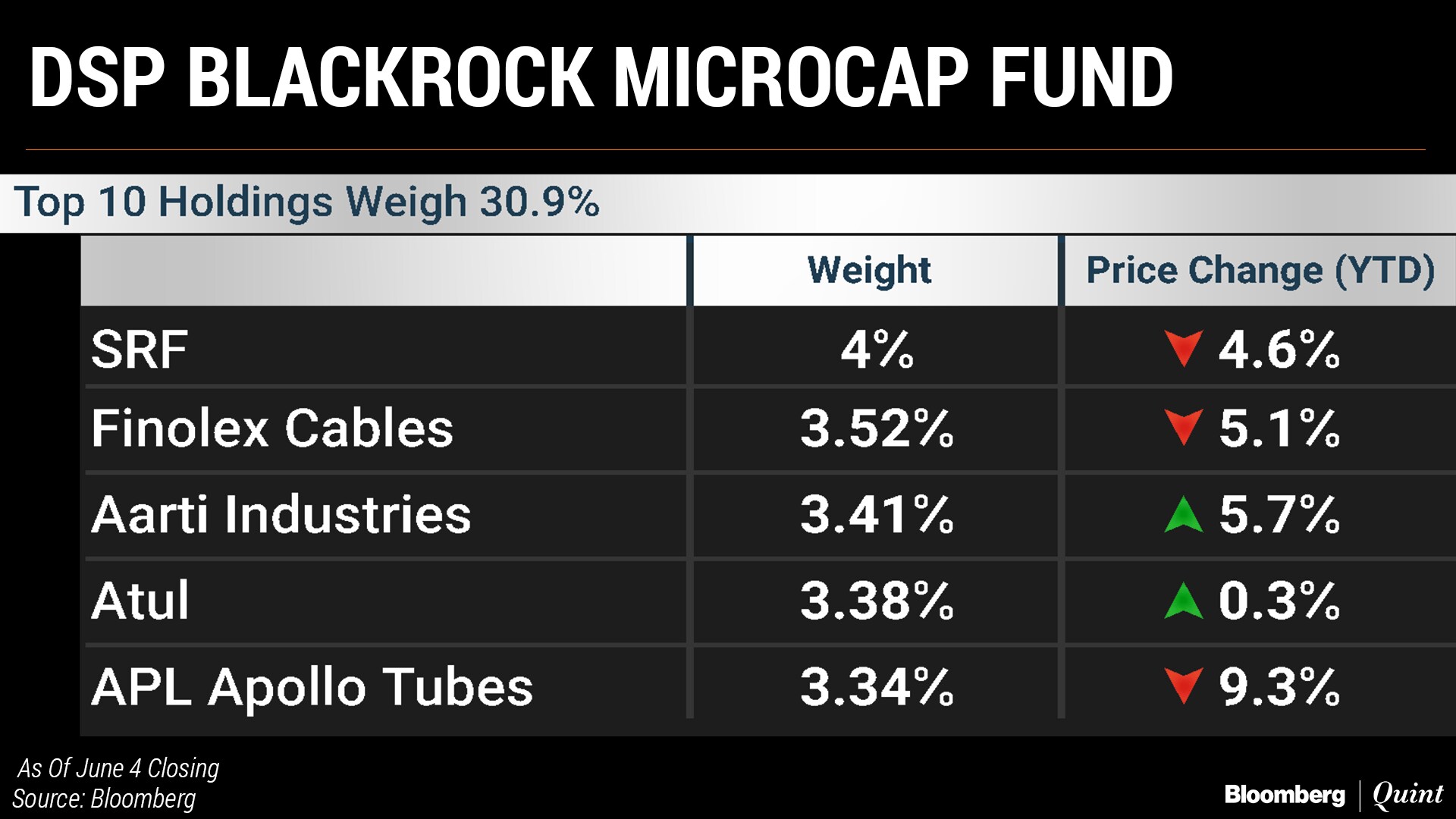

The net asset value of Reliance Vision Fund has fallen the most so far in 2018 among equity funds (excluding thematic and sector-specific funds), according to Bloomberg data. Sundaram Smallcap Fund and DSP Blackrock Microcap Fund follow.

The erosion reflects uncertainty over a host of domestic and global factors in the market, capping Nifty 50 gains at 1 percent. Nifty PSU Bank Index, the worst performer, lost nearly 22 percent followed by Nifty Realty Index's 18.8 percent decline. The Nifty Midcap and Nifty Smallcap indices have fallen over 10 percent each. Some of the small- and mid-cap stocks have declined by up to 60 percent. And India VIX, a measure of volatility, rose 10 percent. Nifty IT, however, bucked the trend, rising 16 percent—the most among sectoral indices.

In response to BloombergQuint's emailed queries, the three fund houses declined to comment. Here's how their schemes fared:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.