Shares of Tata Consultancy Services Ltd. rose over 4% in early trade on Friday as analysts remained optimistic about its outlook following a sequential rise in net profit for the December quarter.

The IT bellwether saw net profit rise 4.1% sequentially to Rs 12,444 crore in the quarter ended Dec. 31, 2024. This is in line with the consensus estimate of Rs 12,537 crore shared by analysts tracked by Bloomberg. The IT major's revenue from operations declined 0.4% over the previous three months to Rs 63,973 crore in the third quarter.

The management commentary was the most positive over the last two years, according to analysts. It showed early signs of revival in discretionary spending leading to a bright outlook, Nuvama Institutional Equities said.

The tech giant expects calendar year 2025 growth to be higher than the previous year, implying high single-digit growth in developed markets, it said.

Jefferies is encouraged by management comments on early signs of revival in discretionary spending. "Ramp-down of the BSNL deal may provide scope to improve margins."

Chief Executive Officer K Krithivasan, expects 2025 to be better than last year, as TCS sees early signs of "revival, not recovery" in discretionary spending in some business verticals.

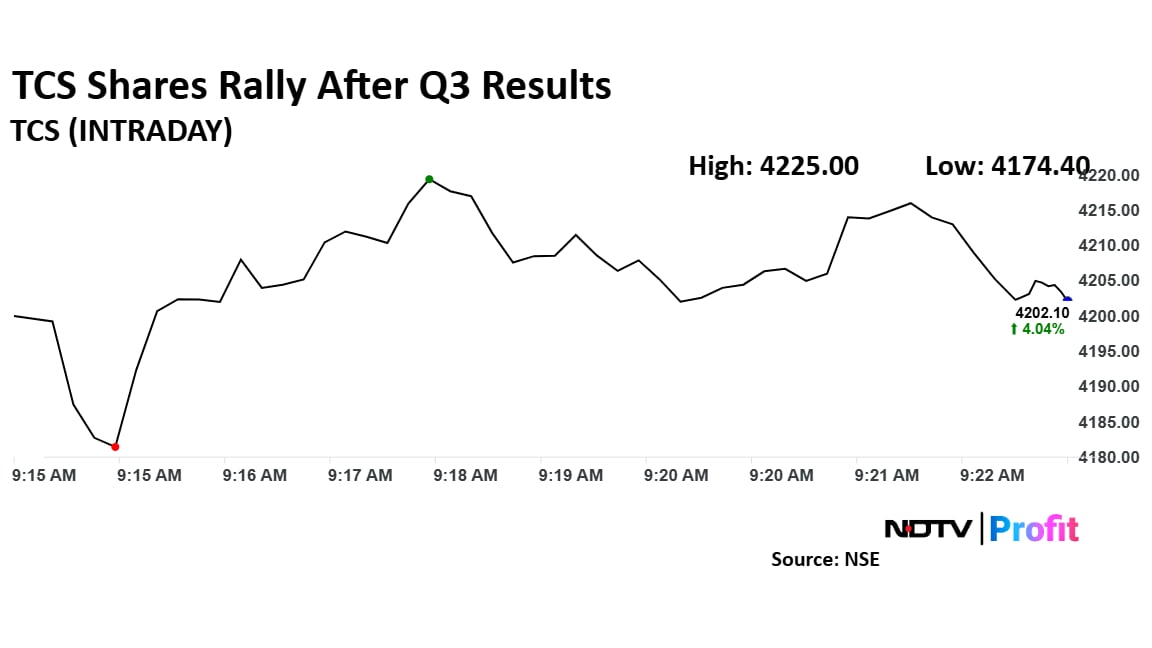

TCS's stock rose as much as 4.6% during the day to Rs 4,225 apiece on the NSE. It was trading 4.1% higher at Rs 4,206 apiece, compared to a 0.19% advance in the benchmark Nifty 50 as of 09:18 a.m.

The shares have risen 13% during the last 12 months. The relative strength index was at 51.

Thirty-three out of the 49 analysts tracking the company have a 'buy' rating on the stock, 11 suggest a 'hold' and five have a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 12%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.