- Tether holds about 140 tons of gold worth $23 billion in a Swiss bunker vault

- Tether bought over 70 tons of gold last year, rivaling major central banks' purchases

- The company plans to compete with banks in gold trading and improve buying efficiency

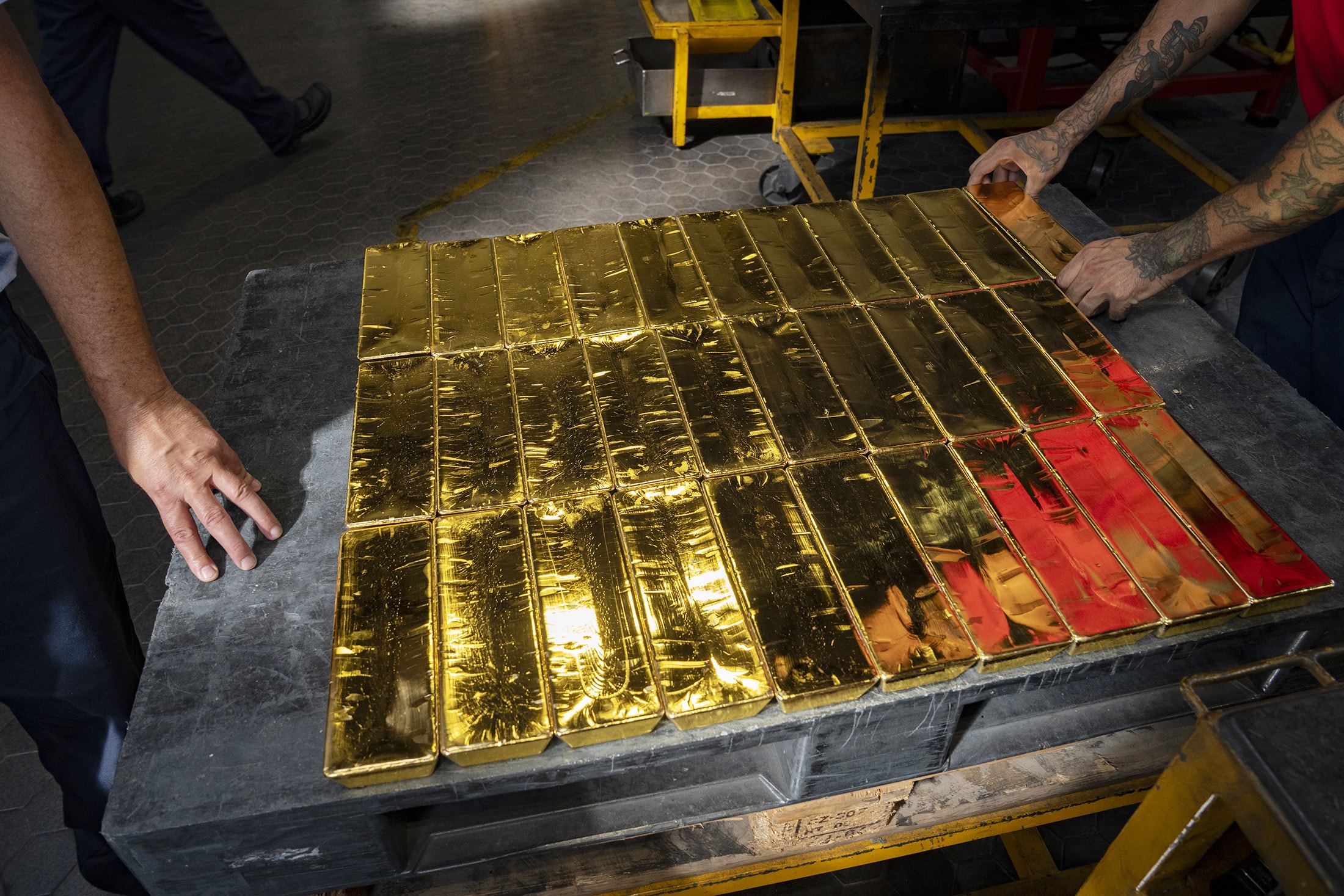

There are roughly 370,000 nuclear bunkers in Switzerland, a legacy of the Cold War that are now rarely used. One of them, though, is a hive of activity. Every week, more than a ton of gold is hauled in to the high-security vault, owned by crypto giant Tether Holdings SA, which is now the world's largest known hoard of bullion outside of banks and nation states.

