Swiggy Ltd.'s share price fell nearly 8% in early trade on Thursday, after its third quarter loss widened amid growth worries on its quick commerce segment.

Net loss for the restaurant-to-quick-commerce aggregator came in at Rs 799.08 crore in the October-December period, as compared to a loss of Rs 625.53 crore in the July-September quarter. Analysts tracked by Bloomberg had expected the company to post a loss of Rs 620 crore.

Revenue rose 10.9% from the preceding quarter to Rs 3,993.07 crore. The consensus estimate was Rs 4,019 crore.

The operating loss or the losses before interest, tax, depreciation and amortisation stood at Rs 725.66 crore, wider than the Rs 554.17 crore clocked in the three months ending December.

Swiggy Instamart, which is the company's quick commerce arm, logged a 17.7% sequential rise in revenue to Rs 576.5 crore. Gross order value growth was 5.5%. The company maintained guidance of doubling dark stores and raising dark store size by March.

Revenue of the food delivery segment was up 3.8%, while gross order value rose 3.4%, sequentially.

Analysts flagged disappointing quick commerce growth, amid intense competition, noting relatively better food delivery performance.

UBS maintained a 'buy' rating on Swiggy stock, with a target price of Rs 510, citing improved food delivery performance but weaker-than-expected quick commerce growth. The target price indicates a potential 22% upside over the previous close.

Meanwhile, Macquarie maintained an 'underperform' rating on Swiggy, with a target price of Rs 325, a 22% downside potential. It noted that quick commerce economics remain meaningfully challenged, with Instamart dragging down overall profitability.

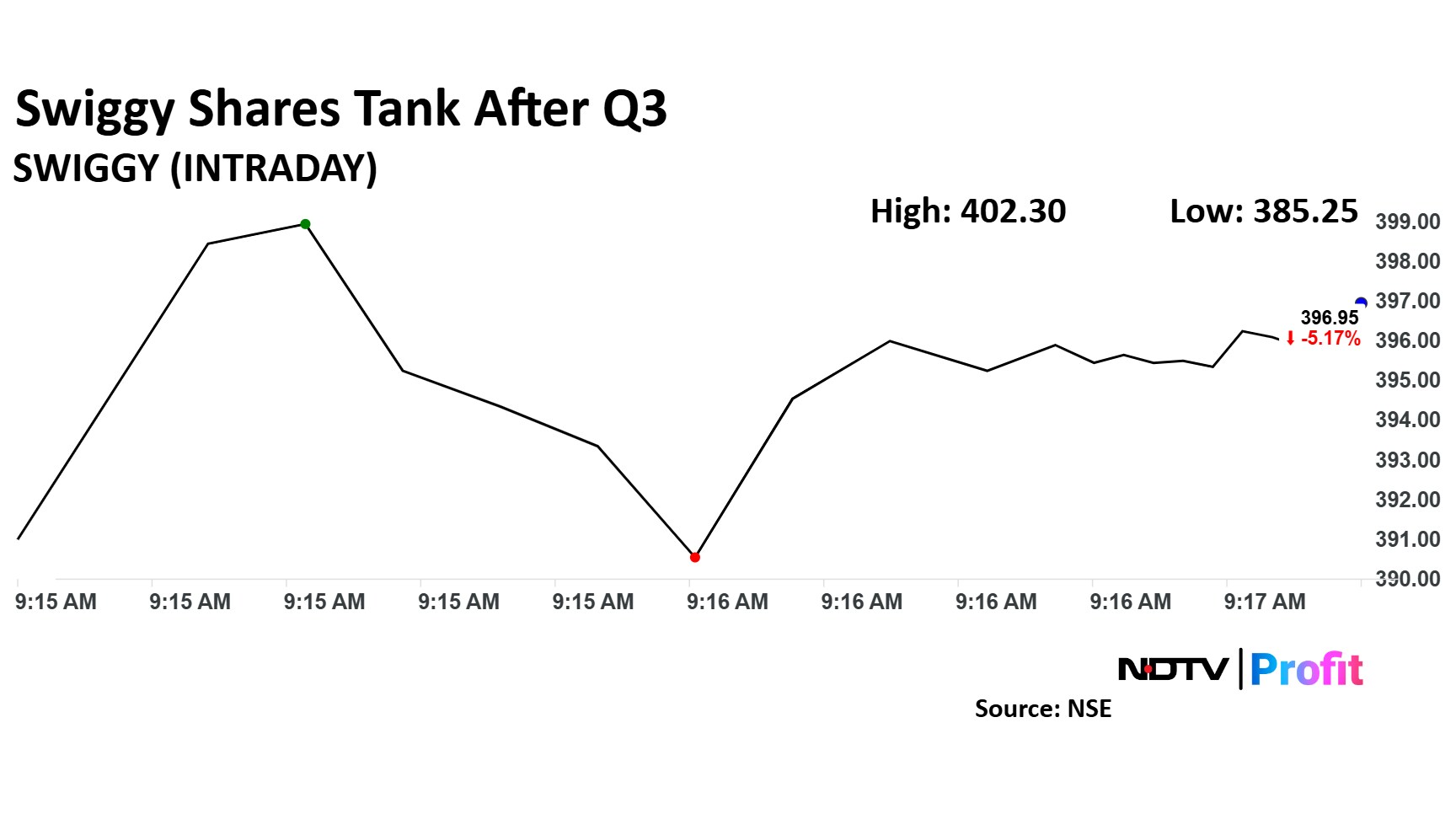

Swiggy Share Price Movement

Shares of Swiggy tanked 7.7% to Rs 385.25 shortly after market open, compared to a 0.28% decline in the Nifty 50.

The scrip had closed 3.56% lower at Rs 418.05 on Wednesday, ahead of the results. Since its listing in November, the stock has fallen by 8.32% and the market cap has slid below Rs 1 lakh-mark. The relative strength index was 39.

Eleven of the 16 analysts tracking Swiggy have a 'buy' rating, two suggest a 'hold', and three have a 'sell', according to Bloomberg data. The average of the 12-month analysts' price target of Rs 550 implies a potential upside of 31%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.