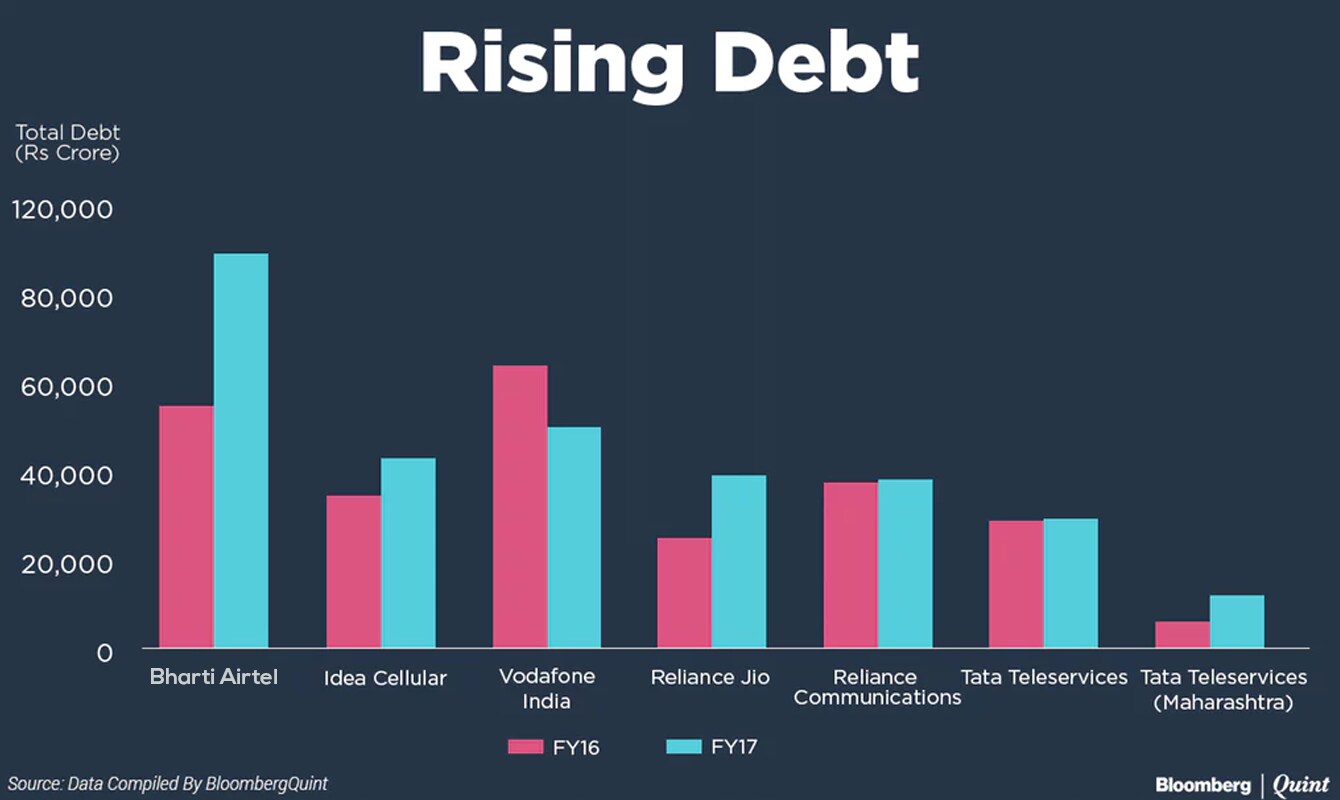

India's top seven telecommunications companies saw their total debt burden rise 20 percent in financial year 2016-17. From Rs 3,02,321 crore in the previous year to Rs 3,59,940 crore.

Vodafone India Ltd. was the only one among the seven which saw a 22 percent fall in its total debt after parent Vodafone Plc. infused equity worth Rs 47,700 crore to repay loans.