Over the past year, Tether has quietly become one of the biggest players in the global gold market - the embodiment of a meeting of the crypto and gold worlds whose shared distrust of government debt is a major factor behind the surge in prices to never-before-seen highs above $5,100 an ounce.

And yet relatively little is known about its inner workings, or its gold strategy. When two of the most senior gold traders quit leading bullion bank HSBC Holdings Plc last year, the industry was abuzz with gossip about where they would head next; few guessed that the answer was Tether.

In an interview with Bloomberg, chief executive Paolo Ardoino described the company's role in the gold market as similar to that of a central bank, and predicted that Washington's geopolitical rivals would launch a gold-backed alternative to the dollar. He revealed that it plans to keep ploughing its enormous profits into gold, while also beginning to compete with banks in trading the metal.

"We are soon becoming basically one of the biggest, let's say, gold central banks in the world," he said.

Even in these historic times for the gold market, Tether's activities stand out.

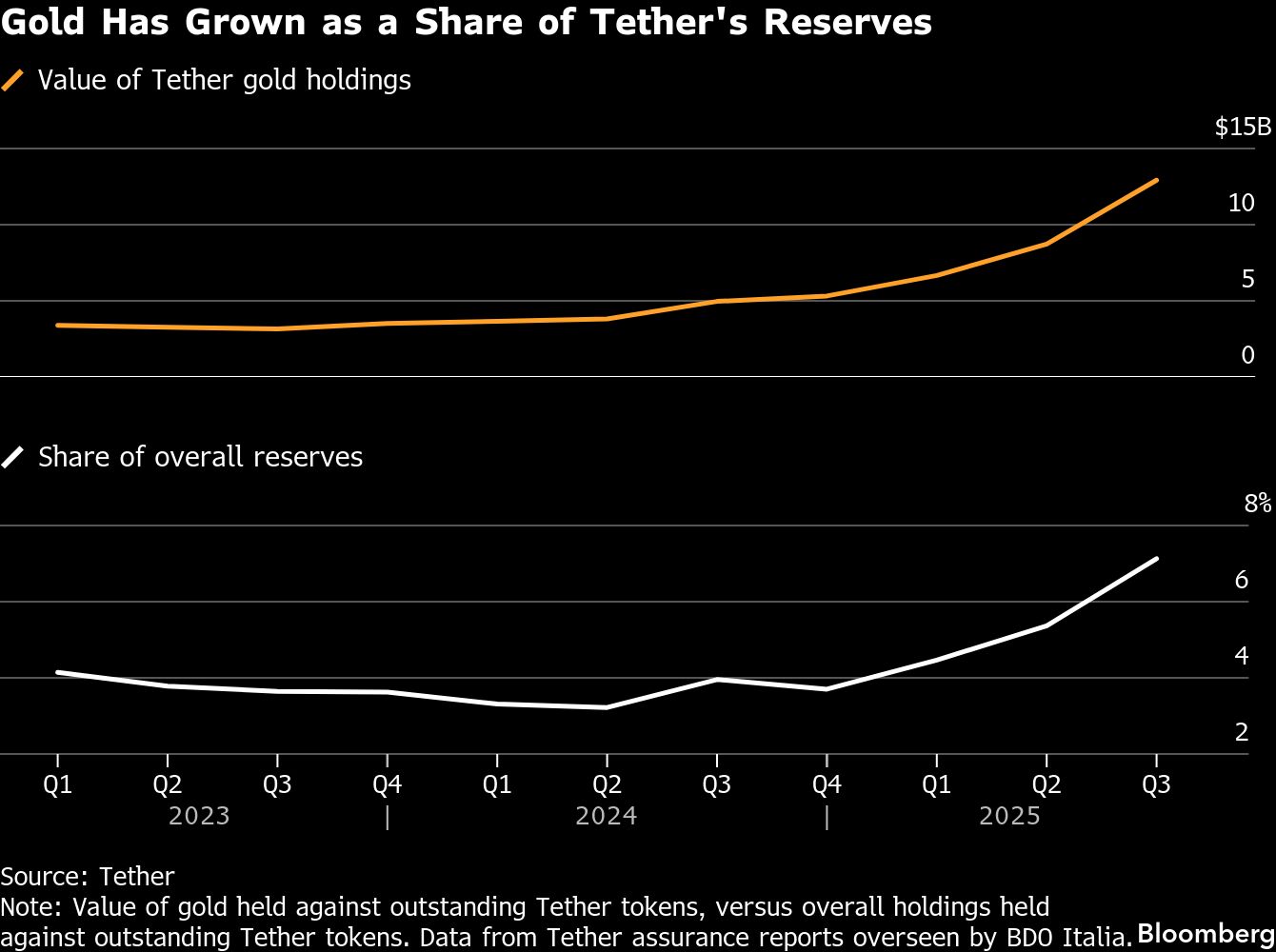

It has rapidly stepped up its purchases, buying over 70 tons of gold over the course of last year for its reserves and its own gold stablecoin, according to a Bloomberg calculation. That's more than was reported by almost any single central bank: only Poland, which added 102 tons to its reserves, made larger declared purchases. It is also more than was bought by any but the three largest exchange-traded funds, which represent the collective activity of tens of thousands of individual traders and investors.

The company holds around 140 tons of gold, according to Ardoino, most of which are its own reserves, along with the bullion backing its own gold token. That amount of metal is worth approximately $23 billion, the largest known hoard outside of those held by central banks, ETFs and commercial banks whose vaults underpin the main trading hubs.

And it's only growing: Ardoino said that Tether had been buying at a rate of about one to two tons a week, and intended to continue doing so for "definitely the next few months."

"Then of course, based on the market, we are going to decide, but yeah, I think we will continue in this direction," the 41 year-old Italian added.

Asked if there was a point at which Tether might reduce its gold purchases, Ardoino said: "Maybe we are going to reduce, we don't know yet. We are going to assess on a quarterly basis our demand for gold."

