Tata Motors has a good risk to reward profile despite recent share price underperformance, according to Macquarie. The financial services firm has a positive outlook on US demand and the potential for domestic commercial vehicle market share gains.

The key factors to monitor, according to Macquarie, include Jaguar Land Rover's progress towards a net cash balance sheet and global demand. Macquarie maintains its 'outperform' rating on the counter with the target price set at Rs 826.

Balance Sheet And Market Share

The management's confidence in achieving JLR's net cash balance sheet target by March 2025 is based on earnings progression during the current quarter, said the brokerage.

In the recent earnings call, JLR's global peers highlighted that 2025 US demand outlook remains strong while European Union demand is also steady-to-strong. Tata Motors' ability to secure market share gains in the domestic commercial vehicle sector is also significantly influencing its overall performance, according to the brokerage.

US And Europe Demand

A healthy growth outlook for the United States, coupled with signs of recovery in the European Union and the United Kingdom, are positive indicators. Despite this, the potential volume risks in China are also highlighted.

In the US, JLR's global peers, including Mercedes, Porsche, and BMW, have expressed optimism regarding the 2025 calendar year demand outlook. While the demand in the European Union is considered to be steady to strong, according to the company.

China Slow Down

In China, uncertainty persists regarding the demand outlook, primarily due to a slowdown. The brokerage also cites the increased competitive intensity, and market share gains by local manufacturers.

This aligns with Tata Motors management's observation-based expectations. The brokerage cites that China only represents 13% of Jaguar Land Rover global sales. While the country accounts for 20 to 34% of the global sales of its peers.

Mitigating Tariff Risk

The impact of potential tariffs on vehicle imports from the European Union and the United Kingdom into the US remains uncertain. Although Jaguar Land Rover does not have manufacturing facilities in the United States, Tata Motors management plans to mitigate the impact of any tariffs.

This will be through premiumisation, price increases, cost optimisation, and other measures, according to the note.

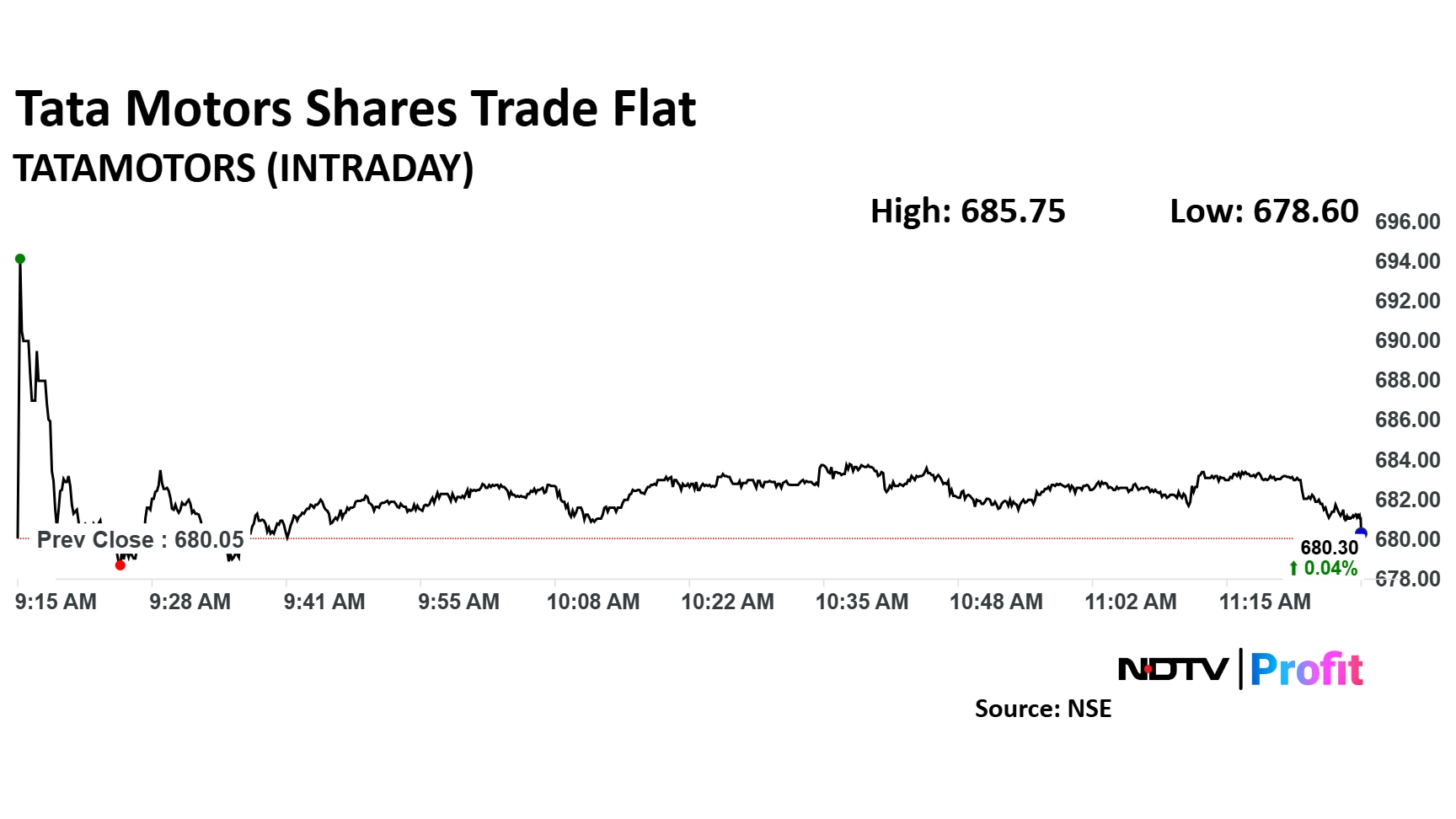

Tata Motors Share Price

Tata Motors stock rose as much as 0.84% during the day to Rs 685 apiece on the NSE. It was trading 0.22% higher at Rs 681 apiece, compared to a 0.23% advance in the benchmark Nifty 50 as of 11:27 a.m.

It had declined 7.96% in the last 12 months. The relative strength index was at 54.

Twenty one out of the 34 analysts tracking the company have a 'buy' rating on the stock, eight recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 815.3, implying an upside of 19.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.