Tata Consumer Products Ltd.'s shares fell over 4% on Thursday as its fourth quarter margins took a beating due to higher tea costs. This, even as the company reported a jump in its net profit.

Margins of the company contracted to 13.5%, compared to 16.0% in the previous quarter.

Its net profit jumped 59% to Rs 344.85 crore, which exceeded analysts' expectations of Rs 255 crore.

The board has proposed a dividend of Rs 8.25 per share for fiscal 2025, to be paid on or after June 21, 2025, pending shareholder approval at the annual general meeting.

The fourth quarter included exceptional gains of Rs 45.32 crore, contrasting with an exceptional loss of Rs 215.80 crore in the same period last year.

These gains comprised fair value gains of Rs 120 crore from remeasurement of contingent consideration, offset by an asset write-down of Rs 72 crore and restructuring costs of Rs 3 crore. In the same quarter last year, the company recorded an exceptional loss of Rs 215.80 crore, which included an asset write-down of Rs 62 crore and a fair value loss of Rs 53 crore on financial instruments.

The owner of Tetley Tea also reported a 5.9% underlying volume growth in its India branded business, excluding acquisitions, for the fourth quarter.

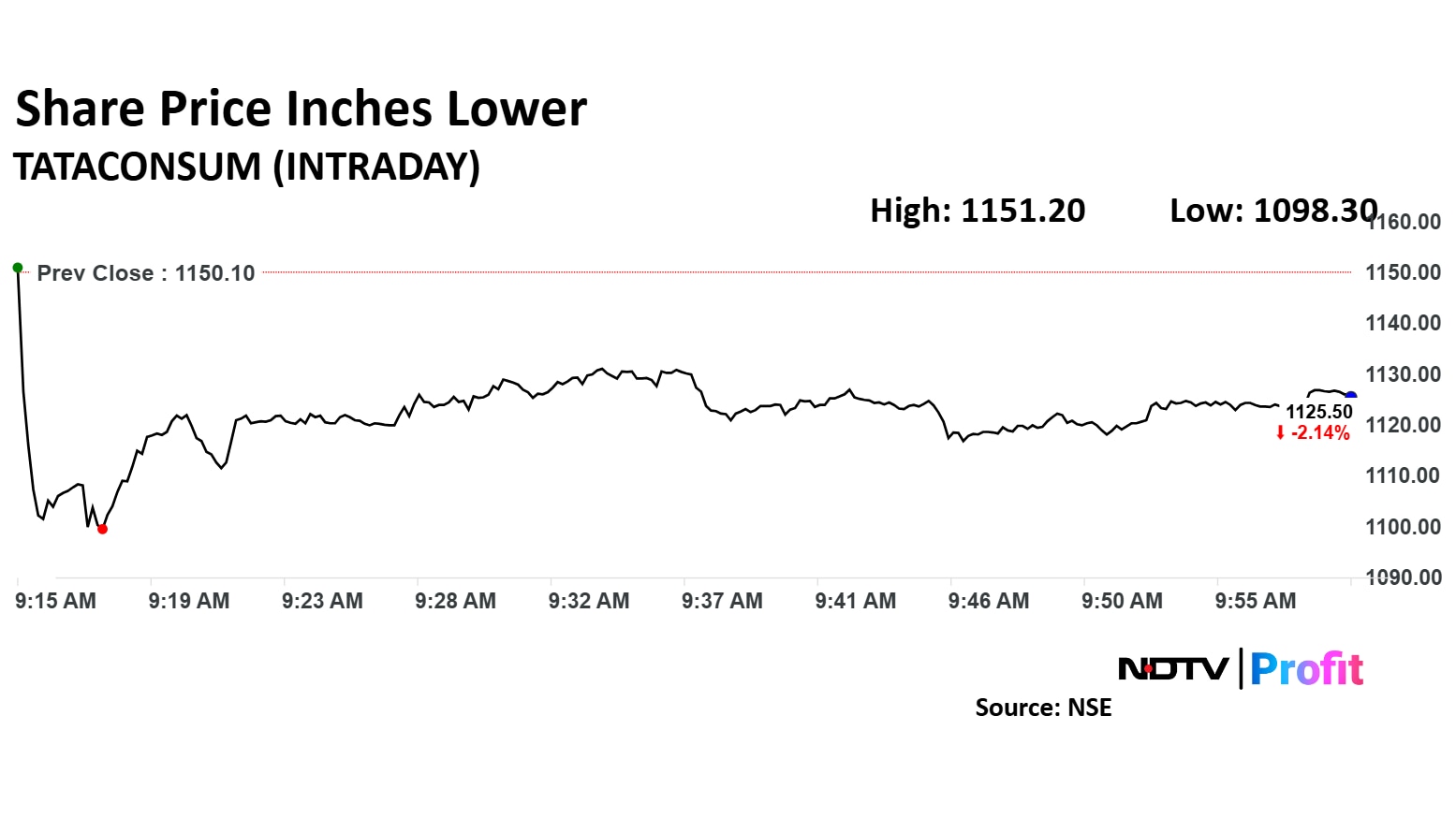

Tata Consumer Products Share Price

The stock fell as much as 4.50% to Rs 1,098 apiece. It pared losses to trade 2.10% lower at Rs 1,126 apiece, as of 10:00 a.m. This compares to a 0.26% decline in the NSE Nifty 50.

It has risen 2.69% in the last 12 months. The relative strength index was at 39.73.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.