Photo Credit: Bloomberg

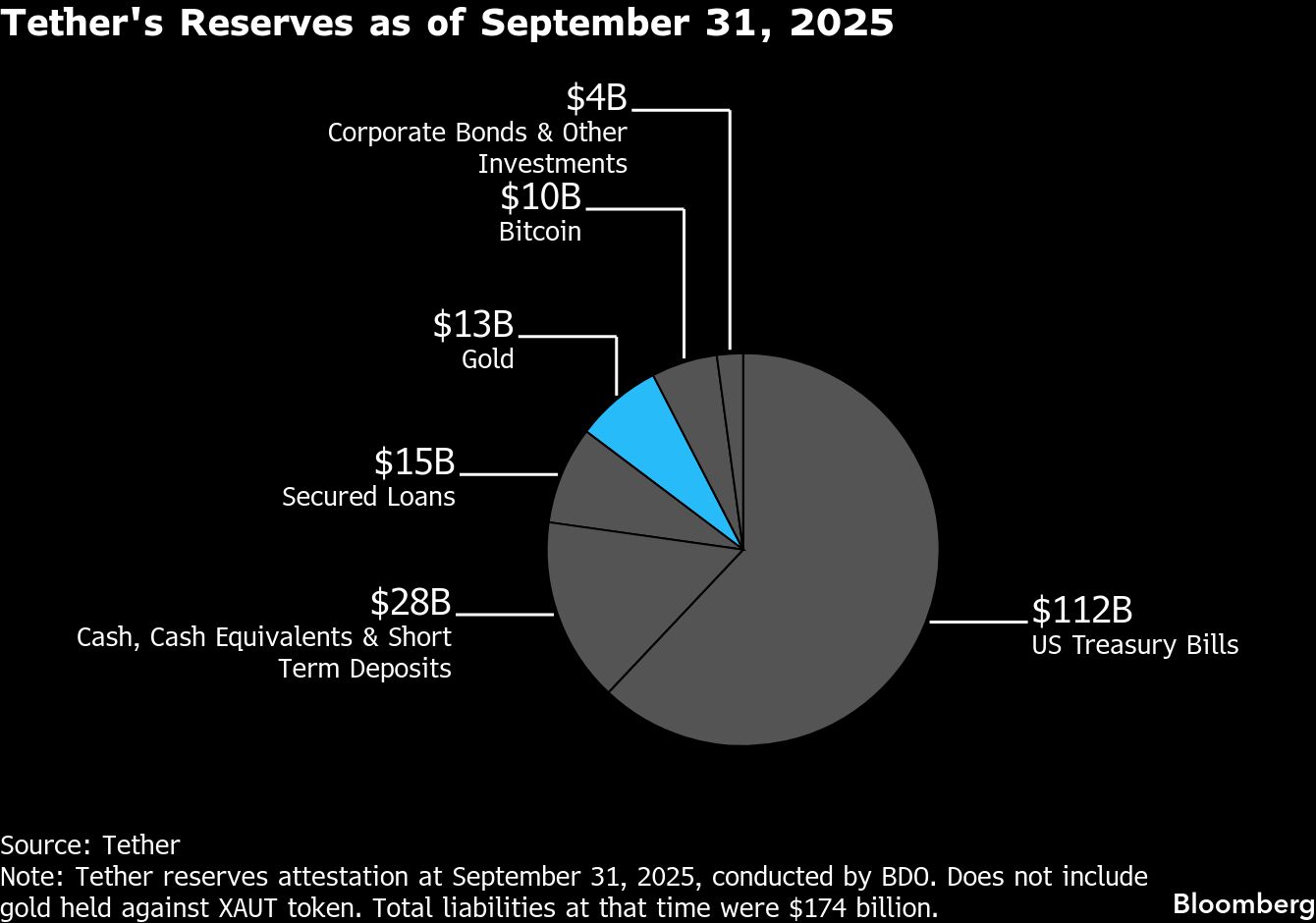

Tether makes money from its dollar stablecoin that is the giant of the sector, with $186 billion in circulation. The company takes in real dollars in exchange for that USDT token, and invests them in Treasuries and other assets, such as gold, raking in billions in interest and trading profits.

Possessing the physical metal is crucial, Ardoino said, so much so that the company has taken the unusual step of storing the bullion itself in the former nuclear bunker in Switzerland, guarded by multiple layers of thick steel doors. "It's a James Bond kind of place," Ardoino said. "It's crazy."

The secretive nature of the gold market means that while it's easy to describe broad drivers of investment, it can be hard to pinpoint who exactly is behind the buying. China, for example, officially disclosed just 27 tons of purchases last year, but many traders believe it bought much more.

Such is the scale of Tether's disclosed purchases, that some market watchers have pointed to their role in shifting global prices. The purchases likely contributed to gold's 65% rally last year, analysts at Jefferies Financial Group Inc said in a note, describing Tether as a "significant new buyer" which "could drive sustained gold demand."

Still, Tether is only a small part of a much larger rush from investors into gold, with central banks and ETF investors collectively buying more than 1,500 tons of metal.

Tether's buying would have had an impact on the price, but was only a small part of the reason for gold's spectacular rally, said John Reade, chief strategist for the World Gold Council. "They have been a component of the rally, but not all by any means," he said.

'The Best Trading Floor for Gold in the World'

Ardoino is not content with merely buying gold. He also wants Tether to trade it - effectively competing with the likes of JPMorgan Chase & Co., HSBC, and the other big banks that dominate the market.

