Tech Mahindra Ltd.'s share price declined nearly 5% on Friday after the company's fourth quarter revenue missed analysts' estimates.

For the quarter ending March 31, 2025, Tech Mahindra's revenue stood at Rs 13,384 crore, slightly below the Bloomberg consensus estimate of Rs 13,460 crore, as per an exchange filing on Thursday.

Tech Mahindra's EBIT rose by 2% to Rs 1,378 crore which was also slightly below the estimated Rs 1,394 crore. Meanwhile, the company's margin expanded to 10.3%, compared to 10.2% previously, aligning with the estimated 10.3%.

The consolidated net profit of the company rose 19% to Rs 1,167 crore, surpassing the Bloomberg consensus estimate of Rs 1,084 crore.

Breaking down the revenue by segments, the manufacturing sector saw a 5.5% year-on-year decline, while healthcare and life sciences grew by 2.3%. The communications sector experienced a 2.2% drop, and high-tech and media fell by 4.1%. Conversely, the banking, financial services, and insurance sectors increased by 6%, and the retail, transport, and logistics sector surged by 10%.

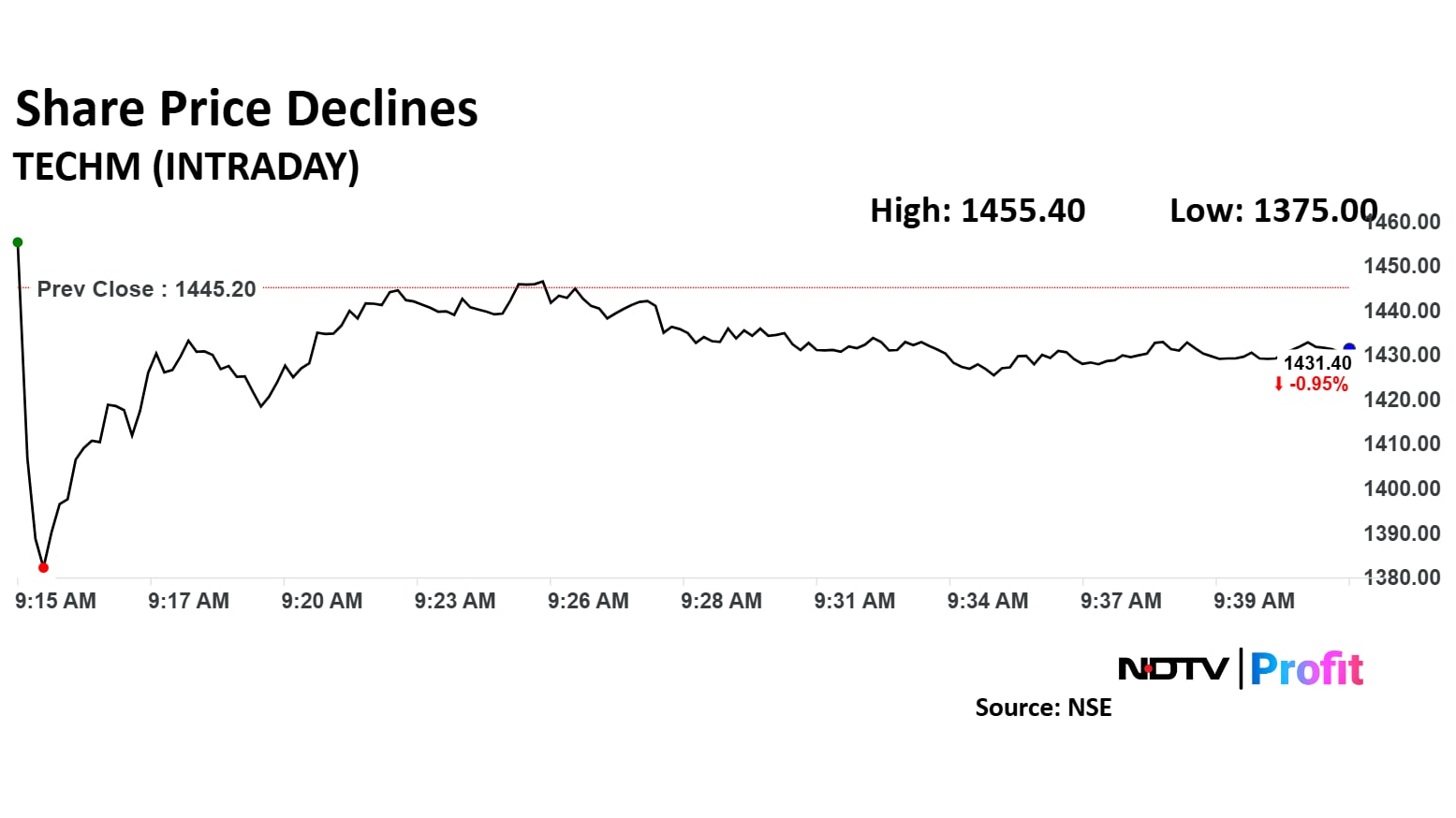

Tech Mahindra Share Price

Shares of Tech Mahindra fell as much as 4.86% to Rs 1,375 apiece. They pared losses to trade 1.01% lower at Rs 1,430.60 apiece, as of 09:40 a.m. This compares to a flat NSE Nifty 50.

The stock has risen 20.19% in the last 12 months. Total traded volume so far in the day stood at 0 times its 30-day average. The relative strength index was at 54.

Out of 46 analysts tracking the company, 22 maintain a 'buy' rating, 11 recommend a 'hold' and 13 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 24.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.