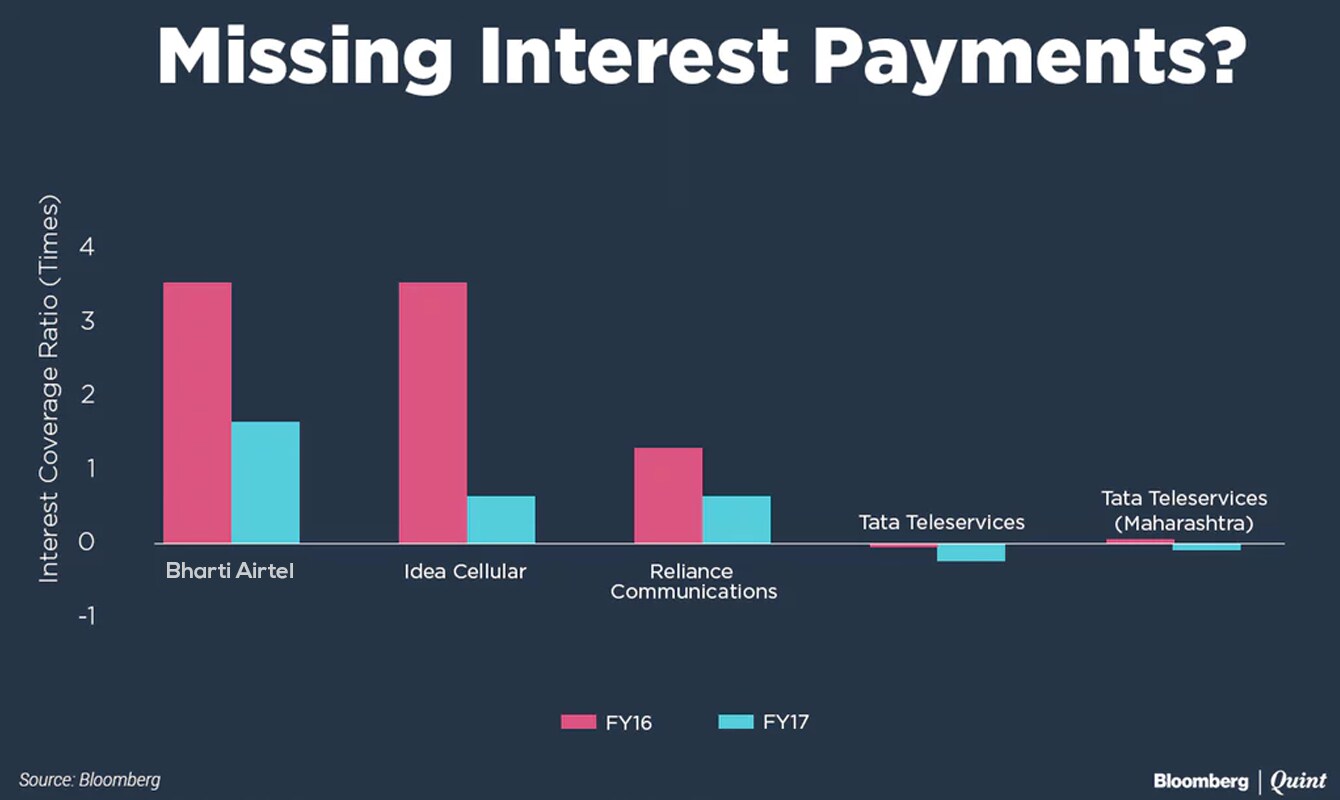

The mounting debt burden has not only resulted into rising finance costs for the companies but has also diminished their ability to re-pay debt. Recently, Anil Ambani-owned Reliance Communications Ltd.s' debt was downgraded to default rating by multiple rating agencies citing “significant stress on its cash flows and high level of debt”.

Also Read: The Story Behind Reliance Communications' SDR

Well, that has been the case with all the telecom companies. Their interest coverage ratios have worsened in the last one year.