The company needs "the best trading floor for gold in the world" in order continue buying bullion in the long term and to capitalize on potential market inefficiencies, Ardoino said, adding that it is still analyzing the market and potential trading strategies would be structured so the company "remains very long physical gold."

Photo Credit: Bloomberg

"Our goal is to have a steady, stable, long-term access to gold," Ardoino said.

It's an indication of its growing ambitions that the company has hired two senior gold traders from HSBC to help manage its activities in the bullion market. Tether is looking at ways of actively trading the gold it owns, Ardoino said, including potentially capturing arbitrage opportunities when the cost of futures diverges widely from prices for the physical metal.

Buying about $1 billion a month of physical gold is a logistical challenge. Tether purchases both directly from refiners in Switzerland, and from the biggest financial institutions in the market, Ardoino said, and a big order of metal can take months to arrive.

The company is exploring how to make its process of buying gold more efficient, he said, "because one to two tons per week is a very sizable amount."

Photo Credit: Bloomberg

It's not just gold bullion that Tether is interested in. The company's bullish stance on the precious metal has also led it to buy up stakes in royalty companies, who specialize in in buying revenue streams from gold miners.

It has taken stakes in almost every mid-sized Canadian listed royalty company, including Elemental Royalty Corp, Metalla Royalty & Streaming Ltd, Versamet Royalties Corp and Gold Royalty Corp.

The rapid accumulation of equity stakes in royalty companies has been spearheaded by Juan Sartori, according to people familiar with the matter - a former Uruguayan senator, businessman and co-owner of Premier League football club Sunderland AFC.

Gold v. Dollar

In some ways, Tether's approach to gold is much like that of a central bank. Like a central bank, it prizes gold for its liquidity, as well as its status as a reserve asset that is no one's debt.

Gold is "logically a safer asset than any national currency." Ardoino said in an earlier Bloomberg interview. "Every single central bank in the BRICS countries is buying gold."

And Tether's emerging markets users of its dollar stablecoin are "exactly the people that love gold and have been using gold as to protect themselves from their own government that have been debasing their currency for a long time," he said this week. "We believe that the world is going towards darkness. We believe that there is a lot of turmoil."

Still, buying gold represents a risk. Any shift away from holding US dollars risks losses that could imperil its ability to ensure that its dollar stablecoin USDT is always worth $1.

In November USDT was downgraded to a stability rating of "weak" by analysts at S&P Global Ratings, who said their assessment "reflects the rise in exposure to high-risk assets in USDT's reserves over the past year," including Bitcoin, gold, secured loans and corporate bonds, as well as limited disclosure.

Tether declares gold held as reserves held against its dollar stablecoin in quarterly attestations signed off by BDO Italia SpA.

Photo Credit: Bloomberg

So far, however, Tether's gold bet has been spectacularly successful. Its buying has coincided with the market's biggest rally since the 1970s, as investors and governments fret about holding dollars.

It's a trend that Tether is seeking to capitalize on with another product, Tether Gold, or XAUT, a gold token redeemable for physical bullion. The company has issued XAUT equivalent to about 16 tons of gold or $2.6 billion, and has also launched a smaller denomination of the token called Scudo.

There is a "good chance" XAUT will end this year with $5 to $10 billion in market circulation, Ardoino said. In that event, the company may have to buy more than one ton of gold a week for XAUT alone, not including gold bought for Tether's reserves, he said.

While XAUT and other gold tokens remain minnows compared to the more-than-$500 billion ETF market, Ardoino predicts that their time will soon come.

"The way I see it, is that there are foreign countries that are buying a lot of gold, and we believe that these countries will soon launch tokenized version of gold as a competitive currency to the US dollar," Ardoino said.

Whether or not a gold-backed rival to the US dollar ever emerges, Tether's buying has captured the zeitgeist. "It's really interesting that one of the main players in the crypto landscape sees gold as the OG US dollar debasement trade," said Reade.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.