- Tata Motors share price opened 0.36% lower after demerger announcement

- Demerger of Commercial Vehicles business effective from 1 October 2025

- Commercial Vehicles business to be re-listed as separate entity in November

Tata Motors Ltd.'s share price opened 0.36% lower after the company in an analyst meet announced that the record date for the demerger of its Commercial Vehicles business is slated for mid-October and listing is to be expected in November.

The demerger takes effect from Wednesday, October 1.

Post the analyst meet, brokerages held mixed opinions on the company. Analysts expect potential upside from the possible Iveco acquisition and tailwinds from the Goods and Services Tax reforms, but concerns remain about the short-term demand outlook for Jaguar Land Rover in key markets such as Europe, China, and the US.

Nomura noted as its takeaway from the meet that "the entry segment might see a temporary uptick in demand but the long-term trend of moving towards compact SUVs and premium segments should continue. EV demand has been stable".

In the longer term, management expects the industry to grow at 1-1.5 times of real GDP or 6-8% year-on-year. Passenger Vehicle division aims to achieve double-digit Ebitda margins in the long term, helped by operating leverage, a better mix and planned price hikes in January 2026. The Commercial Vehicle business will be demerged in mid-October (record date awaited) and re-listed as a separate entity in November 2025, the brokerage said.

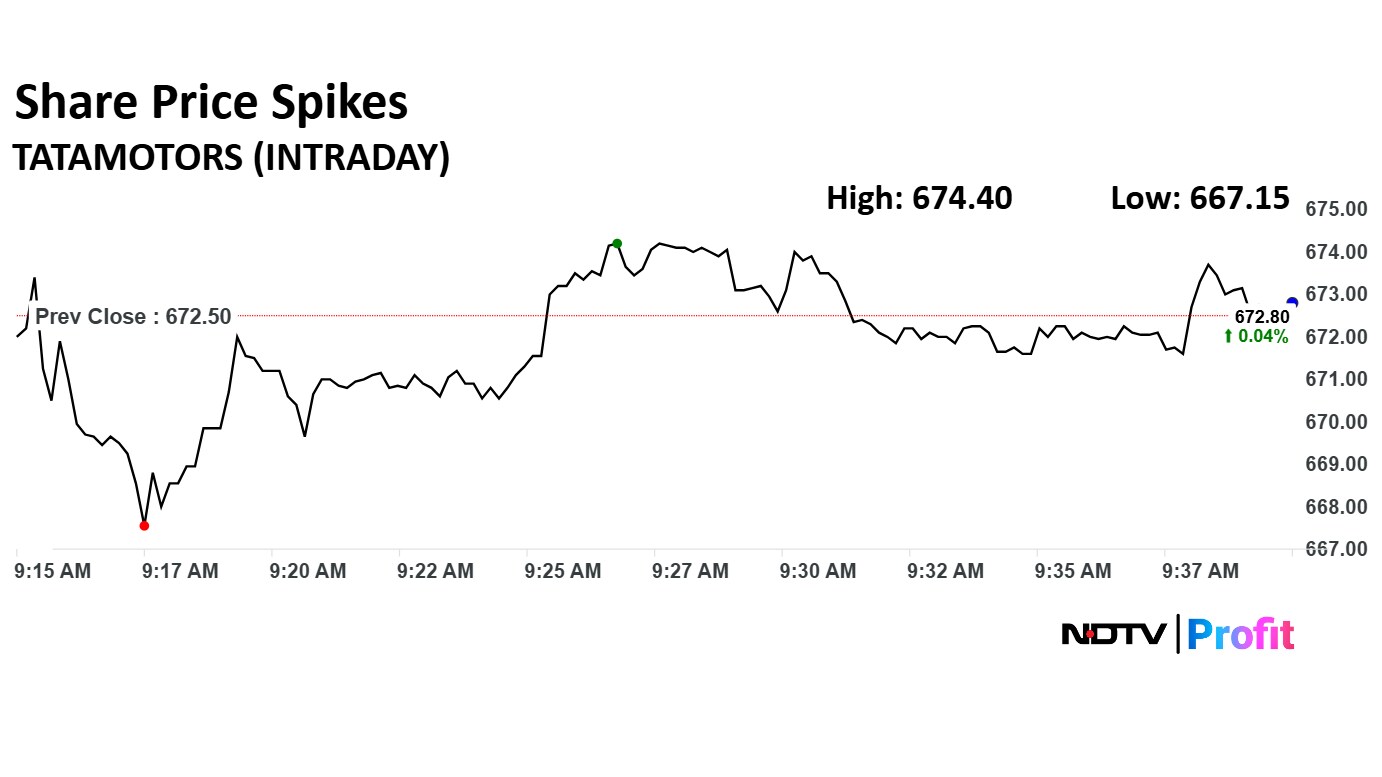

The scrip fell as much as 0.80% to Rs 667.15 apiece. It pared losses to trade 0.07% lower at Rs 672 apiece, as of 09:37 a.m. This compares to a 0.12% advance in the NSE Nifty 50 Index.

It has fallen 31.05% in the last 12 months. The relative strength index was at 41.

Out of 34 analysts tracking the company, 18 maintain a 'buy' rating, 10 recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.3%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.