Interest coverage ratio measures a company's financial ability to service debt.

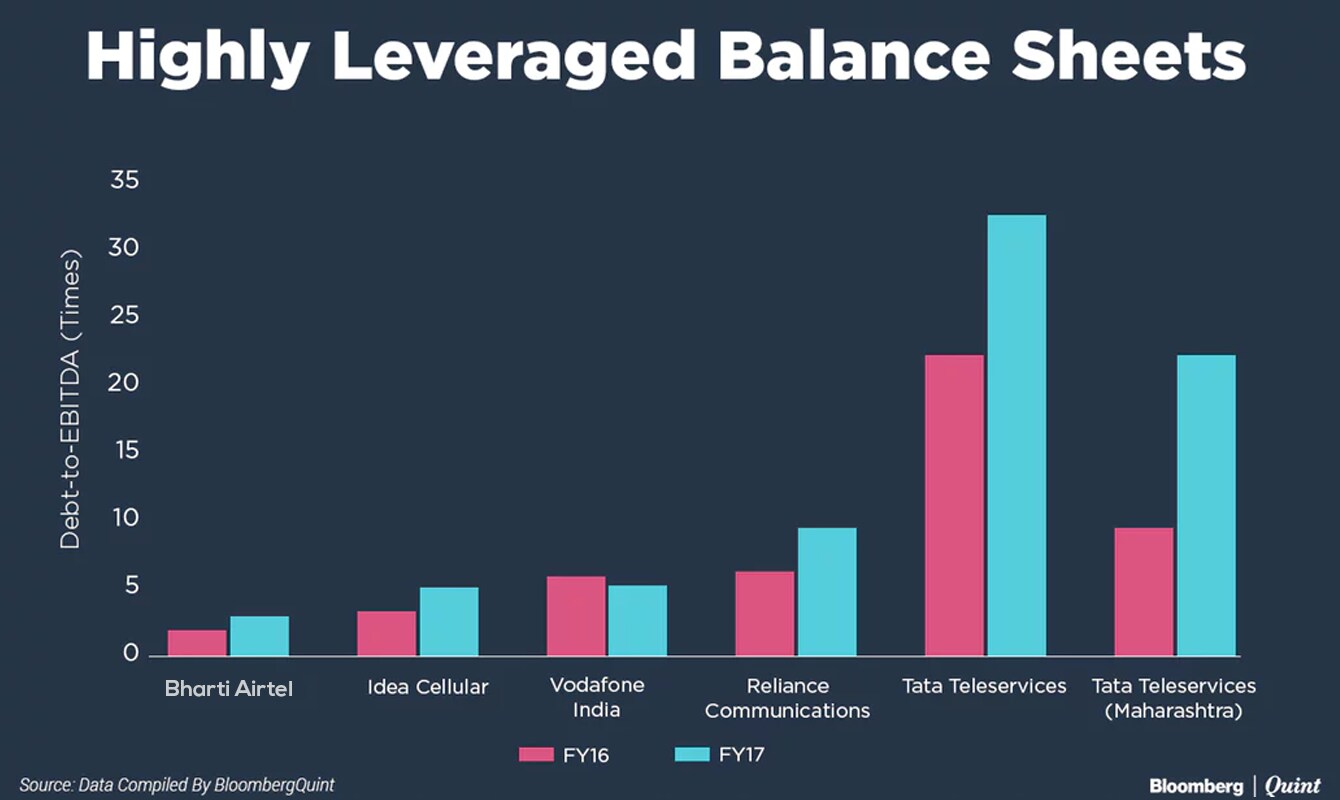

The debt-to-EBIDTA ratios have also deteriorated. Suggesting that fresh funding, for business expansion and customer acquisition, would be difficult to come by.

Also Read: RBI Asks Banks To Consider Raising Provisions Against Telecom Loans

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.